What's Affecting Markets Today

Kospi Hits Record High as IMF Upgrades Growth Outlook

South Korea’s Kospi index surged to a record high on Thursday after the International Monetary Fund raised the nation’s 2025 growth forecast to 0.9% from 0.8% in its latest outlook. The IMF also lifted its global growth projection, noting that the impact of U.S. tariffs has remained modest thanks to private sector agility, diversified trade flows, and continued openness in global commerce.

Further optimism came after U.S. Treasury Secretary Scott Bessent told CNBC that Washington was “about to finish up” trade talks with Seoul, bolstering investor confidence. Autos and electronics led the gains, with Hyundai Motor up 8%, Kia rising 7%, and Samsung Electronics adding 2.3% to a record high.

Across the region, Japan’s Nikkei 225 rose 0.95%, while the Topix added 0.8%. Australia’s ASX 200 also hit a new peak as a higher unemployment rate of 4.5% reinforced expectations of further rate cuts. Meanwhile, Hong Kong’s Hang Seng Index was poised to open slightly lower.

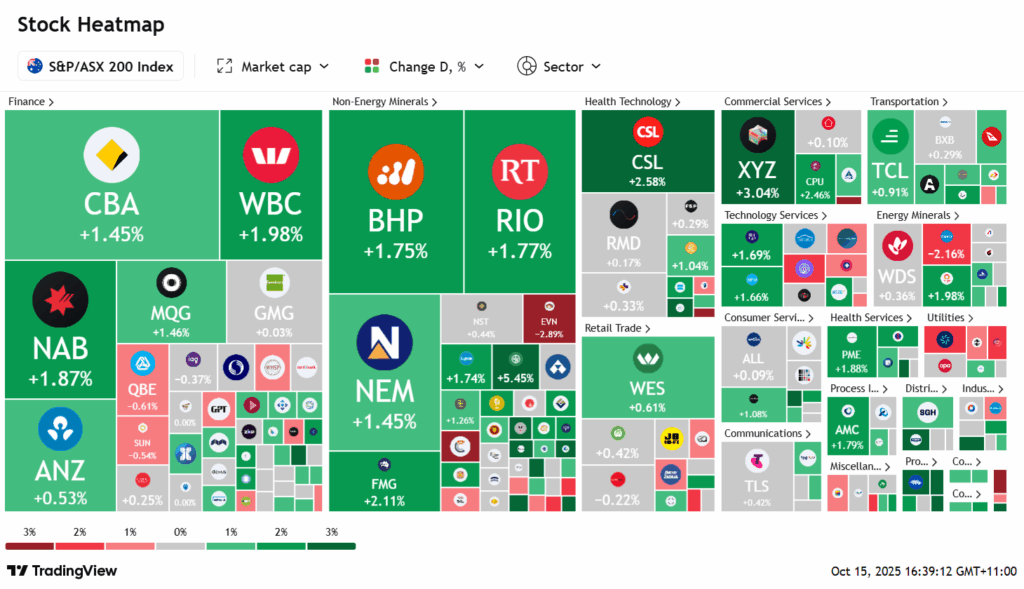

ASX Stocks

ASX 200 9,069.7 (+0.87%)

ASX Hits Fresh Record as Rate Cut Hopes Rise, Gold Miners Lead Gains

The Australian sharemarket surged to a new intraday record on Thursday, with the S&P/ASX 200 peaking at 9109.7 before easing to 9077.8 — up 1%. Gains were driven by financials and property stocks after the jobless rate unexpectedly climbed to a four-year high of 4.5%, boosting expectations of a November rate cut.

The big four banks rallied, led by ANZ (+1.8%) and Commonwealth Bank (+1.3%), while Macquarie Group soared 5.2% after agreeing to sell Aligned Data Centers for $61 billion. Real estate stocks followed suit, with Goodman Group, Mirvac and Stockland up around 3–4%.

Gold miners shone as bullion hit a record US$4200/oz — Genesis rose 7.5%, Northern Star 1.9%, and Evolution 3%. Conversely, rare earth producers retreated sharply after China’s export curbs rally faded.

Among notable movers, AMP jumped 9.5% on higher funds under management, Mayne Pharma surged 11% after a court ruling, while DroneShield slid 3.2% on profit-taking.

Leaders

FFM Firefly Metals Ltd (+22.56%)

CU6 Clarity Pharmaceuticals Ltd (+11.16%)

AMP AMP Ltd (+9.23%)

APZ Aspen Group (+8.33%)

GMD Genesis Minerals Ltd (+7.77%)

Laggards

DTR Dateline Resources Ltd (-10.94%)

ILU Iluka Resources Ltd (-7.87%)

IPX Iperionx Ltd (-5.71%)

HMC HMC Capital Ltd (-5.39%)

LYC Lynas Rare Earths Ltd (-5.25%)