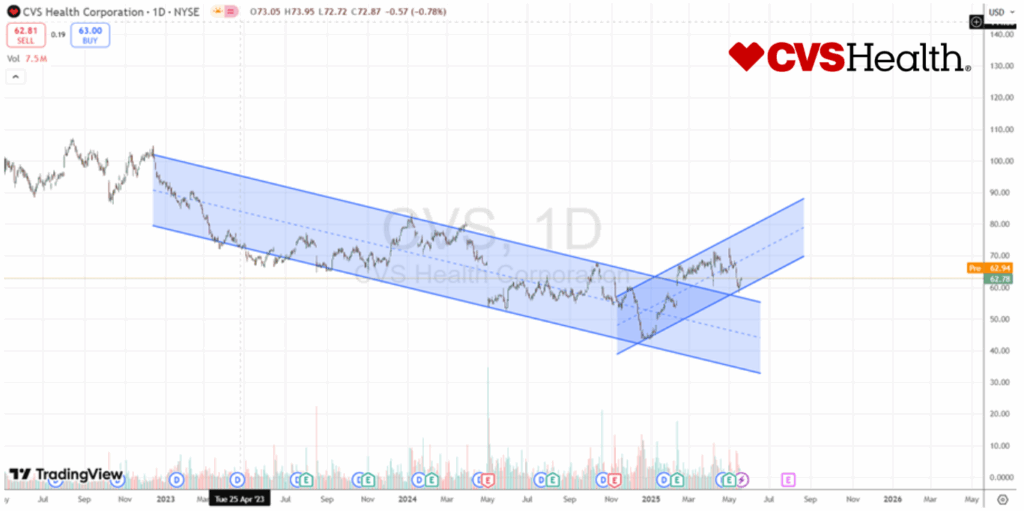

Trade Plan:

- Expected Timeframe: N/A but long term

- Entry: $$62.80

- Stop-loss: $55.00

- Trim Zone: (optional) $79.00

- Target: $$90.00

CVS Health is flashing a strong buy signal from Wall Street, anchored by a consensus recommendation of 1.82 (Strong Buy) and a potential upside of 42.6% based on analyst targets. The standout metric: the mean analyst price target sits well above the current price of $62.80.

Analyst Recommendations 📈

Quick Take:

- Consensus: Strong Buy (1.82)

- Target Upside:6%

Recent Ratings:

Date | Analyst | Rating | Price Target |

05/05/2025 | RBC Capital Markets | Outperform | $81.00 |

02/05/2025 | Barclays | Overweight | $82.00 |

03/12/2024 | Deutsche Bank | Buy | $66.00 |

15/11/2024 | RBC Capital Markets | Outperform | $58.00 |

07/11/2024 | Cantor Fitzgerald | Neutral | $62.00 |

07/11/2024 | Barclays | Overweight | $71.00 |

So, the broker and analyst consensus is overwhelmingly bullish, with only one Neutral rating in the recent lineup and most targets clustered around $80–$82. The near-term momentum is reinforced by positive Q1 earnings (EPS: $2.25 vs. $1.64 forecast) and a robust strategic outlook.

Insights 🔍

- Current Price: $62.80 (as of 20/05/2025)

- 52-Week High: $72.51

- Dividend Yield:1%—a defensive play in uncertain markets

- Bear Watch: 18 analysts recently lowered earnings estimates—a signal to watch for volatility

In summary, CVS Health (NYSE:CVS) is riding high on broker and analyst optimism, with strong buy calls and a hefty upside baked into targets. Just keep an eye on the recent downward earnings revisions; even the best runners can trip if the track changes.

Disclaimer: The recommendation given is general advice only. It does not take into account your personal objectives, financial situation, or specific needs. This information should not be your sole resource when making such decisions. We strongly recommend you to seek the advice of financial, taxation, and legal professionals before finalising any investment decisions.