31st July 2025

********** General Advice Only **********

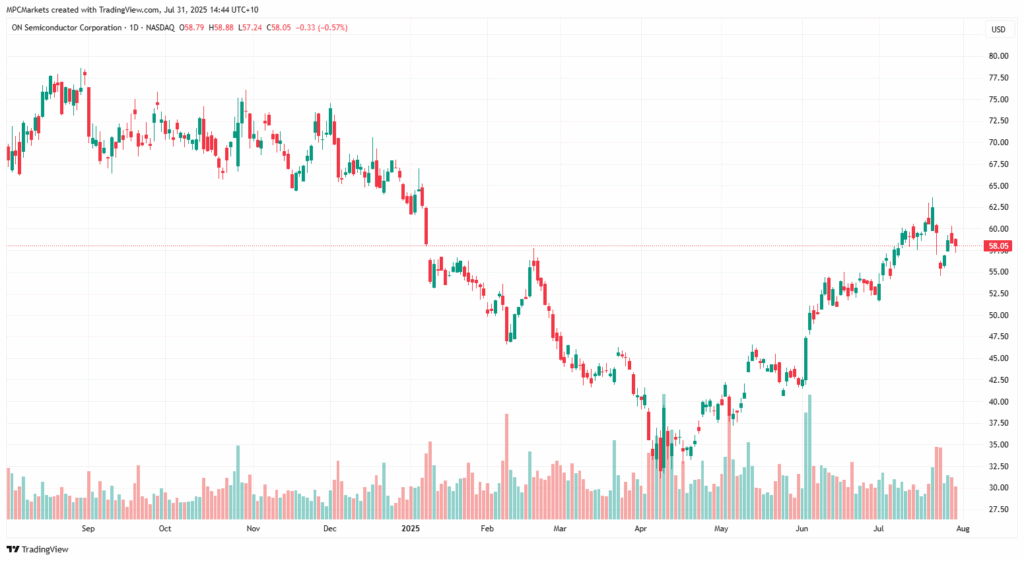

Buy Recommendation – ON Semiconductor (NASDAQ: ON)

Company Overview

ON Semiconductor (onsemi), headquartered in Scottsdale, Arizona, is a leading provider of intelligent power and sensing solutions. The company operates globally, supplying essential semiconductor components used in electric vehicles (EVs), AI data centers, industrial automation, and renewable energy systems. Its products—especially those built with silicon carbide (SiC) and gallium nitride (GaN)—help deliver energy efficiency, better thermal performance, and higher reliability. With operations in over 30 countries and a strong U.S. manufacturing footprint, onsemi is well-aligned with rising global demand for smart, sustainable tech.

Positives

At around $58 per share, onsemi offers an attractive long-term entry point. The company is strategically positioned in two major growth sectors: AI and EVs. It recently announced a partnership with NVIDIA to supply power management chips for next-generation AI data centers. These chips are designed to reduce power loss and cooling costs by up to 30%, supporting the shift toward more efficient 800V DC infrastructure. With global AI data center investment expected to surpass $200 billion annually by 2027, this deal could provide meaningful recurring revenue.

On the EV front, onsemi is a key supplier to Tesla, providing SiC components used in the Cybertruck and Model Y. SiC technology improves EV range and charging speed—core performance metrics in the race for EV dominance. Despite Tesla’s reported efforts to reduce SiC usage, onsemi’s innovation and production scale continue to meet Tesla’s performance and cost needs. The EV semiconductor market is forecast to grow at over 25% CAGR through 2030, providing long-term tailwinds.

The company also benefits from the U.S. CHIPS Act, with tax credits and subsidies supporting its $2 billion expansion in New Hampshire. Its U.S.-based supply chain reduces geopolitical risk and aligns with domestic sourcing mandates.

Risks

Short-term, the company is navigating a cyclical slowdown, with projected FY25 revenue and EPS declines. Margins have also compressed, and higher domestic manufacturing costs pose challenges. However, strong government support, product diversification, and resilient end-markets help mitigate these risks.

Trade Plan

Entry: Buy up to $59

Stop Loss: $49

Initial Profit Target: $79

Watch the MEMBERS ONLY Weekly Video Podcast on Youtube

Disclaimer: The recommendation given is general advice only. It does not take into account your personal objectives, financial situation, or specific needs. This information should not be your sole resource when making such decisions. We strongly recommend you to seek the advice of financial, taxation, and legal professionals before finalising any investment decisions.