What's Affecting Markets Today

Asia-Pacific Markets Advance as Trump Signs Japan Tariff Deal

Asia-Pacific equities rose on Friday after U.S. President Donald Trump signed an executive order lowering tariffs on Japanese auto imports to 15% from 27.5%. The order also confirmed $550 billion of Japanese investment commitments in U.S. projects, boosting sentiment across the region.

Japan’s Nikkei 225 surged 1.39%, while the Topix gained 0.86%, supported by data showing household spending rose 1.4% year-on-year in July. In South Korea, the Kospi edged up 0.26% and the Kosdaq 0.35%. Chipmakers across Asia rallied after Trump warned that tariffs would be imposed on semiconductor imports from companies not shifting production to the U.S., ahead of his meeting with technology executives. Advantest rose 2.99%, Lasertec 3.24%, TSMC 1.29%, and SK Hynix more than 3%.

Australia’s S&P/ASX 200 added 0.58%, while Hong Kong’s Hang Seng Index rose 0.17%. Mainland China’s CSI 300 finished flat. In India, the Nifty 50 inched 0.18% higher and the Sensex gained 0.29%. Markets in Malaysia and Indonesia were closed for a public holiday.

ASX Stocks

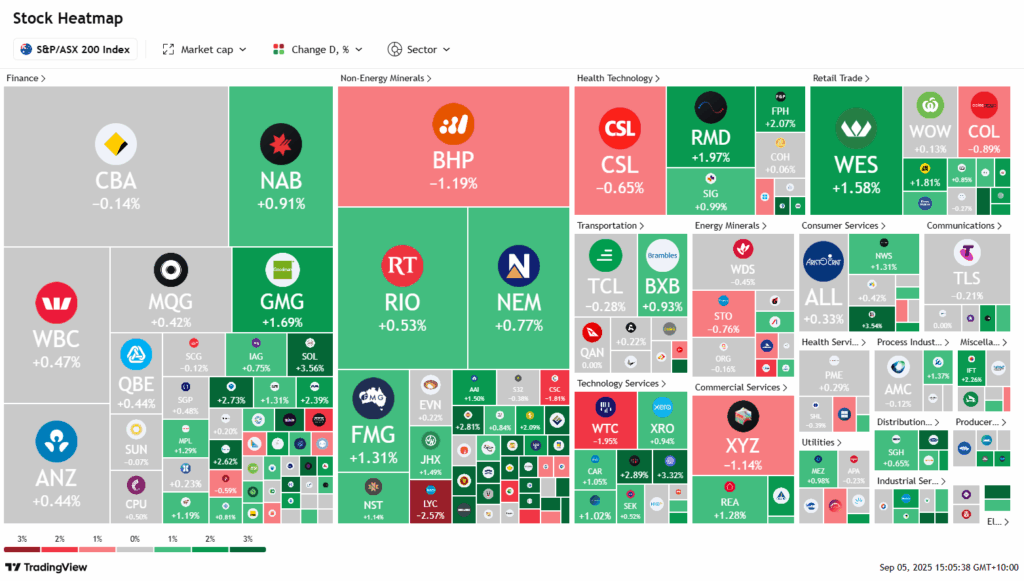

ASX 200 8,861.80 (+0.40%)

ASX Rallies on Rate Cut Optimism, Led by Retail, Tech and Gold

The Australian sharemarket rose on Friday, mirroring Wall Street gains as investors positioned for an anticipated US Federal Reserve rate cut later this month. The S&P/ASX 200 Index advanced 35.3 points, or 0.4 per cent, to 8861.8 by mid-afternoon, with eight of 11 sectors trading higher.

Retail, technology, real estate and gold stocks led the charge. Myer surged 3.8 per cent, Premier Investments gained 2 per cent, while JB Hi-Fi, Wesfarmers and Harvey Norman each rose more than 1 per cent. Technology names also lifted, with Zip up 4.7 per cent, Codan 3.9 per cent, Life360 3.6 per cent and NextDC 2.9 per cent, though WiseTech fell 1.8 per cent.

Gold miners climbed as bullion approached record highs, with Regis Resources up 4.5 per cent, Genesis Minerals 4 per cent, and Vault Minerals 4.4 per cent. Real estate also strengthened, led by Mirvac up 2.8 per cent and Charter Hall 2.6 per cent.

Despite Friday’s rebound, the benchmark index remains on track for a 1.2 per cent weekly decline, its steepest since March.

Leaders

VUL Vulcan Energy Resources Ltd (+8.40%)

OBM Ora Banda Mining Ltd (+7.87%)

PNV Polynovo Ltd (+7.09%)

HMC HMC Capital Ltd (+7.06%)

MSB Mesoblast Ltd (+6.28%)

Laggards

SGLLV Ricegrowers Ltd (-5.52%)

KLS Kelsian Group Ltd (-3.57%)

DRO Droneshield Ltd (-3.04%)

NXG Nexgen Energy (Canada) Ltd (-2.75%)

A4N Alpha Hpa Ltd (-2.60%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!