What's Affecting Markets Today

Asia-Pacific Markets Rise Despite U.S.-China Trade Tensions

Asia-Pacific equities climbed on Wednesday, defying overnight declines on Wall Street as investors shrugged off renewed trade tensions between the United States and China. U.S. President Donald Trump reignited the feud, accusing China of economic hostility for halting soybean purchases and threatening “retribution,” including a potential cooking oil embargo.

Japan’s Nikkei 225 advanced 1.53% and the Topix gained 1.42%, while South Korea’s Kospi surged 2.15% and the Kosdaq rose 1.35%. Australia’s S&P/ASX 200 added 0.85%, and Hong Kong’s Hang Seng Index climbed 1.21%. Mainland China’s CSI 300 was little changed, while India’s Nifty 50 gained 0.43%.

Investor sentiment in China remained cautious after fresh data showed consumer prices fell more than expected in September, reflecting subdued domestic demand. The consumer price index declined 0.3% year-on-year, compared with forecasts for a 0.2% drop, while producer price deflation persisted. On a monthly basis, CPI edged up 0.1%, undershooting expectations for a 0.2% increase, underscoring the ongoing challenges facing the Chinese economy.

ASX Stocks

ASX 200 8,990.5 (+1.03%)

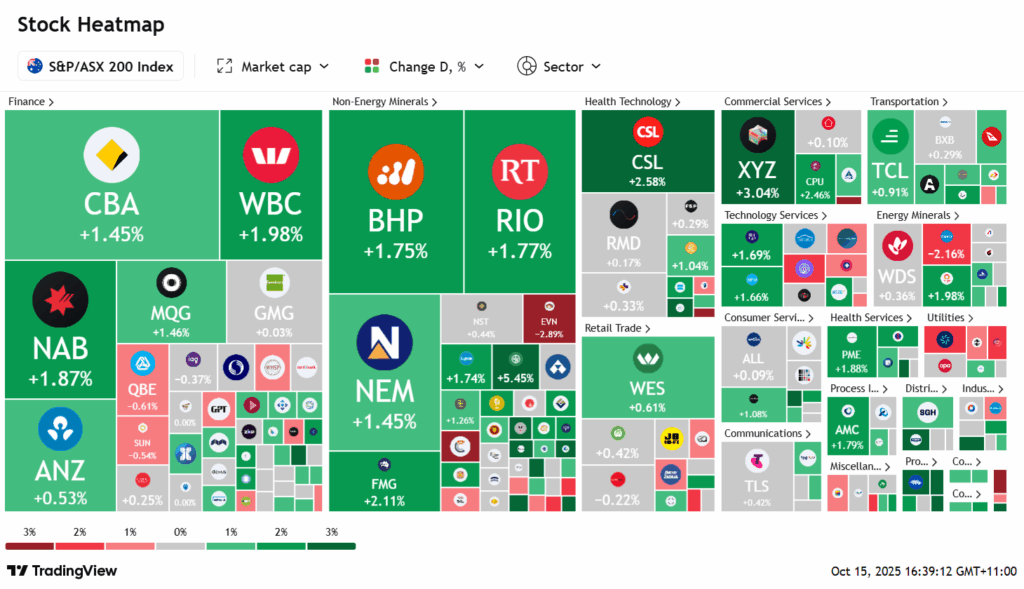

ASX Climbs as Banks and Miners Drive Gains; BoQ Rallies on Profit Lift

The Australian sharemarket advanced on Wednesday, lifted by strength in major banks and miners as gold prices surged to fresh record highs. The S&P/ASX 200 Index rose 0.9 per cent, or 76.2 points, to 8975.6, with nine of 11 sectors closing higher.

Financials led the gains, with Westpac up 1.7 per cent after the prudential regulator removed a $500 million capital penalty. National Australia Bank rose 1.5 per cent, ANZ added 1.2 per cent, and Commonwealth Bank gained 1.1 per cent. Bank of Queensland jumped 2 per cent after posting a 12 per cent rise in annual profit to $383 million and lifting its fully franked final dividend to 20¢ per share.

Gold miners rallied as bullion reached a record US$4185 an ounce, with Newmont and Perseus each up 1.3 per cent. BHP, Fortescue, and Rio Tinto all advanced more than 1 per cent.

Elsewhere, Telix Pharmaceuticals surged 15 per cent on upgraded guidance, while DroneShield slumped 7.3 per cent after launching its new C2 software platform.

Leaders

IPX Iperionx Ltd (+11.34%)

LTR Liontown Resources Ltd (+8.33%)

VUL Vulcan Energy Resources Ltd (+8.24%)

HMC HMC Capital Ltd (+8.01%)

Laggards

DRO Droneshield Ltd (-9.93%)

BVS Bravura Solutions Ltd (-9.10%)

CU6 Clarity Pharma (-6.76%)

ARU Arafura Rare EARTHS (-6.74%)