What's Affecting Markets Today

Sony Financial Surges on Debut as Asia Markets Edge Higher

Shares in Sony Financial Group soared 36 per cent on their market debut Monday after parent Sony Group spun off the unit to operate independently. The stock was priced at 150 yen per share, giving the company a market value of around ¥1 trillion ($6.7 billion). Sony said the move would allow the financial arm—comprising Sony Life Insurance, Sony Assurance and Sony Bank—to raise its own growth capital while retaining brand synergies with the broader Sony ecosystem. The parent cited competing capital needs in semiconductors and entertainment as a driver for the separation.

In broader markets, Japan’s Nikkei 225 fell 0.84 per cent and the Topix shed 1.57 per cent after Friday’s record highs. Elsewhere, Australia’s S&P/ASX 200 advanced 0.71 per cent as investors awaited the Reserve Bank of Australia’s policy meeting, with economists expecting no change to the 3.6 per cent cash rate.

South Korea’s Kospi rose 1.25 per cent, while the Kosdaq gained 1.29 per cent. Hong Kong’s Hang Seng added 1.19 per cent at the open, with the Tech Index up 1.5 per cent. Mainland China’s CSI 300 was flat.

ASX Stocks

ASX 200 8,862.4 (+0.85%)

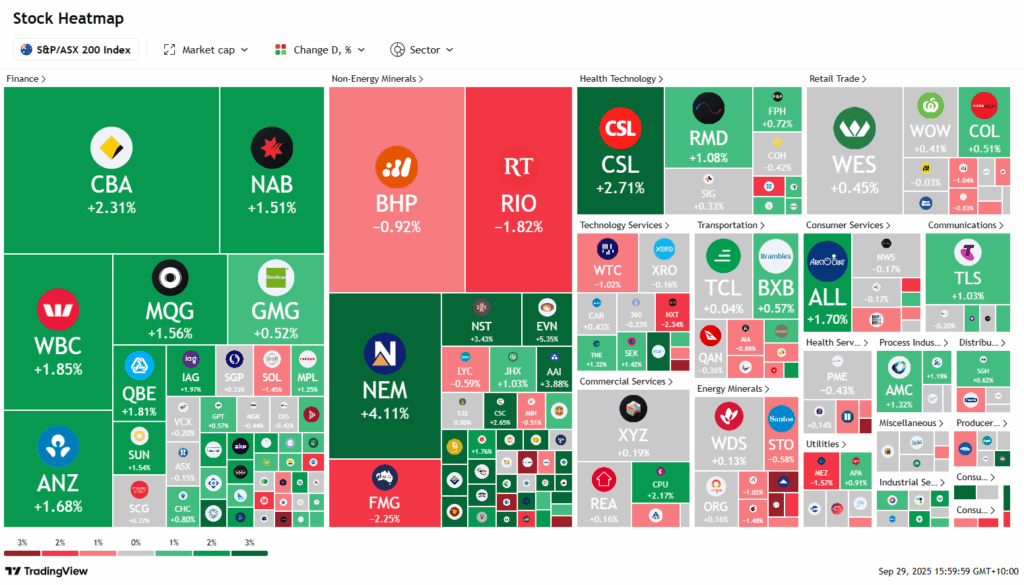

ASX Rises as Banks and Healthcare Lead Gains

The Australian sharemarket advanced on Monday, supported by strength in the financial and healthcare sectors, with investors cautious ahead of the Reserve Bank of Australia’s board meeting. The S&P/ASX 200 climbed 0.7 per cent, or 57.4 points, to 8844.1 in afternoon trade, marking its best gain in a week.

The big four banks were key drivers, with Commonwealth Bank up 2.1 per cent, while Westpac, NAB, and ANZ each added around 1.4 per cent. Healthcare stocks also staged a rebound after last week’s tariff-driven sell-off, with CSL gaining 2.9 per cent, Telix 1.1 per cent, and Imugene 5.6 per cent. Defence technology firm DroneShield surged to a record $4.46, extending its extraordinary 2025 rally of nearly 500 per cent, while Electro Optic Systems also rose on upbeat guidance.

Gains were tempered by weakness in major miners as iron ore prices slipped. Rio Tinto and BHP dropped 1.3 per cent, while Fortescue fell 2 per cent. Meanwhile, Novonix jumped 17 per cent on news of its first large-scale synthetic graphite production.

Leaders

DRO Droneshield Ltd (+22.52%)

EOS Electro Optic Systems Holdings Ltd (+12.70%)

PNR Pantoro Gold Ltd (+9.38%)

KCN Kingsgate Consolidated Ltd (+6.15%)

NXL NUIX Ltd (+5.66%)

Laggards

HSN Hansen Technologies Ltd (-5.94%)

ILU Iluka Resources Ltd (-4.17%)

REG Regis Healthcare Ltd (-3.81%)

SMR Stanmore Resources Ltd (-3.71%)

WHC Whitehaven Coal Ltd (-3.38%)