What's Affecting Markets Today

Asia-Pacific Markets Slide as Tech Rout and Fed Uncertainty Weigh on Sentiment

Asia-Pacific equities declined sharply on Friday after U.S. tech stocks lost ground and expectations for a Federal Reserve rate cut in December faded. Japan’s Nikkei 225 dropped 1.57% at the open, while the Topix fell 0.72%. Tech names led the downturn, with SoftBank plunging more than 10% and semiconductor-related stocks including Advantest, Tokyo Electron and Lasertec posting steep losses. Renesas Electronics also slipped nearly 2%.

Japan’s October core inflation rose at its fastest pace since July, in line with forecasts, reinforcing speculation that the Bank of Japan may move toward further policy tightening.

South Korea saw one of the region’s steepest declines, with the Kospi tumbling 4.09% and the Kosdaq falling 3.01%. Market heavyweights Samsung Electronics and SK Hynix dropped as much as 4% and 9%, respectively.

Elsewhere, Australia’s S&P/ASX 200 slid 1.3%, while Hong Kong’s Hang Seng Index fell 1.88% and its Tech Index shed 2.33%. Major Chinese tech stocks Baidu, Xiaomi and Tencent traded significantly lower, alongside declines in EV makers BYD, Nio and Li Auto. China’s CSI 300 slipped 1.13%, while India’s Nifty 50 and Sensex opened modestly weaker.

ASX Stocks

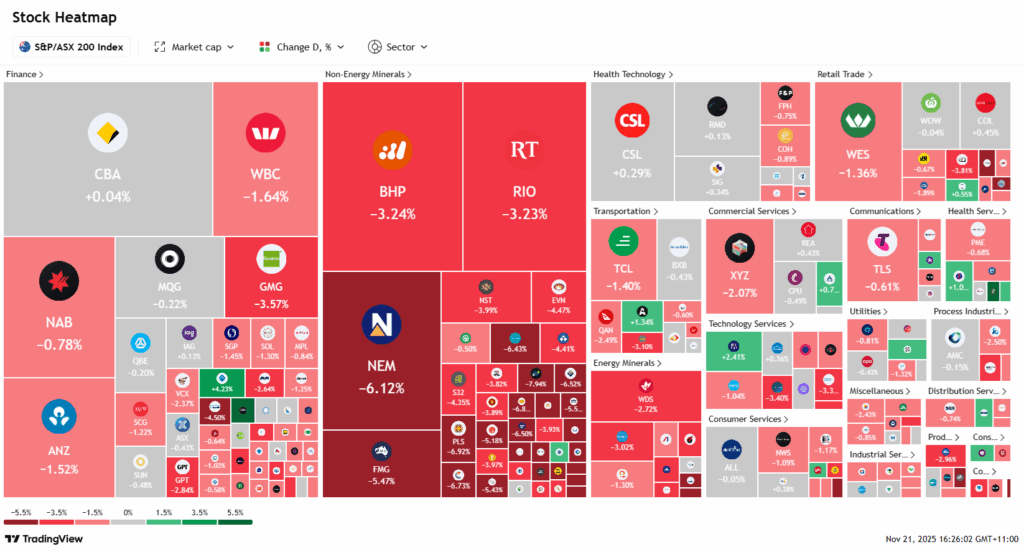

ASX 200 8,416.50 (-1.59%)

ASX Slumps Toward Fourth Consecutive Weekly Loss

The Australian sharemarket is poised for a fourth straight weekly decline, with the S&P/ASX 200 sliding 1.5 per cent, or 128.5 points, to 8424.20 by mid-afternoon Friday. November losses have now reached 5 per cent, setting the benchmark on track for its weakest month since September 2022.

Sentiment deteriorated following a stronger-than-expected US September jobs report, which added 119,000 positions against forecasts of 50,000. The data reignited uncertainty around the Federal Reserve’s near-term policy path. Analysts note markets are pricing in only a marginally higher chance of a December rate cut, while expectations for the 2026 easing cycle are becoming increasingly shallow.

Materials drove the local decline, falling nearly 4 per cent. BHP sank 3.2 per cent after reports China’s state-run iron ore buyer instructed steel mills and traders to halt purchases of a specific grade from the miner. Gold stocks also retreated as rate-cut uncertainty weighed on bullion.

In corporate news, Lovisa tumbled 10.5 per cent, Accent Group plunged 12.8 per cent on an earnings downgrade, while Webjet edged 1.1 per cent higher after BGH Capital lifted its takeover bid.

Leaders

RYM Ryman Healthcare Ltd (+5.39%)

GQG GQG Partners Inc (+5.34%)

CAT Catapult Sports Ltd (+5.32%)

BVS Bravura Solutions Ltd (+4.55%)

WTC Wisetech Global Ltd (+3.91%)

Laggards

ELV Elevra Lithium Ltd (-11.92%)

VUL Vulcan Energy Resources Ltd (-11.11%)

LOV Lovisa Holdings Ltd (-10.91%)

ILU Iluka Resources Ltd (-10.49%)

CYL Catalyst Metals Ltd (-9.37%)