What's Affecting Markets Today

Global markets were mixed this afternoon as investors continued to weigh stretched technology valuations against lingering uncertainty around the path of interest rates. US futures traded flat to slightly lower, reflecting a cautious lead-in to major data releases later in the week, including inflation numbers and key employment prints.

The broader market tone remained hesitant: tech names have struggled to hold recent gains as questions build around whether AI-driven revenues can sustain their aggressive valuations, while cyclical sectors improved modestly on signs of stabilising economic activity in Asia. Commodities were generally firmer, led by gold, which continues to benefit from safe-haven demand, and oil, which saw a mild rebound after several sessions of selling pressure.

Bond yields across major economies were steady, suggesting investors are holding back on making directional calls until clearer signals emerge from central banks. The USD pulled back slightly, helping risk assets avoid steeper declines. Overall, global sentiment is cautious but orderly, with traders preferring to wait for fresh catalysts rather than take on additional risk.

ASX Stocks

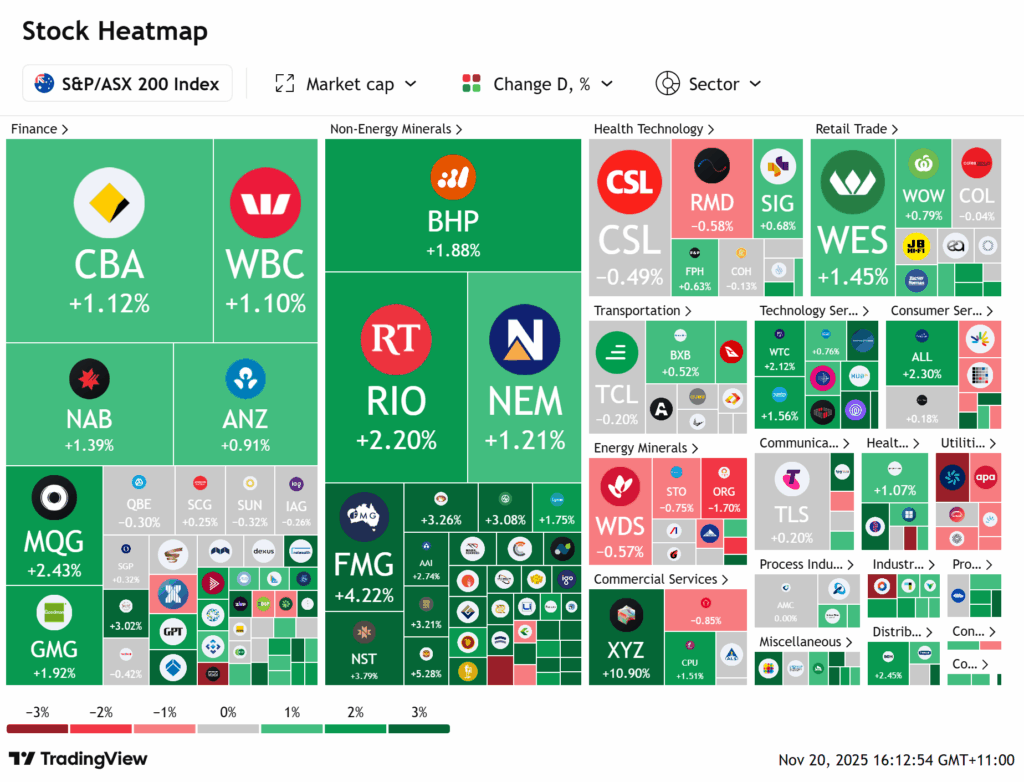

ASX 200 8,552.7 (1.20%)

The ASX traded in a tight range through the afternoon, reflecting the same cautious undertone seen in overseas markets. The index struggled to build meaningful momentum as tech and consumer stocks lagged, mirroring global weakness in high-multiple growth sectors. Investor appetite for local tech remains limited ahead of US earnings updates, which continue to dictate sentiment for anything AI- or cloud-related.

Resources, however, provided support. Gold miners outperformed on the back of firmer spot prices and ongoing geopolitical unease, while energy names also caught a bid as crude prices attempted a recovery. The big banks were generally steady, with investors still digesting mixed economic signals and the Reserve Bank’s recent commentary around persistent inflation.

Turnover across the market was relatively light, suggesting local investors are reluctant to position aggressively ahead of global macro data. Despite this, the ASX remains resilient, holding above key support levels and benefiting from strong performance in defensive sectors. The overall tone remains selective—investors are favouring cash-flow-positive names, high-quality industrials, and resource exposure, while remaining cautious on discretionary and high-valuation tech stocks.