What's Affecting Markets Today

Asia Stocks Slip Ahead of Trump–Takaichi Meeting

Asian markets fell broadly on Tuesday as investors awaited the first official meeting between U.S. President Donald Trump and Japan’s newly appointed Prime Minister, Sanae Takaichi. Trump, who met Emperor Naruhito upon arriving in Tokyo, will be the first foreign leader to hold direct talks with Takaichi since she assumed office.

Japan’s Nikkei 225 retreated 0.38% from its record high, while the Topix declined 0.49%. Losses extended across the region despite overnight Wall Street gains that lifted all three major U.S. indexes to record closes. South Korea’s Kospi led declines, down 1.32%, with the Kosdaq also slightly weaker, even as the country’s third-quarter GDP grew at its fastest pace in over a year.

Australia’s S&P/ASX 200 slipped 0.22% in early trade, while Hong Kong’s Hang Seng edged 0.1% lower and China’s CSI 300 lost 0.39%. In Hong Kong, Sany Heavy Industry traded flat on its debut after raising HK$12.36 billion (US$1.59 billion), marking one of the city’s largest IPOs this year.

ASX Stocks

ASX 200 9,025.3 (-0.32%)

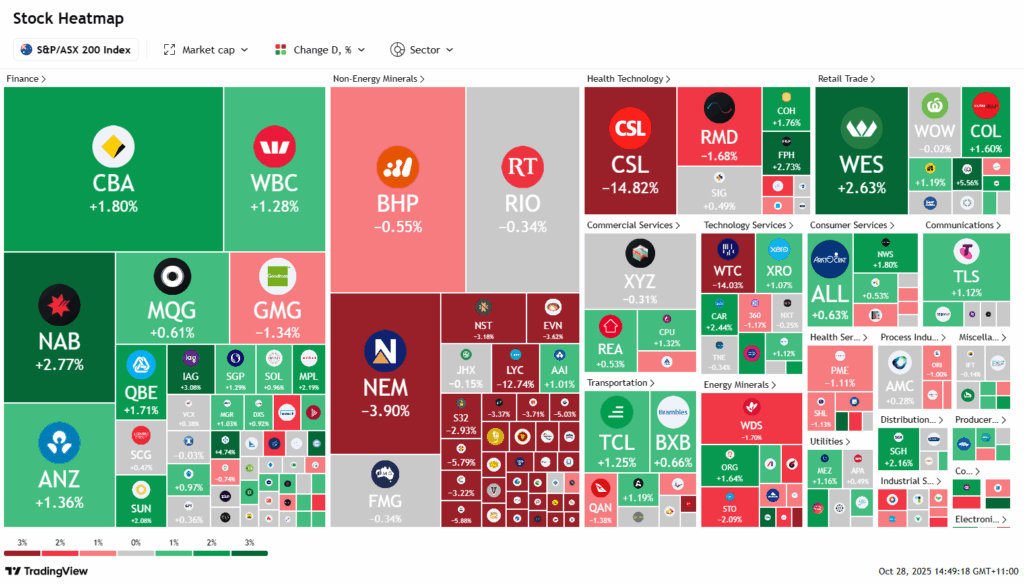

ASX Falls as CSL, WiseTech and Domino’s Volatility Offsets Bank Gains

The Australian sharemarket slipped on Tuesday, with the S&P/ASX 200 down 43.7 points, or 0.5 per cent, to 9011.9 by 2pm AEDT. Losses in technology and healthcare outweighed strength in the banking and retail sectors despite Wall Street’s overnight rally on optimism for a US-China trade deal.

CSL plunged 15 per cent after cutting revenue guidance and facing a second shareholder strike, while WiseTech Global tumbled 15 per cent following AFP and ASIC raids over alleged insider trading. Domino’s Pizza surged 17.4 per cent before entering a trading halt amid reports of a potential Bain Capital takeover.

Gold miners also declined as bullion prices fell below US$4000 an ounce, with Greatland, Genesis and Capricorn sliding up to 9 per cent. Offsetting the losses, the big four banks advanced between 1.1 and 2.4 per cent, while consumer names Wesfarmers, JB Hi-Fi and Eagers gained ground. AUB jumped 8.2 per cent on a takeover approach, while Liontown sank 11.8 per cent after a $44 million cash burn.

Leaders

DMP Domino’s PIZZA Ent(+17.35%)

WBT Weebit Nano Ltd (+8.45%)

AUB AUB Group Ltd (+7.95%)

APE Eagers Automotive Ltd (+5.56%)

SDF Steadfast Group Ltd (+4.66%)

Laggards

DTR Dateline Resources Ltd (-32.90%)

CSL CSL Ltd (-14.88%)

WTC Wisetech Global Ltd (-14.21%)

LYC Lynas Rare EARTHS Ltd (-12.87%)

LTR Liontown Resources Ltd (-12.60%)