What's Affecting Markets Today

Asia Markets Slide as AI Sell-Off and Weak China Data Weigh on Sentiment

Asia-Pacific equities retreated on Friday, mirroring Wall Street’s declines as investors grew wary of stretched valuations in artificial intelligence stocks. The Nikkei 225 tumbled 1.93%, dragged by sharp losses in AI-linked shares — SoftBank sank more than 8%, Advantest dropped over 7%, while Renesas Electronics and Tokyo Electron lost 4% and 2.2%, respectively. The Topix index slid 0.99%.

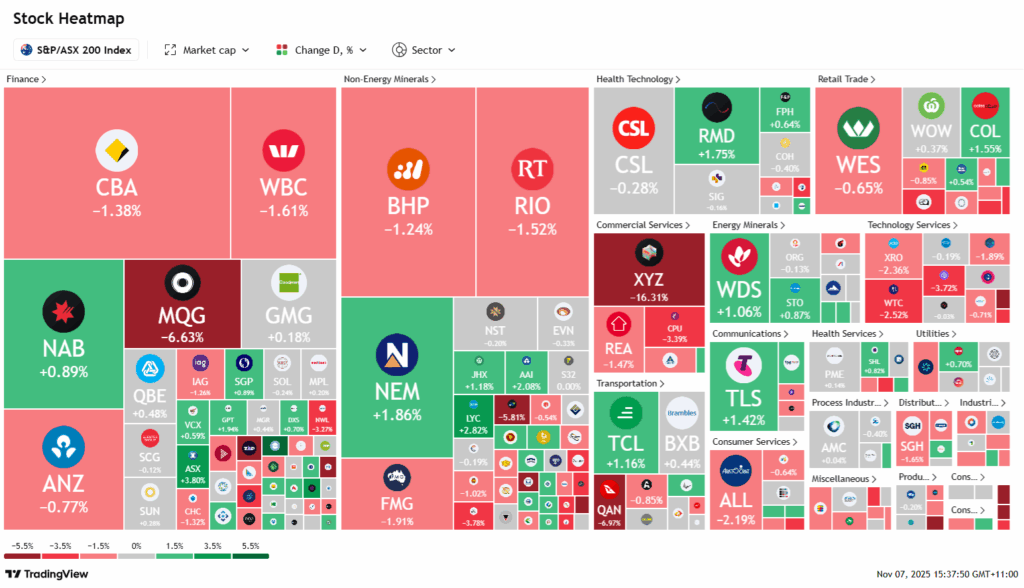

In South Korea, the Kospi fell 1.47% and the Kosdaq shed 1.96% amid volatile trading. Australia’s ASX 200 declined 0.27%, while Hong Kong’s Hang Seng slipped 0.61% and the CSI 300 in mainland China edged down 0.3%.

Adding to regional pressure, China’s latest trade figures disappointed. Exports in October fell 1.1% year-on-year in U.S. dollar terms, missing forecasts for 3% growth, while imports rose just 1%, short of expectations. The weak trade data underscored persistent softness in domestic demand, weighed down by a sluggish property sector and fading consumer stimulus.

ASX Stocks

ASX 200 8,766.5 (-0.70%)

ASX Extends Weekly Slide as Macquarie, Block Sink

The Australian sharemarket edged lower on Friday, heading for its second straight weekly loss as investor sentiment cooled following the Reserve Bank’s decision to keep rates unchanged. The S&P/ASX 200 fell 0.5% to 8787.1 at 2:10pm AEDT, with the benchmark on track for a 1% weekly decline.

Financials dragged the index as Macquarie Group plunged 7.4% after its $1.7 billion half-year profit missed analyst forecasts. Commonwealth Bank slipped 1.5%, while NAB rose 1%. Tech stocks mirrored Wall Street weakness, with Iren down 12% and WiseTech Global, Life360, and Xero all lower.

In materials, Newmont gained 2.2% on firmer gold prices near US$4000 an ounce, offsetting falls in Rio Tinto and Fortescue. Alliance Aviation crashed 41% after warning of rising costs and a leadership exit. Block plunged 14% after disappointing U.S. revenue, while Qantas fell 5.7% on weaker domestic growth guidance. News Corp jumped 4% on better-than-expected quarterly results.

Leaders

AUB AUB Group Ltd (+6.48%)

ASX ASX Ltd (+3.74%)

LYC Lynas Rare EARTHS Ltd (+3.62%)

ILU Iluka Resources Ltd (+3.57%)

NWS News Corporation (+3.31%)

Laggards

XYZ Block, Inc (-15.48%)

WBT Weebit Nano Ltd (-11.51%)

FFM Firefly Metals Ltd (-8.80%)

SLX SILEX Systems Ltd (-7.81%)

ZIP ZIP Co Ltd (-7.34%)