What's Affecting Markets Today

Asian Markets Slip as Trade Tensions Resurface; Kospi Retreats from Record High

Asian equities fell on Thursday as renewed U.S.-China trade concerns weighed on sentiment, while South Korea’s Kospi retreated from a record high after the Bank of Korea held interest rates steady at 2.5%, in line with expectations. The Kospi slipped 0.56% and the Kosdaq lost 0.61%, while the Korean won weakened 0.2% to 1,434.70 per dollar, its lowest level since May.

In Japan, the Nikkei 225 dropped 1.52% and the Topix shed 0.71%, dragged by a sharp 6% fall in SoftBank shares after the company announced plans to issue $2 billion in U.S.-dollar bonds and €750 million in hybrid notes to fund AI investments.

Across the region, Hong Kong’s Hang Seng Index declined 0.17% and China’s CSI 300 lost 0.8%. Australia’s S&P/ASX 200 slipped 0.33%, tracking Wall Street’s overnight losses.

India’s markets bucked the trend, with the Nifty 50 rising 0.83% and the Sensex adding 0.69%, recovering strongly after a holiday break.

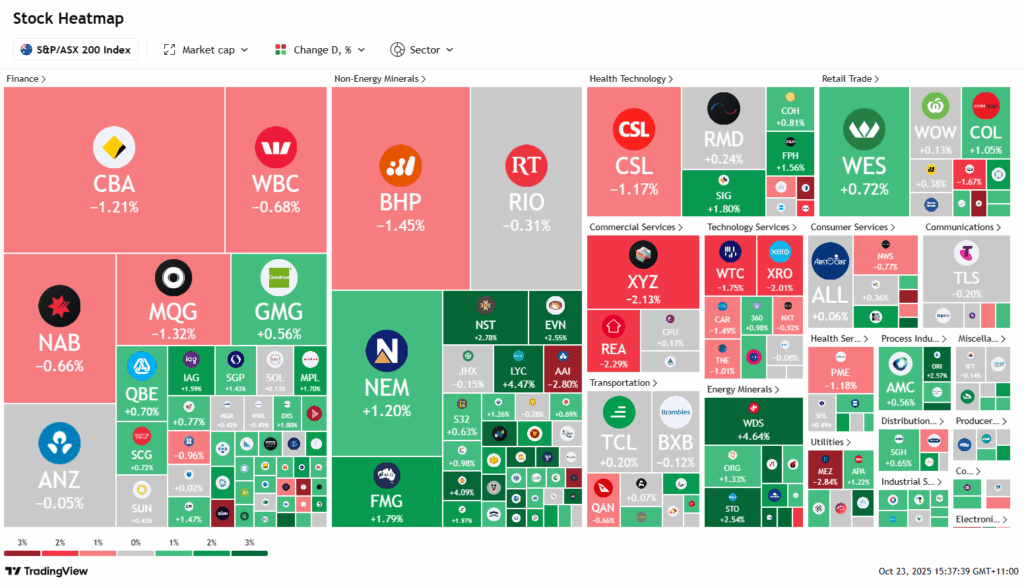

ASX Stocks

ASX 200 9,032.3 (+0.03%)

Energy Stocks Power ASX Higher as Oil Surges

The Australian sharemarket edged higher on Thursday, buoyed by a strong rebound in energy stocks as oil prices spiked following fresh U.S. sanctions on major Russian producers. The S&P/ASX 200 gained 0.1 per cent to 9039 by mid-afternoon, recovering from earlier losses driven by weakness in technology shares.

Energy stocks jumped 2.9 per cent, led by Woodside, up 4.1 per cent after announcing a strategic partnership with U.S. gas infrastructure firm Williams. Santos climbed 2.2 per cent and Karoon Energy soared 8.8 per cent as Brent crude traded above $US64 a barrel.

Technology was the weakest sector, mirroring Wall Street’s declines, with WiseTech and Xero each down 1.6 per cent and Nuix sliding 4.4 per cent. Materials were mixed: BHP slipped 1.7 per cent, while Fortescue gained 0.4 per cent after record quarterly shipments.

Elsewhere, IAG rose 2.8 per cent on upgraded guidance, Ainsworth Game Technology rallied 4 per cent on a takeover bid, and Super Retail Group fell 3.8 per cent after modest sales growth.

Leaders

ARU Arafura Rare EARTHS Ltd (+11.45%)

SLX SILEX Systems Ltd (+10.47%)

KAR Karoon Energy Ltd (+9.76%)

EOS Electro Optic Systems Holdings Ltd (+8.51%)

MAF MA Financial Group Ltd (+7.88%)

Laggards

DTR Dateline Resources Ltd (-8.43%)

CU6 Clarity Pharmaceuticals Ltd (-4.58%)

NXL NUIX Ltd (-4.56%)

VUL Vulcan Energy Resources Ltd (-4.05%)

PPT Perpetual Ltd (-3.82%)