What's Affecting Markets Today

Nikkei Breaks 51,000 as U.S.-Japan Trade Optimism and Fed Cut Bets Lift Markets

Japan’s Nikkei 225 surged more than 1 per cent on Wednesday to a fresh record high above 51,000, buoyed by optimism surrounding strengthened U.S.-Japan trade ties and growing expectations of further Federal Reserve easing. The rally followed the signing of a new rare earths cooperation framework between U.S. President Donald Trump and Japanese Prime Minister Sanae Takaichi during his first official visit to Tokyo. Trump also met Emperor Naruhito at the Imperial Palace.

Investors increasingly expect the Fed to deliver a second consecutive 25-basis-point interest rate cut, which would lower the federal funds rate to 3.75–4.00 per cent. Analysts say a dovish tone from Chair Jerome Powell could further extend equity gains.

Elsewhere, the broader Topix traded flat. South Korea’s Kospi inched up 0.17 per cent, while the Kosdaq slipped 0.25 per cent. Australia’s S&P/ASX 200 edged 0.16 per cent lower after quarterly inflation accelerated to 3.2 per cent, its fastest pace in more than a year. China’s CSI 300 rose 0.37 per cent, while Hong Kong markets remained shut for a public holiday.

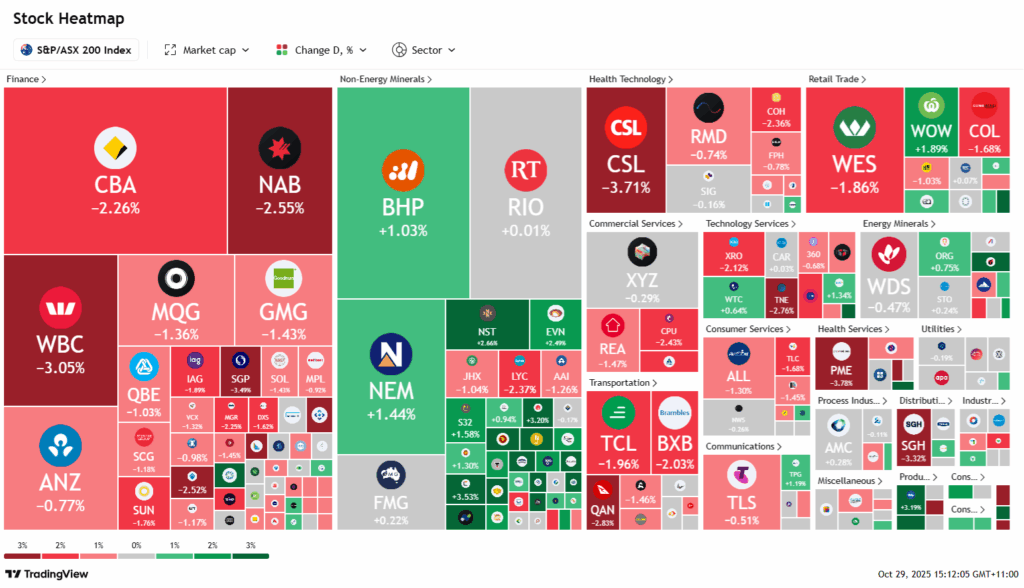

ASX Stocks

ASX 200 8,923.10 (-0.99%)

ASX Slides as Hot Inflation Data Delays Rate-Cut Expectations

The Australian sharemarket weakened on Wednesday after a stronger-than-expected inflation reading dented hopes of an imminent interest rate cut. The S&P/ASX 200 fell 0.9 per cent, or 81 points, to 8931.2 by mid-afternoon, with property, banks and healthcare weighing on the index.

Core inflation – the Reserve Bank’s preferred measure – rose 1 per cent for the September quarter, exceeding forecasts of 0.8 per cent and well above the RBA’s projected 0.6 per cent. The upward revision to Q2 further reduced expectations of a Melbourne Cup Day rate cut, and economists cautioned even a February reduction is now less likely.

Real estate stocks dropped 1.3 per cent, with Stockland and Mirvac down 2 per cent. The major banks each slipped more than 2 per cent. Healthcare underperformed, led by CSL’s 3.8 per cent decline.

Select company results provided relief. Nick Scali surged 12 per cent on strong sales, while Boss Energy jumped 18.2 per cent after record uranium output. Gains for Woolworths, SiteMinder and Ansell also helped offset declines in Cash Converters, Helia and Medibank.

Leaders

DTR Dateline Resources Ltd (+16.67%)

NCK Nick Scali Ltd (+12.41%)

PDN Paladin Energy Ltd (+11.82%)

NXG Nexgen Energy (+10.47%)

DYL Deep Yellow Ltd (+9.87%)

Laggards

ARU Arafura Rare EARTHS Ltd (-20.67%)

DRO Droneshield Ltd (-8.95%)

ASB Austal Ltd (-5.53%)

DVP Develop Global Ltd (-4.73%)

OCL Objective Corporation Ltd (-4.36%)