What's Affecting Markets Today

Asia-Pacific Markets Mixed as China PMI Shows Signs of Stabilisation

Asia-Pacific equities were mixed on Tuesday as fresh data from China pointed to a slower pace of contraction in manufacturing activity. The National Bureau of Statistics reported its official Manufacturing Purchasing Managers’ Index at 49.8 for September, beating expectations of 49.6 in a Reuters poll and marking the strongest reading since March, though still in contraction territory.

Separately, private surveyor RatingDog posted its manufacturing PMI at 51.2, well above forecasts of 50.2, and the highest level since May, signalling expansion in factory activity. Mainland China’s CSI 300 was flat at the open.

Elsewhere, the Reserve Bank of Australia left its benchmark cash rate unchanged at 3.6 per cent, in line with expectations, as inflation remains at its highest level in more than a year. The S&P/ASX 200 was little changed following the decision.

Japan’s Nikkei 225 slipped 0.1 per cent while the Topix traded flat. In South Korea, the Kospi was steady but the Kosdaq fell 0.34 per cent. Hong Kong’s Hang Seng Index gained 0.45 per cent, with Zijin Gold soaring more than 60 per cent on debut.

ASX Stocks

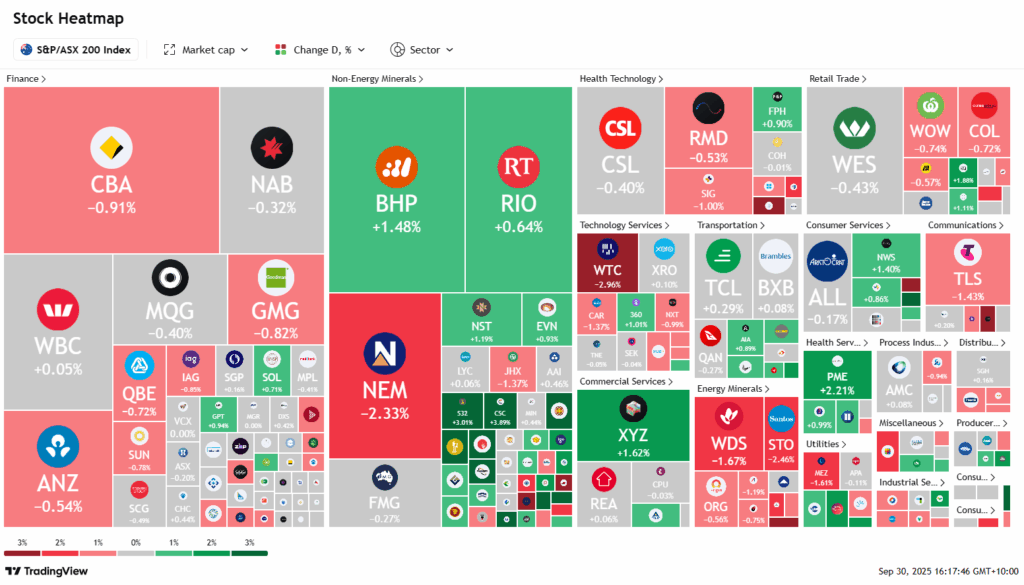

ASX 200 8,848.8 (-0.16%)

RBA Holds Cash Rate Steady as Markets Weigh Inflation Risks

The Reserve Bank of Australia (RBA) has kept the cash rate unchanged at 3.6 per cent, in a unanimous decision that matched market expectations. The board cited lingering uncertainty in the outlook, noting that recent data suggest inflation in the September quarter could exceed its earlier forecasts.

The central bank has already delivered three rate cuts this year as inflation retreated into its target band and labour market conditions softened. However, August’s monthly consumer price index showed an unexpected rise, while employment numbers fell, complicating the policy outlook. Markets currently see a 50 per cent chance of another cut in November.

Following the announcement, the Australian dollar edged up to US65.98¢ and government bond yields rose modestly, with the three-year yield at 3.58 per cent. On the equity market, gold miners led gains, buoyed by bullion hitting a fresh record high above US$3830 an ounce.

RBA Governor Michele Bullock will hold a press conference later today to expand on the board’s decision.

Leaders

IEL Idp Education Ltd (+15.19%)

4DX 4DMEDICAL Ltd (+13.89%)

SMR Stanmore Resources Ltd (+7.95%)

PDI Predictive Discovery Ltd (+6.10%)

CSC Capstone Copper Corp (+4.37%)

Laggards

PNR Pantoro Gold Ltd (-5.39%)

IPX Iperionx Ltd (-4.65%)

GNP Genusplus Group Ltd (-4.01%)

TLX TELIX Pharmaceuticals Ltd (-2.92%)

CU6 Clarity Pharmaceuticals Ltd (-2.85%)