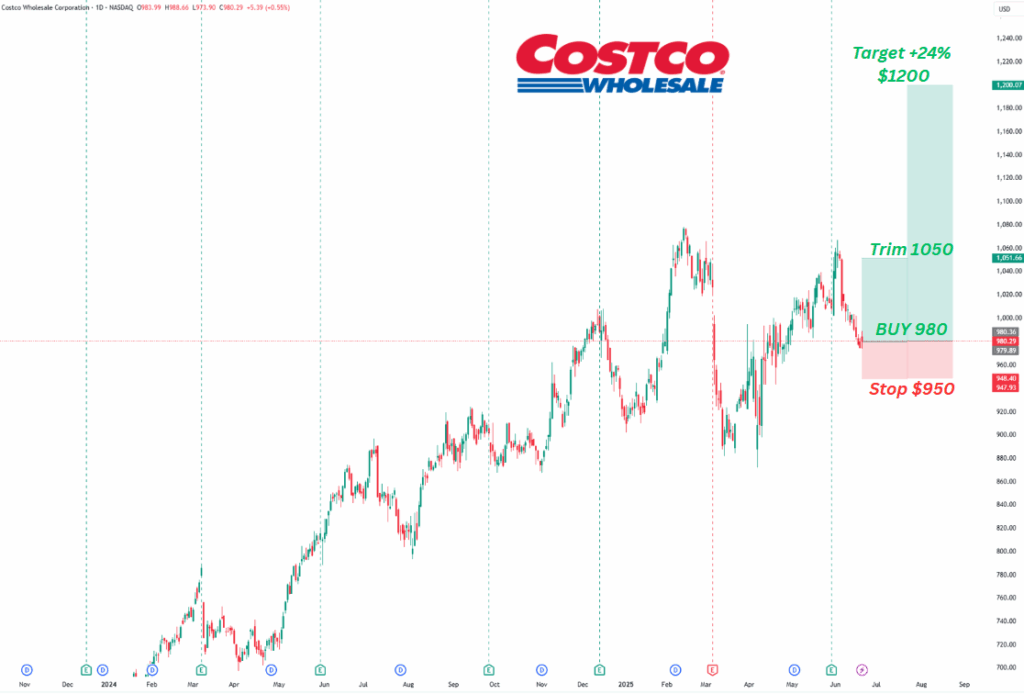

Costco (COST:NASDAQ) trades at a lofty $980.29, with analysts’ price targets stretching from $620 to a bullish $1,225—yet its current price sits a striking 26.0% above fair value. That gap says it all: while momentum is strong, value investors may see flashing yellow lights.

The technical indicators shows the stock has found accumulation zone after the recent sell off – strong bull candle for Fridays session.

🚦 Premium Price, Premium Story

Costco’s forward P/E is a sky-high 53.8x—far above sector norms—fueled by a business model that churns out 8.0% revenue growth and 13.2% EPS growth year-over-year. But here’s the kicker: that growth is powered by a loyal membership base (79.6 million households) and expanding e-commerce, not by margin expansion or cost cuts.

💡 Analyst Targets: Wide, but Cautious

- UBS reaffirms a Buy and $1,205 target, citing new growth levers like extended hours for Executive members. But even the analyst consensus ($1,056.36) is only about 7.8% above current levels.

- Price targets range a whopping $620 to $1,225—evidence of both upside optimism and valuation anxiety.

🏦 Cash Flow Fortress, But Yield Is Token

Costco covers its 4.8x dividend easily and boasts 20.1% ROIC—but the dividend yield is just 0.5%. Don’t look here for income: it’s a compounding machine, not a cash cow.

⚠️ Bottom Line : Buy the Model, Not the Multiple

Costco’s business model is best-in-class—recurring membership fees, sticky customers, and global expansion potential. But at a 26.0% premium to fair value and trading at 50x+ earnings, it’s priced for perfection. Momentum traders may ride the trend, but value-focused investors may want to wait for a pullback or signs of margin expansion.

Costco is a retail juggernaut with operational excellence and enviable growth, but even great companies can be too expensive. The story is still strong—just know you’re paying a hefty premium for it.

Trade Plan:

- Expected Timeframe: Mid Term

- Entry:980

- Stop-loss:$950

- Trim Zone: 1050

- Target:1200

Disclaimer: The recommendation given is general advice only. It does not take into account your personal objectives, financial situation, or specific needs. This information should not be your sole resource when making such decisions. We strongly recommend you to seek the advice of financial, taxation, and legal professionals before finalising any investment decisions.