What's Affecting Markets Today

SoftBank Soars on $5.4b ABB Robotics Deal; HSBC Moves to Take Hang Seng Private

Shares of SoftBank surged as much as 13% on Thursday after announcing a $5.4 billion deal to acquire ABB’s robotics division, marking a major push into what founder Masayoshi Son calls “Physical AI.” The acquisition, pending global regulatory approval, means ABB will no longer spin off its robotics arm as a standalone entity.

Son said the partnership aims to “fuse Artificial Super Intelligence and robotics,” positioning SoftBank at the forefront of the next AI revolution. The company already owns Arm and holds stakes in OpenAI and Graphcore, which reportedly plans a $1.3 billion investment in India tied to Prime Minister Keir Starmer’s upcoming visit.

Elsewhere in Asia, Hang Seng Bank shares jumped nearly 30% after HSBC proposed a HK$290 billion ($37b) privatization offer, exchanging shares for HK$155 apiece. HSBC stock slipped 6% in response.

Japan’s Nikkei 225 rose 1.1%, the ASX 200 gained 0.44%, while Hong Kong’s Hang Seng Index fell 0.93%. South Korea’s markets were closed for a holiday.

ASX Stocks

ASX 200 8,966.10 (+0.21%)

Miners Lift ASX as Elders Slumps on Drought Update

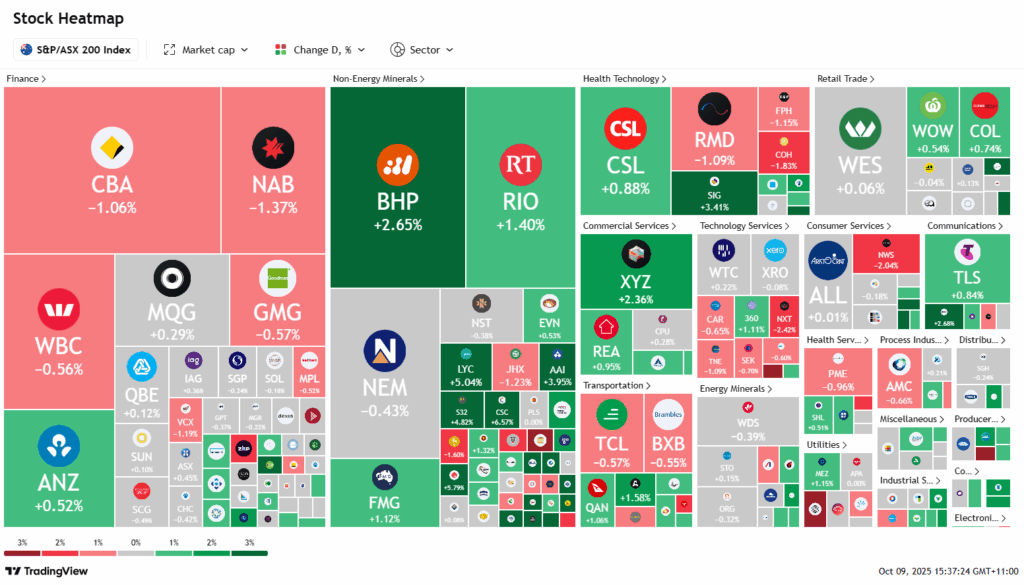

The Australian sharemarket rose modestly on Thursday, supported by gains in the major miners. The S&P/ASX 200 advanced 0.2 per cent, or 23.7 points, to 8971.3, nearing its record high from August.

Materials led the rally, driven by stronger copper prices, with Sandfire Resources jumping 5.5 per cent, BHP up 2.5 per cent, and Rio Tinto gaining 1.5 per cent. Lithium producers also advanced, including Lake Resources (+3.1%), IGO (+2.2%), and Mineral Resources (+1.3%).

In contrast, gold and silver miners retreated amid profit-taking despite gold touching a record US$4095 an ounce. Silver Mines dropped over 7 per cent, while Regis Resources fell 4 per cent.

Lynas Rare Earths climbed 4.6 per cent after partnering with US-based Noveon Magnetics. Brazilian Rare Earths surged 8.3 per cent on a supply deal with France’s Carester.

Among laggards, agribusiness Elders slipped 2.8 per cent following a downbeat trading update citing drought conditions, while bank stocks were mixed, with NAB down 1.3 per cent and ANZ up 0.4 per cent.

Leaders

L1G L1 Group Ltd (+13.70%)

CHN Chalice Mining Ltd (+11.11%)

DMP Domino’s PIZZA Enterprises Ltd (+8.09%)

NIC Nickel Industries Ltd (+8.00%)

DVP Develop Global Ltd (+8.00%)