What's Affecting Markets Today

Asia-Pacific Markets Retreat as Global Tech Weakness Weighs on Sentiment

Asia-Pacific equities traded lower on Tuesday, mirroring a tech-driven sell-off on Wall Street that dampened risk appetite across the region. Japan led the declines, with the Nikkei 225 sliding 0.92% and the broader Topix down 0.6%, as investors reacted to rising domestic bond yields and renewed pressure on technology shares. Long-dated Japanese government bond yields continued their upward move, with the 20-year yield climbing nearly 4 basis points to 2.78%—its highest level since July 1999—while the 10-year yield added around 2 basis points to reach 1.751%, according to LSEG data.

In South Korea, the Kospi slipped 0.64% and the small-cap Kosdaq shed 0.58%, reflecting softer sentiment across semiconductor and growth-oriented names. Hong Kong’s Hang Seng index fell 0.86% as weakness in financials and tech weighed on the market, while the mainland CSI 300 finished largely unchanged.

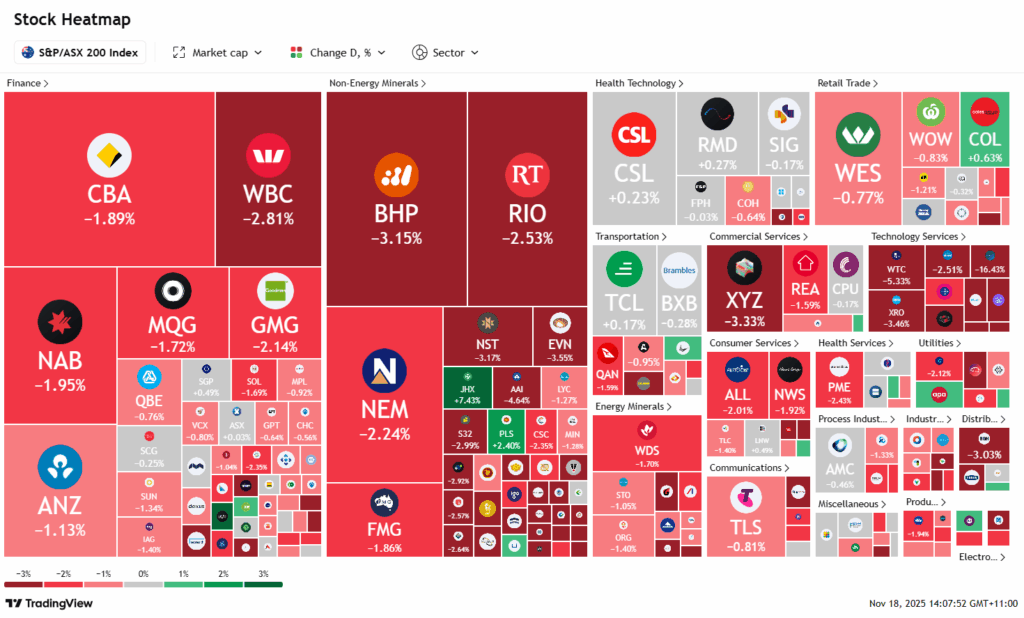

Australia’s S&P/ASX 200 declined 0.76%, pressured by pullbacks in miners and energy stocks amid a cautious global outlook. Regional investors continued to track U.S. tech performance and shifting interest-rate expectations, keeping volatility elevated.

ASX Stocks

ASX 200 8,487.8 (-1.72%)

ASX Slides to Five-Month Low as Tech Rout Deepens and RBA Minutes Weigh on Sentiment

The Australian sharemarket fell sharply on Tuesday, with the S&P/ASX 200 dropping 1.4 per cent to 8517.70 by midday AEDT—its weakest level since June. A steep sell-down in technology stocks led the decline, driven by investor caution ahead of Nvidia’s earnings and renewed uncertainty over the interest-rate outlook. The sector tumbled 5.4 per cent, with TechnologyOne plunging 14 per cent after its annual recurring revenue outlook disappointed, while WiseTech and Xero fell 5.1 per cent and 3.8 per cent respectively.

Adding to the pressure, minutes from the Reserve Bank’s latest meeting flagged higher-than-expected inflation and reinforced expectations that rates will remain elevated, with major banks signalling no cuts likely in 2026. Financials weakened, with Commonwealth Bank sliding 1.5 per cent and other majors down more than 1 per cent.

Materials traded mixed as iron ore softness weighed on BHP, Fortescue and Rio Tinto, while PLS jumped 2.8 per cent on bullish lithium price forecasts. Defensive names outperformed, including CSL, Coles and a2 Milk. Among individual movers, James Hardie surged 6.6 per cent after lifting earnings guidance, while BlueScope and Catapult Sports declined on softer outlooks.

Leaders

JHX James Hardie Industries Plc (+7.55%)

GQG GQG Partners Inc (+5.90%)

LTR Liontown Resources Ltd (+3.25%)

PLS Pilbara Minerals Ltd (+3.16%)

KCN Kingsgate Consolidated Ltd (+2.81%)

Laggards

TNE Technology One Ltd (-16.58%)

SLC Superloop Ltd (-10.77%)

ABB Aussie Broadband Ltd (-9.89%)

CAT Catapult Sports Ltd (-9.43%)

DTR Dateline Resources Ltd (-8.93%)