What's Affecting Markets Today

Wingtech Plunges as Dutch Government Seizes Chip Subsidiary; Asia Markets Mixed

Shanghai-listed shares of Chinese chipmaker Wingtech tumbled 10% for a second consecutive session on Tuesday after the Dutch government took control of its Netherlands-based unit, Nexperia, citing national security concerns under the “Goods Availability Act.” The move aims to ensure Europe’s access to essential semiconductor components, given Nexperia’s key role in automotive and industrial chip supply chains.

Across Asia, markets were mixed. South Korea’s Kospi hit a record high of 3,646.67, up 1.01%, led by construction and mining stocks. Korea Zinc and Tongyang surged nearly 18%, while LG Energy Solution jumped 7% on strong U.S. EV demand. Samsung Electronics rose 2.5% after projecting a 32% profit increase for the third quarter.

Japan’s Nikkei 225 slid 1.34% as SoftBank dropped more than 5% following reports linking its Arm subsidiary to OpenAI’s new partnership with Broadcom. Meanwhile, China’s CSI 300 gained 0.87%, Hong Kong’s Hang Seng added 0.75%, and Singapore’s economy outpaced forecasts with 2.9% third-quarter growth.

ASX Stocks

ASX 200 8,897.3 (+0.16%)

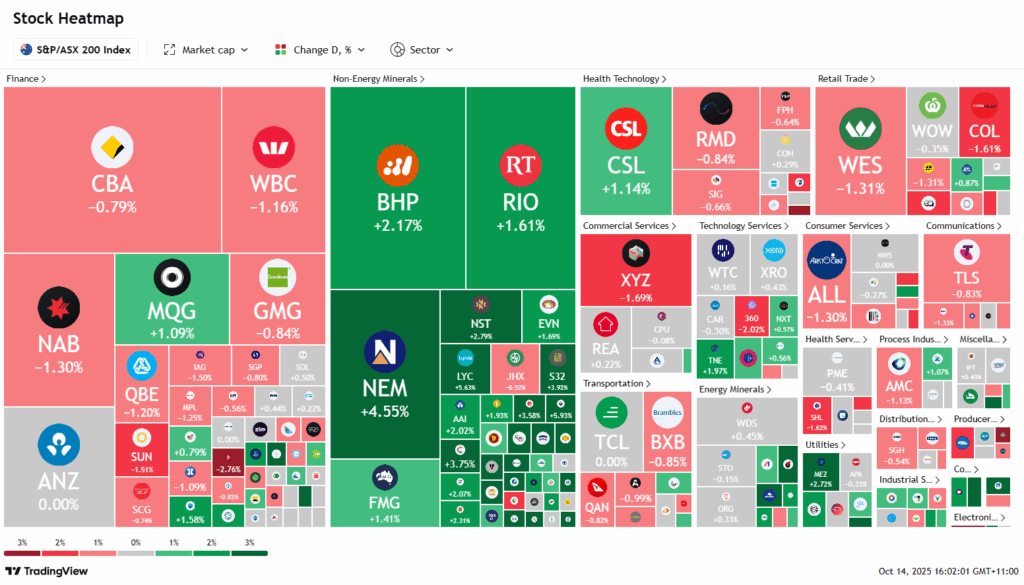

ASX Seesaws as Gold and Iron Ore Giants Rally

The Australian sharemarket fluctuated on Tuesday as optimism over renewed US-China trade dialogue and easing Middle East tensions lifted sentiment. The S&P/ASX 200 was steady at 8883 points by mid-afternoon, with strong gains in gold miners and iron ore majors offsetting weakness across most sectors.

Rio Tinto rose 1.7%, BHP 1.9%, and Fortescue 0.8% as benchmark iron ore hit US$109.20 a tonne, its highest level since February. Gold miners surged after bullion touched a record US$4109 an ounce, with Newmont up 3.5% and Genesis Minerals climbing 4.5%. Silver producers also rallied sharply amid a record short squeeze in London.

Uranium stocks advanced after Paladin Energy’s upbeat production report, while rare earths and copper producers gained on supply deals and capital raisings. Offsetting these gains, the major banks declined up to 1.5%, led by Westpac.

Market sentiment improved after President Trump signalled renewed trade cooperation with China and a ceasefire deal in Gaza boosted global risk appetite.

Leaders

SRG SRG Global Ltd (+27.56%)

ARU Arafura Rare EARTHS Ltd (+23.94%)

ILU Iluka Resources Ltd (+14.84%)

CYL Catalyst Metals Ltd (+13.09%)

DYL Deep Yellow Ltd (+12.56%)

Laggards

EOS Electro Optic Systems Holdings Ltd (-10.40%)

DTR Dateline Resources Ltd (-10.28%)

CU6 Clarity Pharmaceuticals Ltd (-8.74%)

DRO Droneshield Ltd (-5.97%)

4DX 4DMEDICAL Ltd (-5.30%)