What's Affecting Markets Today

Asia-Pacific Markets Mixed as Investors Weigh China Data and U.S. Tariff Ruling

Asia-Pacific equities traded mixed on Monday as investors weighed China’s manufacturing signals, regional diplomacy, and a key U.S. trade ruling. China’s private RatingDog manufacturing index rose to 50.5 in August, marking expansion from 49.5 in July, while official PMI data released Sunday held in contraction territory at 49.4. Markets also reacted to developments at the Shanghai Cooperation Organization summit, where leaders from China and India emphasized partnership over rivalry. President Xi Jinping called on members to boost artificial intelligence cooperation and reject a “Cold War mentality.”

Hong Kong’s Hang Seng index led gains, climbing 1.77% on strength in Alibaba Group, which surged 17.29%. Alibaba Health rose 6.41% and BOC Hong Kong advanced 6.08%. In contrast, mainland China’s CSI 300 edged down 0.12%. Japan’s Nikkei 225 fell 1.7% with sharp losses in semiconductor makers Advantest, Disco Corp, and Socionext. The Topix lost 0.72%.

Elsewhere, South Korea’s Kospi fell 1.14% and Kosdaq 1.2%. Australia’s S&P/ASX 200 dropped 0.68%. India outperformed, with the Nifty 50 up 0.43% and Sensex higher by 0.4%.

Markets also assessed a U.S. appeals court ruling that most of Donald Trump’s reciprocal tariffs were illegal, curbing presidential authority on trade levies.

ASX Stocks

ASX 200 8,926.6 (-0.53%)

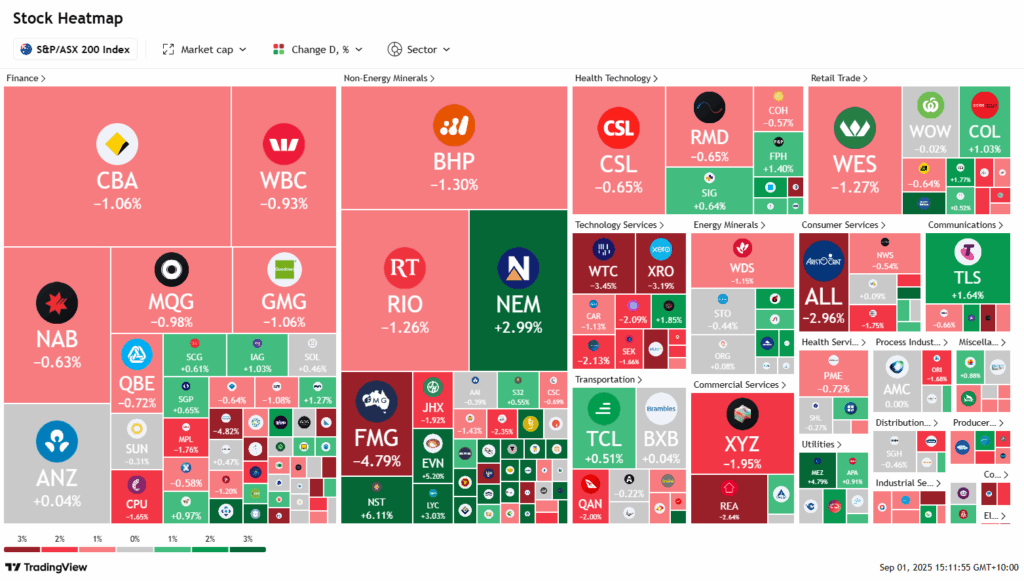

ASX Slips to Two-Week Low as Gold Miners Surge

The Australian sharemarket slipped to a two-week low as investors rotated into gold on concerns over US Federal Reserve independence. At 2.15pm AEST, the S&P/ASX 200 Index was down 0.7 per cent, or 60.9 points, at 8912.2. Gold traded near US$3500 an ounce, close to record levels, after US President Donald Trump again attacked Fed governor Lisa Cook and pushed for steep rate cuts. Lower rates typically boost bullion, and gold miners surged with Capricorn Metals and Genesis Minerals up nearly 10 per cent, Emerald Resources 8.3 per cent and Westgold 7.8 per cent.

Losses were broad-based across eight of 11 sectors, led by tech, with WiseTech Global down 3.8 per cent and Xero 3.1 per cent. Heavyweights BHP and Rio Tinto each lost about 1.5 per cent as iron ore futures fell. Macquarie Group slid 1.3 per cent and Fortescue 4.8 per cent after going ex-dividend.

In company news, RPMGlobal rocketed 23.1 per cent on a takeover approach, while Harvey Norman gained 9.1 per cent after an upgrade from UBS. Austal fell 4.1 per cent following founder John Rothwell’s retirement.

Leaders

CYL Catalyst Metals Ltd (+10.35%)

CMM Capricorn Metals Ltd (+10.26%)

GMD Genesis Minerals Ltd (+10.09%)

GGP Greatland Resources Ltd (+9.78%)

EMR Emerald Resources NL (+9.00%)

Laggards

BAP Bapcor Ltd (-6.66%)

GDG Generation Development (-6.59%)

MSB Mesoblast Ltd (-5.96%)

PPT Perpetual Ltd (-5.55%)

CAT Catapult Sports Ltd (-5.14%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!