What's Affecting Markets Today

Asia-Pacific Stocks Retreat as Bond Yields Rise; China Services Activity Surges

Asia-Pacific equities mostly declined on Wednesday as rising global bond yields and renewed trade tensions weighed on sentiment.

Chinese markets were in the spotlight after President Xi Jinping addressed a military parade marking the 80th anniversary of the end of World War II, attended by 26 world leaders including Russia’s Vladimir Putin and North Korea’s Kim Jong Un. The Hang Seng slipped 0.4 per cent, while the CSI 300 shed 0.89 per cent. Still, services activity showed strength, with the RatingDog China General Services PMI climbing to 53 in August from 52.6 in July, a 15-month high, driven by strong domestic demand and rebounding exports.

Australia’s S&P/ASX 200 dropped 1.74 per cent, despite GDP rising 1.8 per cent year-on-year in the second quarter, the fastest pace since September 2023 and ahead of expectations.

Japan’s Nikkei 225 fell 1.02 per cent and the Topix slid 1.22 per cent as government bond yields rose sharply. The 30-year JGB yield hit 3.254 per cent, its highest level since August, while 20-year yields reached a 26-year high.

South Korea’s Kospi edged up 0.12 per cent, while India’s benchmarks ended flat.

ASX Stocks

ASX 200 8,732.90 (-1.88%)

ASX Slumps Despite GDP Growth; Gold Miners Shine

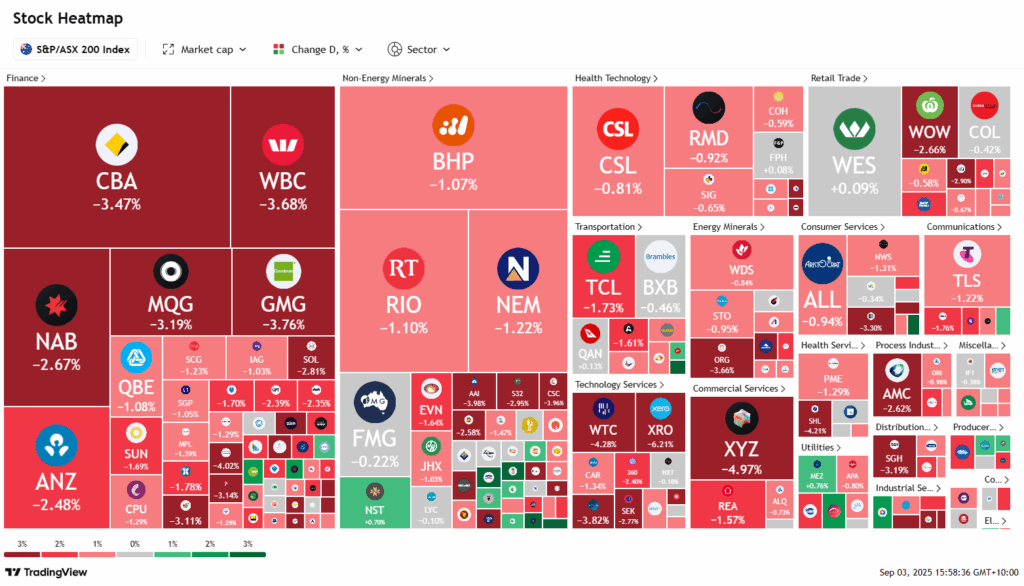

The Australian sharemarket extended its losing streak on Wednesday, falling for a fourth consecutive session in its sharpest decline since April. At 2:05pm AEST, the S&P/ASX 200 was down 1.59 per cent, or 141.8 points, at 8758.8 – a two-week low – with all 11 sectors in negative territory.

The sell-off followed stronger-than-expected second-quarter GDP data, which pushed government bond yields higher. The three-year yield rose to 3.45 per cent and the 10-year climbed to 4.40 per cent, its highest in six weeks. Analysts noted that rising yields are pressuring equity valuations globally, echoing declines across Wall Street.

Gold provided a rare bright spot, holding near record highs at US$3550 an ounce, as investors sought safe-haven assets. Gold miners outperformed, with Bellevue Gold up 3.4 per cent, Genesis Minerals 1.3 per cent, and Northern Star 1 per cent.

Elsewhere, tech stocks led losses after a Wall Street sell-off, while financials weakened. Among notable moves, Wisetech fell 3.3 per cent, Westpac dropped 3.2 per cent, and Graincorp gained nearly 3 per cent on upbeat crop forecasts.

Leaders

EOS – Electro Optic Systems (+9.47%)

OBM – Ora Banda Mining Ltd (+5.50%)

TEA – Tasmea Ltd (+4.39%)

RIC – Ridley Corporation Ltd (+3.97%)

GNC – Graincorp Ltd (+3.80%)

Laggards

XRO – Xero Ltd (-6.23%)

XYZ – Block, Inc (-5.03%)

WHC – Whitehaven Coal Ltd (-4.90%)

A4N – Alpha HPA Ltd (-4.81%)

LLC – Lendlease Group (-4.54%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!