What's Affecting Markets Today

Nikkei Extends Record Rally Ahead of BOJ Decision

Japan’s Nikkei 225 index climbed 1.19% on Friday, marking a second consecutive record high, as investors positioned ahead of the Bank of Japan’s policy decision. The central bank is expected to keep rates unchanged at 0.5%, according to a Reuters survey, though HSBC analysts project a 25 basis point hike at the October meeting.

Fresh data showed Japan’s core inflation eased to 2.7% in August, the lowest since November 2024 and in line with expectations. Headline inflation also moderated to 2.7% from 3.1% in July, extending its three-month decline. Analysts noted the BOJ remains focused on signs of economic resilience, with second-quarter GDP growth beating market forecasts.

Government bond markets reflected this outlook, with two-year yields climbing to 0.885%, the highest since 2008. The broader Topix rose 0.84%.

Elsewhere in Asia, Australia’s S&P/ASX 200 added 0.77%, while South Korea’s Kospi and Kosdaq were little changed. Hong Kong’s Hang Seng Index fell 0.4%, even as Zijin Gold unveiled a HK$25 billion ($3.2 billion) IPO, with trading to commence on September 29.

ASX Stocks

ASX 200 8,799.9 (+0.63%)

Healthcare Strength Pushes ASX Higher as Santos Rebounds

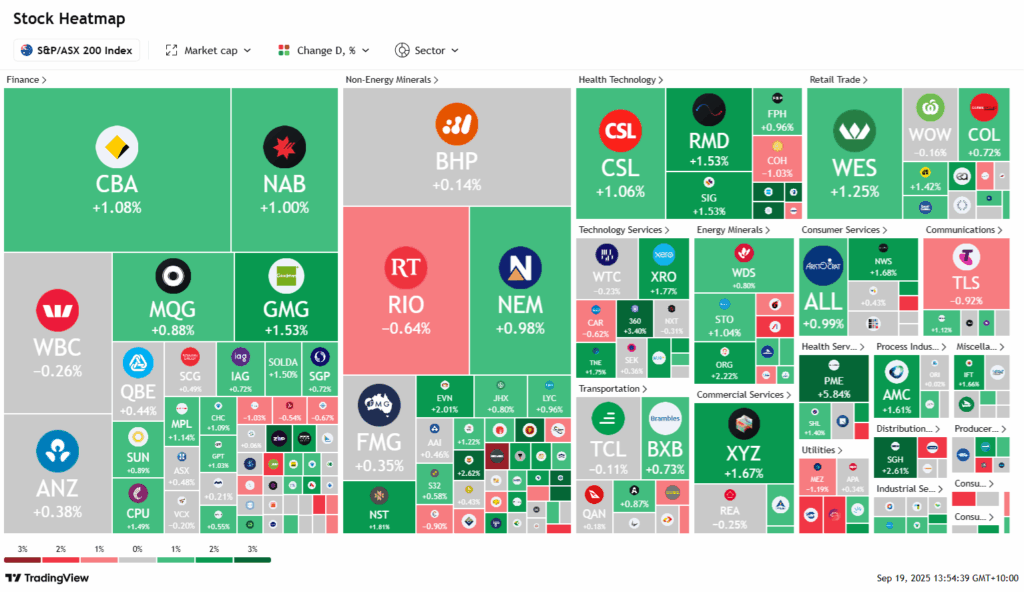

The Australian sharemarket advanced on Friday, lifted by record gains on Wall Street and strong performances in healthcare and utilities. The S&P/ASX 200 rose 61.2 points, or 0.7 per cent, to 8806.4 by midday, with 10 of 11 sectors trading higher. Despite the rally, the index remains more than 200 points below last month’s record peak.

Healthcare led the charge, with Telix Pharmaceuticals and Pro Medicus both surging 6.5 per cent after Citi initiated coverage. Telix was backed on the potential of its prostate cancer therapy to become a “blockbuster,” while Pro Medicus was highlighted for its pricing power. Utilities also gained, while BHP and Rio Tinto slipped on softer iron ore prices.

Energy stocks saw a rebound, with Santos climbing 1 per cent after Thursday’s heavy sell-off on the collapsed takeover bid, while Woodside rose 0.8 per cent. Banks were mixed, though Commonwealth Bank and NAB advanced. AGL Energy jumped 1.6 per cent after winning federal approval for a major wind and battery project.

Leaders

SGLLV Ricegrowers Ltd (+6.43%)

PME Pro Medicus Ltd (+6.19%)

BCI BCI Minerals Ltd (+5.26%)

CU6 Clarity Pharma (+5.24%)

Laggards

BFL BSP Financial Group Ltd (-3.64%)

DMP Domino’s PIZZA Enterprises Ltd (-2.76%)

4DX 4DMEDICAL Ltd (-2.52%)

DTL Data#3 Ltd (-2.44%)

MFG Magellan Financial Group Ltd (-2.28%)