What's Affecting Markets Today

Japan Leads Asian Markets Higher as US–China Reach Rare Earths Truce

Asian equities were mixed on Friday, with Japan leading regional gains after the US and China signalled a truce in their rare earths dispute. The agreement followed a high-stakes meeting between President Donald Trump and Chinese President Xi Jinping in South Korea, easing tensions that had threatened to escalate into a broader trade war.

The Nikkei 225 rose more than 1% to a fresh record, while the Topix gained 0.79%. South Korea’s Kospi added 0.22% after hitting a record on Thursday, and the Kosdaq rose 0.47%. Australia’s S&P/ASX 200 opened 0.45% higher.

However, sentiment was softer in Greater China. Hong Kong’s Hang Seng slipped 0.33% and the CSI 300 was flat as China’s October manufacturing PMI fell to 49, missing expectations and marking a sixth month of contraction amid renewed trade pressures.

In corporate news, Panasonic Holdings dropped more than 8% after cutting its full-year operating profit forecast by 13.5%, citing weaker earnings from its energy division, which supplies batteries to Tesla and other automakers.

ASX Stocks

ASX 200 8,903.8 (+0.21%)

ASX Edges Higher as Banks and Gold Miners Rebound; Mayne Pharma Slumps

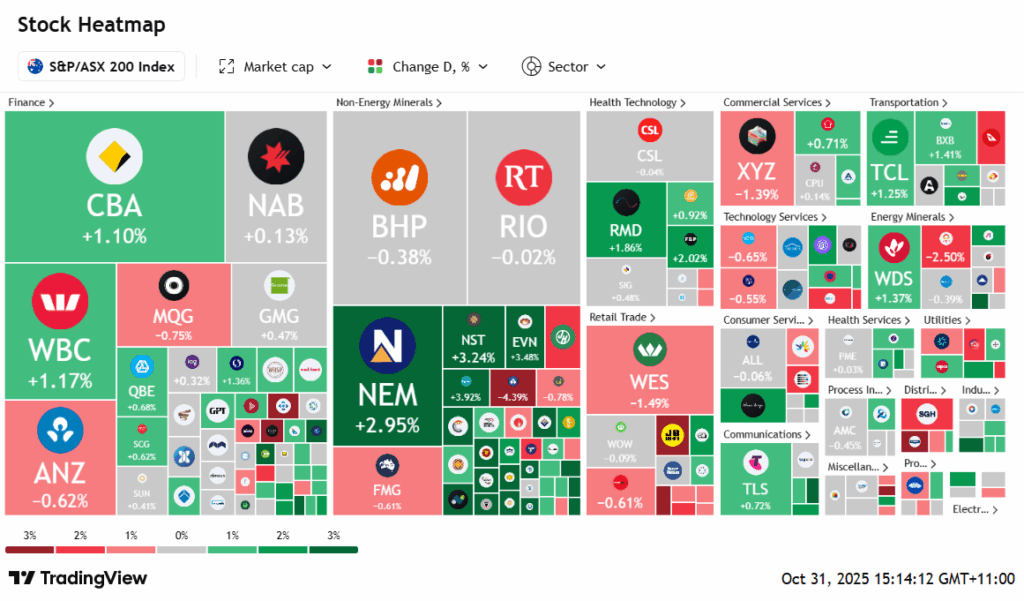

The ASX climbed on Friday afternoon, supported by gains in major banks and gold miners after bullion rebounded from a four-session slide. The S&P/ASX 200 rose 0.3% to 8914.9 at 2:12pm AEDT, with nine of 11 sectors advancing.

Gold producers led the rally as the commodity jumped 2.5% following positive signals from the Trump–Xi meeting, where China committed to resume US soybean purchases and ease rare earth controls. Westgold jumped 6%, Evolution 4.2%, and Newmont and Bellevue Gold each gained 3.5%.

Commonwealth Bank rose 1.2% as the financials sector firmed, though ANZ slipped 0.8% ahead of full-year results impacted by $1.1b in after-tax adjustments.

Wall Street was mixed overnight. Meta fell 11.3% on higher AI spending plans, while Amazon and Apple shares surged on strong quarterly updates. Atlassian rallied in after-hours trade as cloud revenue rose 26%.

On the ASX, ResMed gained 2.2% on higher earnings, while Mayne Pharma plunged 32% after the Treasurer signalled rejection of its $672m takeover. Steadfast dropped 7.9% amid an investigation into its CEO.

Leaders

KCN Kingsgate Consolidated Ltd (+10.40%)

FFM Firefly Metals Ltd (+7.24%)

VUL Vulcan Energy Resources Ltd (+6.07%)

DTR Dateline Resources Ltd (+5.46%)

VAU Vault Minerals Ltd (+5.07%)

Laggards

SDF Steadfast Group Ltd (-7.82%)

DRO Droneshield Ltd (-4.79%)

LOV Lovisa Holdings Ltd (-4.44%)

AAI Alcoa Corporation (-4.21%)

WA1 WA1 Resources Ltd (-4.07%)