What's Affecting Markets Today

Asia-Pacific Markets Mixed as Japan Hits Records and Australia Slides on Jobs Data

Asia-Pacific equities delivered a mixed performance on Thursday, following a subdued Wall Street session and renewed optimism in Washington after the U.S. House passed a short-term funding bill to end the nation’s longest federal shutdown.

Japan outperformed the region, with the Nikkei 225 rising 0.23% and the Topix advancing 0.62% to a record high. SoftBank Group, however, remained under pressure, falling more than 5% for a second straight day after confirming the sale of its entire US$5.8 billion Nvidia stake to bolster its OpenAI investment strategy.

South Korea’s Kospi traded flat while the Kosdaq edged up 0.31%.

Australia’s S&P/ASX 200 lagged regional peers, dropping 1.01% after October unemployment unexpectedly eased to 4.3%, below economist expectations. The stronger labour data reduced the likelihood of a near-term RBA rate cut, sending the Australian dollar up to US$0.6556.

Hong Kong’s Hang Seng Index slipped 0.15%, while China’s CSI 300 was steady in early trade as investors awaited further policy signals.

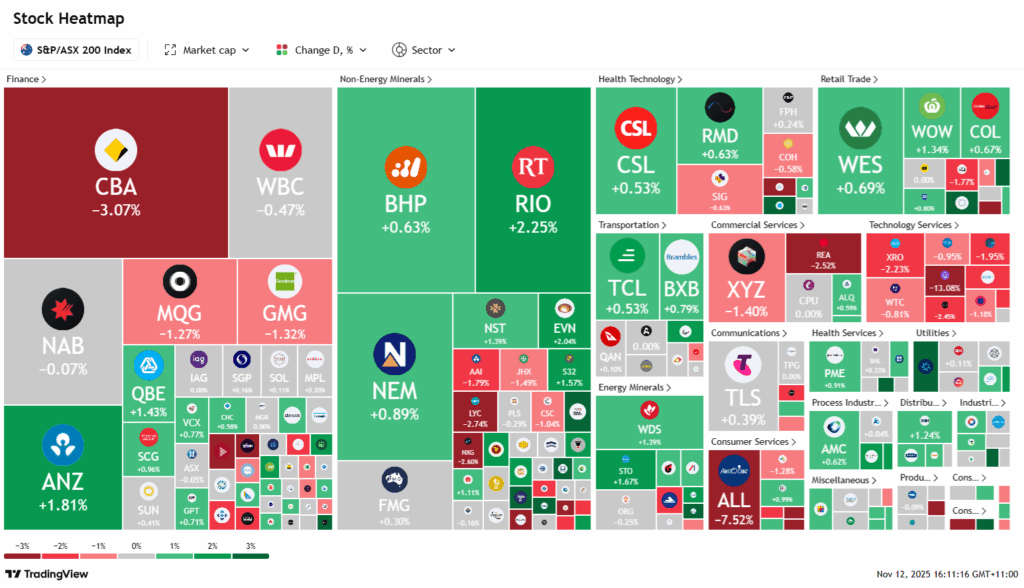

ASX Stocks

ASX 200 8,806.80 (-0.14%)

ASX Drops 1% as Hot Labour Data Crushes Rate-Cut Hopes

The Australian sharemarket slid sharply on Thursday after a stronger-than-expected jobs report dampened hopes of a 2025 interest-rate cut. The S&P/ASX 200 fell as much as 1 per cent to a 10-week low, with the unemployment rate unexpectedly dropping to 4.3 per cent in October alongside a 42,200 jobs surge. Money markets slashed the probability of a June RBA cut to 30 per cent, down from 80 per cent a week earlier.

Rate-sensitive technology and property stocks led the sell-off. Xero dived 6.8 per cent on higher-than-expected operating costs, while NextDC fell 4.9 per cent. Major developers including Mirvac and Stockland lost more than 3 per cent. ANZ weighed on financials as its shares traded ex-dividend.

Energy stocks weakened after crude oil sank nearly 4 per cent, dragging Woodside down 3 per cent. Gold miners outperformed as bullion hovered near $US4200 an ounce, lifting Newmont and Evolution Mining.

In company news, DroneShield plunged 31 per cent following large director share sales, while GrainCorp sank 11 per cent on a sharp profit drop. Sandfire’s deal for Kalkaroo sent Havilah up 31 per cent, and Webjet slumped 19 per cent after issuing a profit warning.

Leaders

DTR Dateline Resources Ltd (+9.65%)

MIN Mineral Resources Ltd (+9.61%)

LTR Liontown Resources Ltd (+6.65%)

SNZ Summerset Group Holdings Ltd (+5.00%)

FCL Fineos Corporation Holdings Plc (+4.48%)

Laggards

360 LIFE360 Inc (-12.70%)

ALL Aristocrat Leisure Ltd (-7.53%)

ZIP ZIP Co Ltd (-6.43%)

CU6 Clarity Pharmaceuticals Ltd (-5.30%)

A4N Alpha Hpa Ltd (-4.97%)