While the headlines often focus on tech giants or banks at record highs, Australia’s engineering services companies have been quietly delivering impressive results in the background. Over the past year, several of these “behind-the-scenes” players have emerged as standout performers on the ASX, rewarding investors with strong returns and demonstrating the essential role they play in keeping the nation’s infrastructure and industry running smoothly.

The Standout Performers: SSM, SRG, and TEA

Service Stream Limited (ASX:SSM) has been a real star. Over the last 12 months, its share price climbed nearly 40%, hitting new highs. What’s behind this success? Put simply, Service Stream is the backbone for many of Australia’s essential services. The company designs, builds, and maintains the networks that deliver internet, phone, electricity, gas, water, and renewable energy to homes and businesses. With revenue reaching AUD 2.38 billion and net profit surging to AUD 52.6 million, Service Stream’s financial recovery has been impressive. Their strategy of locking in long-term contracts—re-securing more than 95% of their major deals—has provided stability and growth. Add in a rising dividend and positive future forecasts, and it’s easy to see why investors have taken notice.

SRG Global (ASX:SRG) is another company that’s quietly excelled. Its share price soared 72% over the past year, thanks to record financial results and a focus on long-term, recurring contracts. SRG Global works on big projects like bridges, buildings, mines, and power stations, making sure they’re built right and kept in good shape. Revenue jumped 32% to AUD 1.18 billion, and net profit rose 53% to AUD 38.1 million. The company’s Maintenance & Industrial Services segment has been a key driver, providing steady growth and reliable margins. Operational improvements, smart investments in technology, and strong cash generation have all played a part. A 13% dividend increase was the cherry on top, cementing SRG’s status as a sector standout.

Tasmea Limited (ASX:TEA) has perhaps been the biggest surprise, with its share price rocketing more than 140% in the last 12 months. Tasmea specializes in keeping the machinery and equipment running at mines, power plants, water treatment facilities, and factories. Their services range from scheduled maintenance and emergency repairs to complex engineering projects. The company’s net profit after tax jumped 76.6% in the latest half-year, and profit margins improved significantly. Tasmea’s success comes from a record order book, disciplined management, and smart acquisitions. By reinvesting profits and increasing dividends, they’ve built confidence among investors and positioned themselves for further growth.

Who’s Next? CVL and NWH

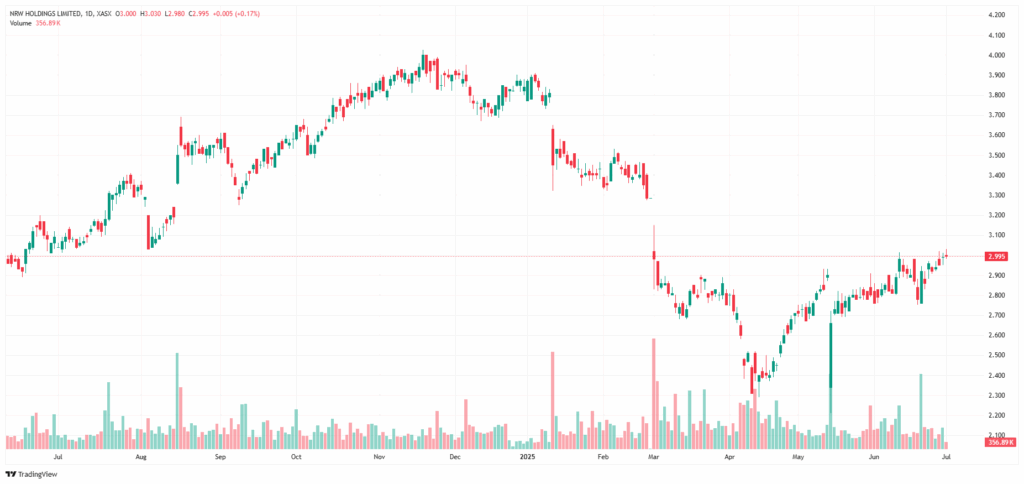

Looking ahead, Civmec Limited (ASX:CVL) and NRW Holdings (ASX:NWH) are two names that could be set for strong runs.

Civmec builds, maintains, and repairs large structures for industries like mining, energy, infrastructure, marine, and defence. In the last three months, Civmec’s share price has been supported by robust financials and a major boost to its order book, which now exceeds $760 million. The company recently secured $285 million in new contracts across resources, infrastructure, and rare earths. With a strong pipeline of opportunities and strategic positioning in sectors benefiting from ongoing infrastructure and defence investment, Civmec looks well placed for further contract wins and long-term growth.

NRW Holdings is another engineering powerhouse, providing construction and mining services for major projects across Australia. They build and maintain roads, railways, bridges, and mining sites, working with both the resources sector and public infrastructure projects. In the past three months, NRW’s share price has risen nearly 4%, buoyed by significant contract wins (including a $157 million deal with Rio Tinto) and continued growth in its Mining and Civil segments. The company boasts steady earnings, strong cash flow, and a rising dividend, which has helped boost investor confidence. With a healthy pipeline of new contracts and forecasts for ongoing earnings and revenue growth, NRW is well positioned to benefit from Australia’s infrastructure and resources investment boom.

In summary, while they may not always grab the headlines, these engineering services companies are the backbone of Australia’s economy. As a charts guy, I love it when these engineering firms start trending as they are often geometrically amazing. So keep and eye on CVL & NWH as their uptrends have only started in the last few months

Got a question about this article? Ask the Team at MPC

ASK A QUESTION

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.