Market Update and Rationale

On November 4, 2025, U.S. stocks closed sharply lower as valuation concerns intensified following warnings from major bank CEOs about a potential 10–15% market pullback. The S&P 500 declined 1.17% to close at 6,771.55, the Nasdaq Composite dropped 2.04% to 23,348.64, and the Dow Jones Industrial Average fell 0.5% to around 44,000. Tech stocks led the downturn, with Nvidia down 2.3%, Alphabet slipping 1.8%, Microsoft off 0.7%, and Palantir plunging 7.5% amid profit-taking in high-growth names. Broader sentiment remains cautious, with Nasdaq futures pointing to further declines of over 2% ahead of November 5 trading, as investors reassess AI-driven gains and lofty equity valuations.

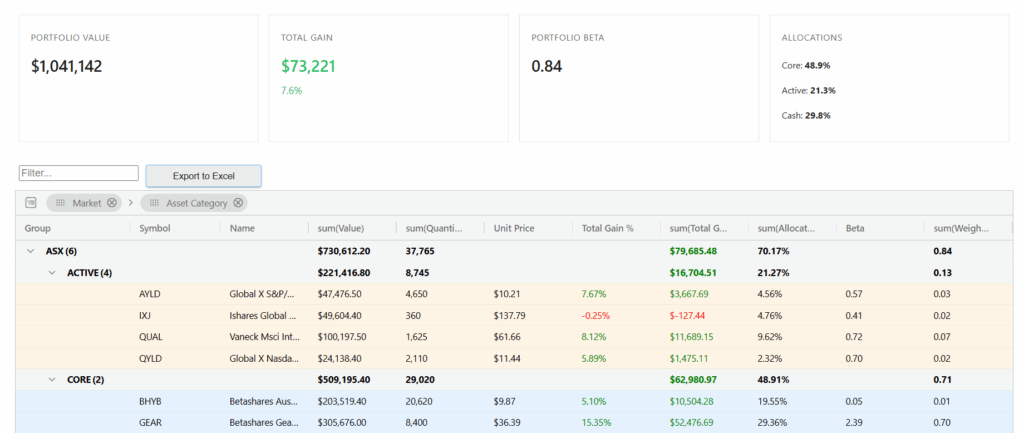

At MPC Markets, we believe it’s prudent to take profits and trim positions, as the market has shown clear signs of frothiness after months of strong upward momentum. This strategic adjustment allows us to clean up the portfolio and free up capital, positioning us to capture more attractive opportunities should prices pull back to lower levels.

These developments heighten risks of a broader market correction, particularly impacting leveraged equity exposures and international quality stocks tied to U.S. tech and growth themes.

Trade Plan

Security: BetaShares Geared Australian Equity Fund (GEAR)

- Action: Sell 7.5% of the current GEAR position.

Security: VanEck MSCI International Quality ETF (QUAL)

- Action: Sell 5% of the current QUAL position

Disclaimer: The recommendation given is general advice only. It does not take into account your personal objectives, financial situation, or specific needs. This information should not be your sole resource when making such decisions. We strongly recommend you to seek the advice of financial, taxation, and legal professionals before finalising any investment decisions.