What's Affecting Markets Today

Asia-Pacific Markets Mixed as Japan PM Resigns, OPEC+ Slows Output Hikes

Asia-Pacific equities traded mostly higher Monday as investors weighed Japan Prime Minister Shigeru Ishiba’s resignation and regional economic data. The Nikkei 225 climbed 1.5% and the Topix advanced 1% to a record high after Ishiba announced his departure, triggering speculation over successors. Likely contenders include Koizumi Shinjiro, son of a former prime minister, and Takaichi Sanae, a protégé of Abe Shinzo. Analysts highlighted strong market optimism, with Takaichi’s pro-deregulation stance viewed as growth supportive.

The yen weakened 0.64% to 148.33 against the U.S. dollar, while Japanese government bonds extended losses. The 30-year yield rose above 3.27% and the 20-year yield climbed to 2.68%, reflecting persistent inflation and fiscal concerns. Fitch unit BMI warned Japan faces “extended uncertainty” heading into Q4 2025.

Elsewhere, South Korea’s Kospi rose 0.15% and Kosdaq gained 0.47%. Hong Kong’s Hang Seng added 0.23%, while China’s CSI 300 slipped 0.3% as August export growth of 4.4% undershot forecasts. Australia’s ASX 200 fell 0.38%. Oil prices edged higher after OPEC+ confirmed slower production increases, with Brent up 0.53% to $62.20 a barrel.

ASX Stocks

ASX 200 8,849.6 (-0.24%)

ASX Slips as Energy and Banks Weigh on Market

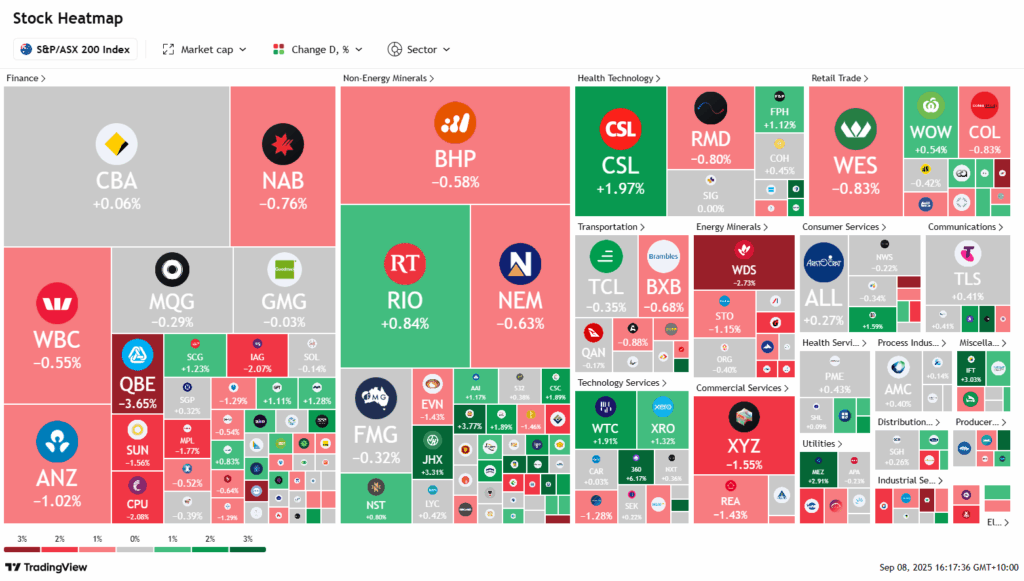

The Australian sharemarket fell on Monday afternoon, with losses in energy and banking outweighing strength in technology. The S&P/ASX 200 Index dropped 0.4 per cent, or 34.9 points, to 8836.3 by 2.30pm AEST, following Wall Street’s Friday decline.

Energy stocks were among the weakest, with Woodside down 3.5 per cent, Beach Energy 2.3 per cent lower and Santos off 1.9 per cent. Banks also retreated, with ANZ and NAB both falling more than 1 per cent, Westpac easing 0.8 per cent and CBA shedding 0.5 per cent.

Gold traded near a record high at $US3600 an ounce, yet miners failed to rally, with Evolution, Perseus and Newmont all slipping. Lithium miners outperformed, with Evergreen up nearly 8 per cent and Pilbara Minerals 4 per cent higher. Boss Energy surged 7.1 per cent, while Life360 added 5.7 per cent.

In company moves, DroneShield jumped 5.6 per cent on ASX 200 entry news, while Mayne Pharma tumbled 13 per cent on takeover concerns. Supermarket giants Coles and Woolworths traded mixed after flagging $800 million in backpay provisions.

Leaders

VSL Vulcan Steel Ltd (+8.48%)

SGLLV Ricegrowers Ltd (+7.93%)

SLC Superloop Ltd (+7.73%)

TUA Tuas Ltd (+7.47%)

RDX REDOX Ltd (+6.32%)

Laggards

QAL Qualitas Ltd (-6.30%)

SSM Service Stream Ltd (-5.76%)

PPC Peet Ltd (-5.59%)

SIQ Smartgroup Corporation Ltd (-4.84%)

ZIM Zimplats Holdings Ltd (-4.71%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!