Investment catalysts

DoorDash (NYSE:DASH) Earnings Preview

DoorDash is set to report Q1 2025 earnings before market open on Tuesday, May 6th (recently changed from May 7th after-hours). With the stock experiencing recent volatility (down 8.84% last week), this report comes at a crucial time for investors.

Analyst Consensus & Expectations

Wall Street maintains a generally bullish stance on DoorDash, with recent price targets averaging around $215-230. Key analyst ratings include:

Firm | Rating | Target | Date |

JMP Securities | Market Outperform | $225 | Apr 4, 2025 |

BofA Global Research | N/A | $245 | Mar 10, 2025 |

Truist Securities | Buy | $235 | Feb 24, 2025 |

Barclays | Equal Weight | $200 | Feb 13, 2025 |

What to Watch For 📊

- Gross Order Value (GOV) – Last quarter showed 19% YoY growth to $20.0B. Watch for continued momentum here as a key growth indicator.

- EBITDA Growth 📈 – Q4 2024 saw impressive 55% YoY EBITDA growth. Analysts will focus on whether this trajectory continues.

- Take Rate Improvement – Previously reached 13.5%, any further expansion would be viewed positively.

- New Verticals Performance – Growth in grocery and convenience store segments will be critical for the bull case.

- Advertising Revenue 💰 – This high-margin business segment could significantly impact profitability.

Recommendation: HOLD ahead of earnings, with potential to upgrade to BUY if results demonstrate continued EBITDA margin expansion and strong performance in new verticals.

Trade Plan:

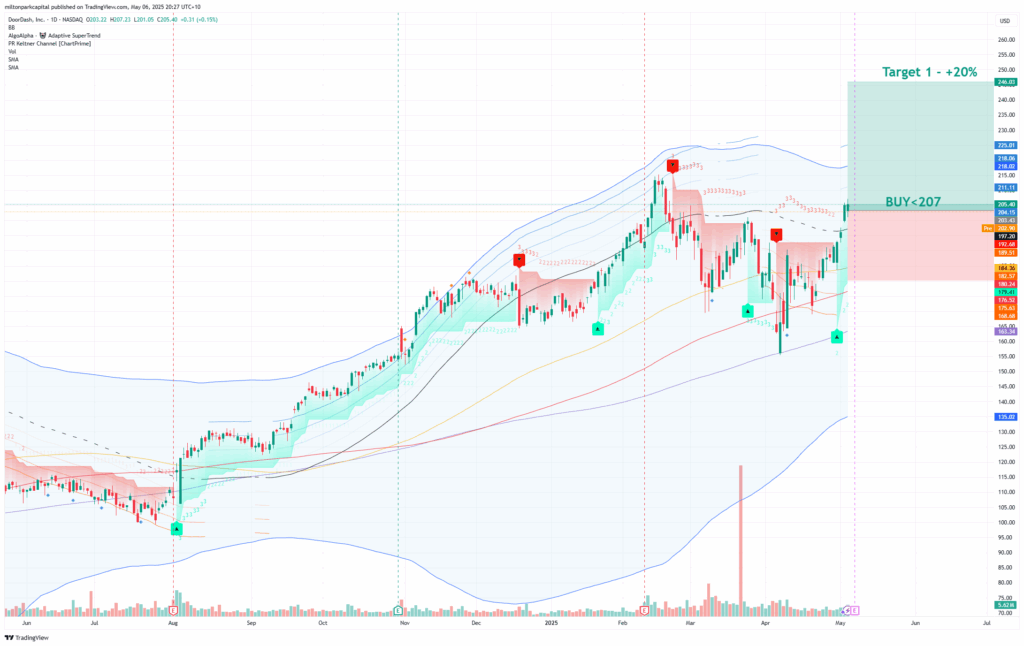

- Expected Timeframe: 1-month to 2-months

- Entry: Under $207

- Stop-loss: Under $175 (-15%

- Trim Zone: (optional) >$245 (+20%)

- Target: undefined

Bottom Line

DoorDash has successfully transitioned to GAAP profitability and demonstrated strong EBITDA growth, but the market has already priced in significant optimism. The company’s ability to maintain growth while expanding margins will be critical this quarter.

The stock appears fairly valued at current levels, with upside potential if they can continue to execute on their multi-vertical strategy and advertising business. However, competition remains fierce, and any signs of slowing growth could trigger significant downside.

Bull Case Factors

- Vertical Expansion: Success in grocery and convenience delivery

- Advertising Growth: Higher-margin revenue stream gaining traction

- International Expansion: Wolt acquisition performance

- DashPass Momentum: Subscription growth and engagement

Bear Case Concerns ⚠️

- Competition Pressure: Potential margin compression from rivals

- Regulatory Headwinds: Worker classification challenges

- Economic Sensitivity: Consumer spending pullback in uncertain economy

- Valuation Concerns: Trading near fair value with high expectations

Disclaimer: The recommendation given is general advice only. It does not take into account your personal objectives, financial situation, or specific needs. This information should not be your sole resource when making such decisions. We strongly recommend you to seek the advice of financial, taxation, and legal professionals before finalising any investment decisions.