What's Affecting Markets Today

Asia-Pacific Markets Rise on Wall Street Momentum and Fed Rate-Cut Optimism

Asia-Pacific equities advanced on Thursday, buoyed by overnight gains on Wall Street as expectations for Federal Reserve rate cuts strengthened and technology stocks rebounded.

Japan’s Nikkei 225 climbed 1.42%, with tech stocks leading the charge. Chip-testing giant Advantest surged up to 5%, SoftBank rallied more than 5%, and Tokyo Electron gained 2.09%. The broader Topix index rose 0.64%.

In South Korea, the Kospi added 1.05% while the Kosdaq increased 0.39%. The Bank of Korea held its benchmark interest rate at 2.5% for the fourth consecutive meeting, balancing a soft local currency and elevated housing market risks. The Korean won remains near its weakest level since April.

Australia’s S&P/ASX 200 rose 0.42%, mirroring the region’s positive tone. Hong Kong’s Hang Seng Index inched up 0.12% at the open, while China’s CSI 300 was little changed.

However, China’s industrial sector showed signs of strain, with October industrial profits falling 5.5% from a year earlier. Cumulative profits for the first ten months grew 1.9%, easing from a 3.2% rise through September.

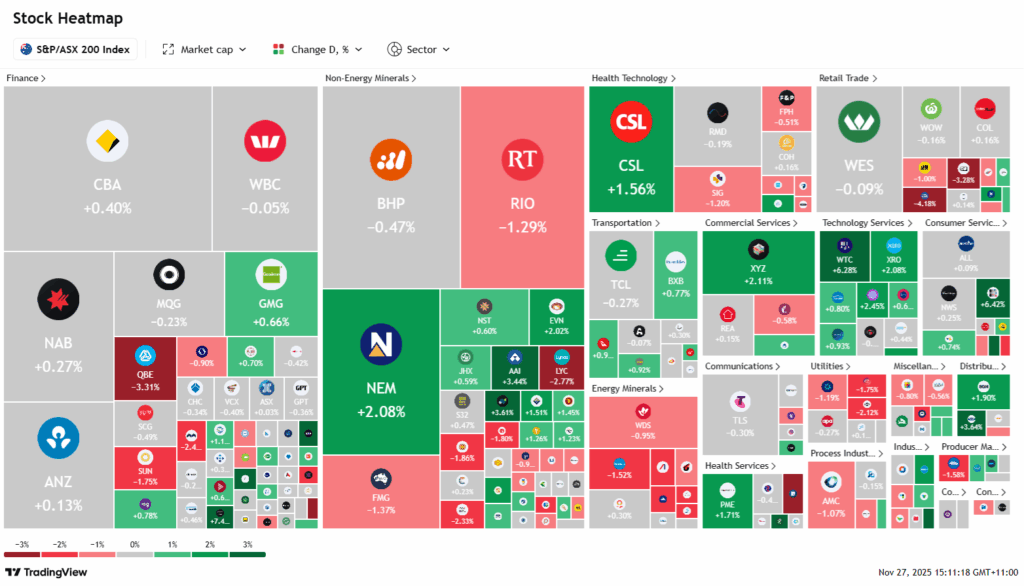

ASX Stocks

ASX 200 8,604.3 (-0.03%)

Tech Gains Offset Energy Weakness as ASX Edges Higher

The Australian sharemarket held marginally higher on Thursday afternoon, lifted by strength in the technology sector but constrained by weakness in energy names. The S&P/ASX 200 inched up 3.2 points, or less than 0.1%, to 8609.7 by mid-afternoon, with seven sectors in positive territory.

Local tech stocks tracked Wall Street’s upbeat lead, where US markets rallied for a fourth straight session on expectations of Federal Reserve rate cuts and renewed enthusiasm for the AI trade. WiseTech rose 6% following a board appointment, while Xero added 2% and Life360 gained 2.7%.

Gains in gold miners, supported by a jump in the spot gold price to US$4168 an ounce, helped steady the index. Newmont lifted 2.2% and Bellevue Gold added 3.2%. However, iron ore majors retreated as prices eased in Singapore, with BHP, Rio Tinto and Fortescue all lower.

Energy stocks weighed on the market as Brent crude fell to US$62 a barrel ahead of the OPEC+ meeting. Santos dropped 1.8% and Woodside slipped 1.1%. DroneShield was the biggest laggard, down 9.2% after recent strong gains.

Leaders

DTR – Dateline Resources Ltd (+9.62%)

HMC – HMC Capital Ltd (+8.85%)

GQG – GQG Partners Inc (+7.78%)

JDO – Judo Capital Holdings Ltd (+7.64%)

DGT – Digico Infrastructure REIT (+6.88%)

Laggards

DRO – Droneshield Ltd (-8.18%)

LFG – Liberty Financial Group (-5.20%)

VSL – Vulcan Steel Ltd (-5.07%)

HVN – Harvey Norman (-4.32%)

EOS – Electro Optic Systems (-3.36%)