What's Affecting Markets Today

Asia-Pacific Markets Rally on China Data and Japan Coalition Deal

Asia-Pacific equities advanced on Monday as investors digested China’s latest economic data and a political breakthrough in Japan boosted sentiment.

China’s gross domestic product expanded 4.8 per cent in the September quarter from a year earlier, matching analysts’ expectations, while the central bank left its benchmark one-year loan prime rate unchanged at 3 per cent. The steady policy stance and solid growth figures helped lift regional markets.

Hong Kong’s Hang Seng Index climbed more than 2 per cent, and the mainland’s CSI 300 gained 0.74 per cent. In Japan, the Nikkei 225 surged nearly 3 per cent, crossing the 49,000 level for the first time, after reports that the ruling Liberal Democratic Party and the Japan Restoration Party had agreed to form a coalition government. The broader Topix added 2 per cent.

South Korea’s Kospi rose 0.36 per cent, marking its fourth straight record session, while the Kosdaq advanced 1.13 per cent. Australia’s S&P/ASX 200 edged 0.1 per cent lower at the open.

ASX Stocks

ASX 200 9,028.50 (+0.38%)

ASX Rebounds as Investors Rotate Out of Gold Miners

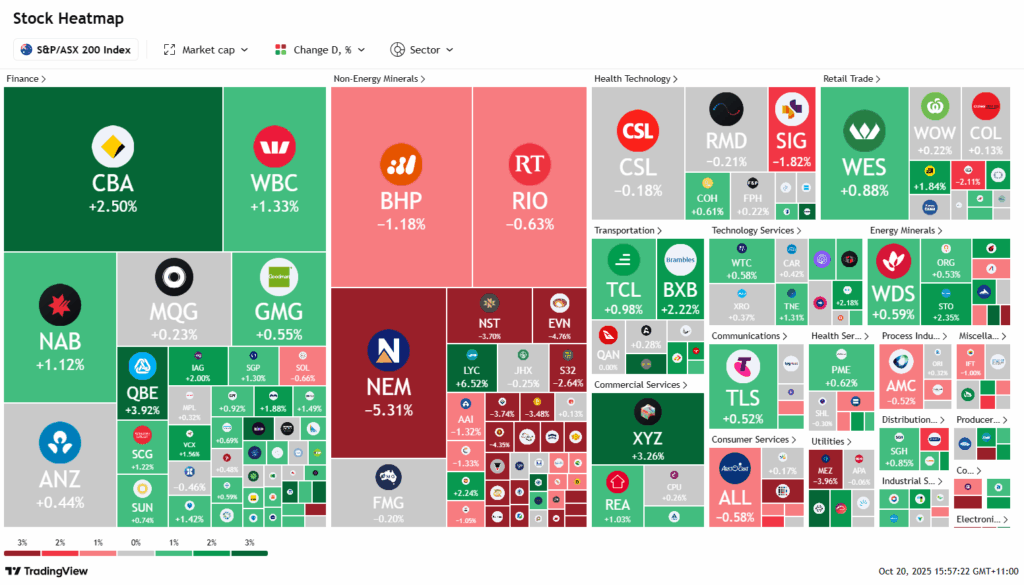

The Australian sharemarket recovered from a weak open on Monday, tracking gains on Wall Street as traders digested fresh Chinese economic data and awaited key US-Australia talks. The S&P/ASX 200 rose 0.1 per cent to 9005.9 at 2pm AEDT, reversing early losses after touching record highs above 9100 last week.

Nine of eleven sectors advanced, led by technology, while materials dragged with a 1.5 per cent fall as investors sold down gold and critical minerals stocks. Newmont, Evolution, and Perseus each plunged over 5 per cent, despite gold prices stabilising. Iluka dropped 6.8 per cent, while BHP and Rio Tinto softened on weaker iron ore.

Deep Yellow tumbled 18 per cent after its CEO’s sudden exit, and Bapcor slumped 17 per cent on a profit downgrade. Offsetting the weakness, Beach Energy climbed 4.1 per cent on stronger production, DroneShield edged higher after reporting a 1000 per cent revenue jump, and Zip gained nearly 4 per cent on upgraded US growth forecasts.

Leaders

ARU Arafura Rare EARTHS Ltd (+16.05%)

DTR Dateline Resources Ltd (+8.13%)

NEU Neuren Pharmaceuticals Ltd (+6.54%)

LYC Lynas Rare EARTHS Ltd (+5.51%)

MAD Mader Group Ltd (+5.04%)

Laggards

DYL Deep Yellow Ltd (-18.64%)

BAP Bapcor Ltd (-17.98%)

SX2 Southern Cross Gold (-9.46%)

EMR Emerald Resources NL (-9.26%)

CHN Chalice Mining Ltd (-8.61%)