What's Affecting Markets Today

Nikkei Hits Record as Political Shift Spurs Optimism; Asia-Pacific Mixed

Japan’s Nikkei 225 surged 0.9 per cent to a record high on Tuesday, extending gains for a second session after Prime Minister Shigeru Ishiba announced his resignation. The broader Topix advanced 0.52 per cent, led by strength in technology stocks. Advantest climbed 7.62 per cent, Tokyo Electron gained 3.64 per cent, and Renesas Electronics rose 2.59 per cent, according to LSEG data.

Analysts noted investors are positioning for fresh fiscal stimulus under new leadership in the ruling Liberal Democratic Party. XTB’s Hani Abuagla highlighted expectations of pro-growth measures, while Julius Baer’s Louis Chua forecast longer-term policy stability and projected the Nikkei could reach 46,000 within 12 months. The yen edged 0.1 per cent higher to 147.38 per dollar.

Elsewhere in the region, South Korea’s Kospi added 0.35 per cent and the Kosdaq rose 0.19 per cent. Hong Kong’s Hang Seng jumped 1.48 per cent to its highest since late 2021, while China’s CSI 300 slipped 0.41 per cent. Indonesia’s Jakarta Composite dropped 1.25 per cent following a surprise cabinet reshuffle, with the rupiah weakening 1.17 per cent. India’s Nifty 50 rose 0.4 per cent.

ASX Stocks

ASX 200 8,793.4 (-0.64%)

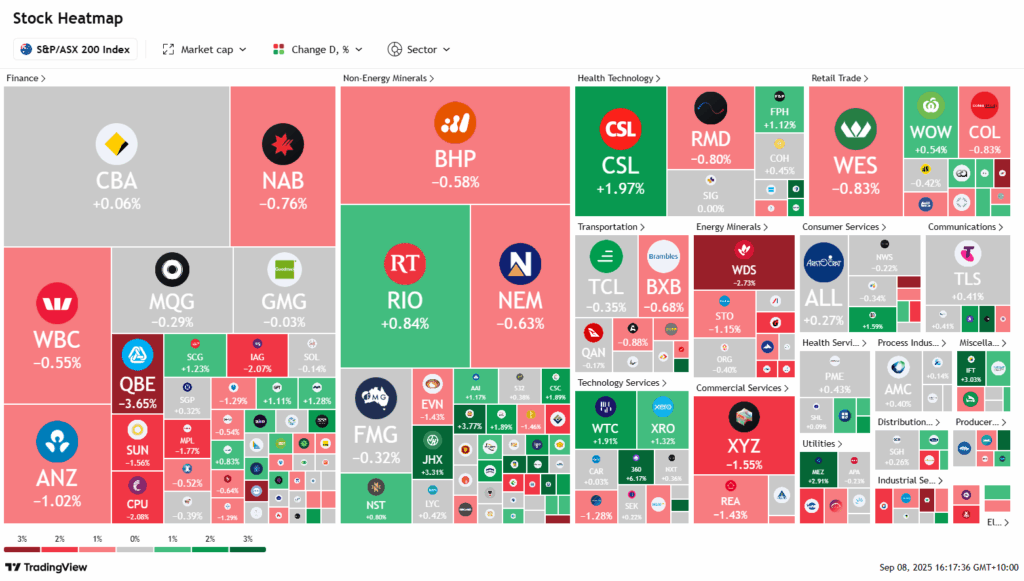

ASX Slips as Banks and Energy Weigh; Life360 Extends Rally

The Australian sharemarket traded lower at midday on Tuesday, weighed down by weakness in the banking and energy sectors. The S&P/ASX 200 fell 57.5 points, or 0.7 per cent, to 8792.1, with seven of the 11 sectors in negative territory.

Heavyweight banks led the decline as investors locked in profits. Commonwealth Bank and Macquarie each shed 1.3 per cent, while Westpac slipped 0.8 per cent after Morgan Stanley downgraded it to “least preferred” among the majors. ANZ dipped 0.6 per cent amid reports of 3500 planned job cuts. Schroders’ Andrew Fleming noted banks remain challenged by “very low growth” despite elevated valuations.

Energy stocks continued their retreat after OPEC+ announced an October production increase. Woodside lost 1 per cent, following a 3 per cent slide the previous session, while Viva, Beach and Santos also fell.

Elsewhere, Telix Pharmaceuticals gained 4.3 per cent on progress with the FDA for its brain cancer imaging agent. BHP slipped 0.7 per cent after settling a $110 million class action. Life360 extended its strong run, adding 3.4 per cent and taking its 12-month gain above 170 per cent.

Leaders

OBM Ora Banda Mining Ltd (+9.05%)

RSG Resolute Mining Ltd (+8.16%)

PNR Pantoro Gold Ltd (+6.19%)

CYL Catalyst Metals Ltd (+4.80%)

IEL Idp Education Ltd (+4.14%)

Laggards

4DX 4DMEDICAL Ltd (-17.97%)

IPX Iperionx Ltd (-7.20%)

TEA Tasmea Ltd (-6.00%)

PNV Polynovo Ltd (-5.10%)

DRO Droneshield Ltd (-4.39%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!