What's Affecting Markets Today

Nikkei Hits Record High Again as Tech Stocks Surge; Yen Weakens, Yields Climb

Japan’s Nikkei 225 reached another record high on Tuesday, marking its second consecutive session of gains, buoyed by a global tech rally following news of a landmark deal between OpenAI and AMD — viewed as a major challenge to chipmaking leader Nvidia.

Chip-related stocks led the advance, with Advantest rising more than 4%, Tokyo Electron up 2%, Lasertec gaining 1.35%, and Renesas Electronics surging 4.85%. The broader Topix index added 0.31%.

The Nikkei also drew support from political developments after the ruling Liberal Democratic Party elected Sanae Takaichi as its new leader, paving the way for Japan’s first female prime minister.

Bond markets saw renewed pressure, with Japanese Government Bond yields climbing to multi-decade highs. The 10-year JGB yield rose 2 basis points to 1.694%, the highest since 2008, while the 30-year yield reached a record 3.333%.

The yen weakened 0.11% to 150.49 per U.S. dollar, extending a four-day slide. Australia’s ASX 200 fell 0.27%, while major Asian markets were closed for holidays.

ASX Stocks

ASX 200 8,961.2 (-0.22%)

ASX Retreats Amid Broad Market Sell-Off; Web Travel Gains as Broncos Slide

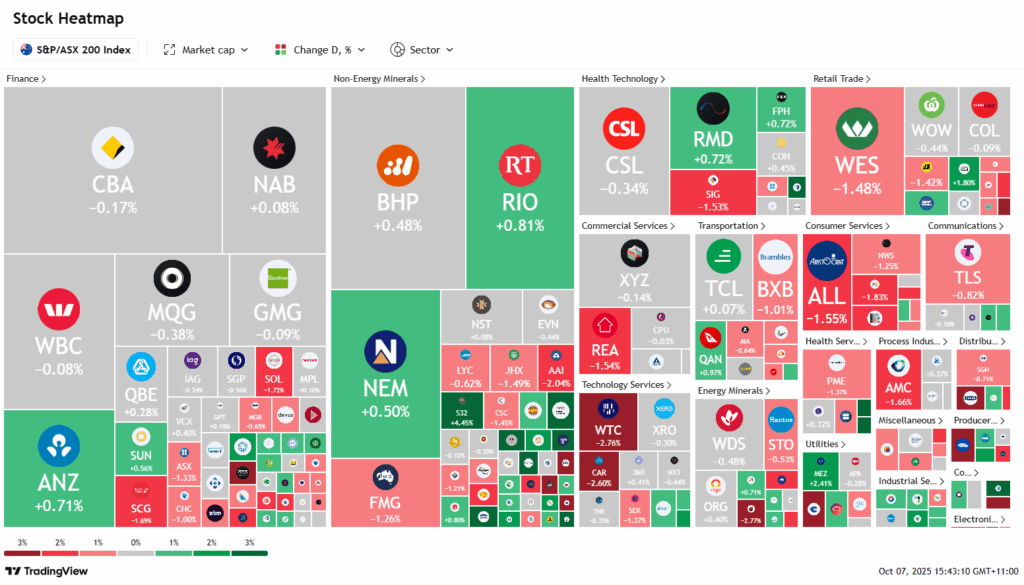

Australian shares declined on Tuesday in a broad-based sell-off despite overnight gains on Wall Street. The benchmark S&P/ASX 200 slipped 0.3 per cent, or 29.3 points, to 8952.1 by 2pm AEDT, with all sectors trading in the red.

Communication services led losses, down 1.2 per cent, with REA Group falling 2.2 per cent, Seek off 2.5 per cent, and CAR Group dropping 3.5 per cent. Financials also weakened, with Commonwealth Bank easing 0.1 per cent and ASX Limited down 1.7 per cent after Cboe Australia received regulatory approval to compete for listings. Consumer stocks lagged, with Breville tumbling 5.1 per cent.

Gold hit a record high near $US4000 an ounce amid U.S. rate-cut hopes and government shutdown fears, lifting Newmont shares 0.4 per cent.

Among notable movers, Rio Tinto reaffirmed a $1.1 billion Pilbara expansion, Web Travel jumped 2.5 per cent on record-earnings guidance, DroneShield fell 1 per cent, St Barbara slumped 12.7 per cent on a $58 million raising, and Brisbane Broncos plunged 12.8 per cent after their post-grand final rally faded.

Leaders

GGP Greatland Resources Ltd (+9.32%)

PDI Predictive Discovery Ltd (+8.85%)

RYM Ryman Healthcare Ltd (+7.05%)

KCN Kingsgate Consolidated Ltd (+4.68%)

MSB Mesoblast Ltd (+4.63%)

Laggards

CYL Catalyst Metals Ltd (-7.11%)

PNV Polynovo Ltd (-5.52%)

GQG GQG Partners Inc (-4.94%)

REH Reece Ltd (-4.69%)

BRG Breville Group Ltd (-4.35%)