Investment catalysts

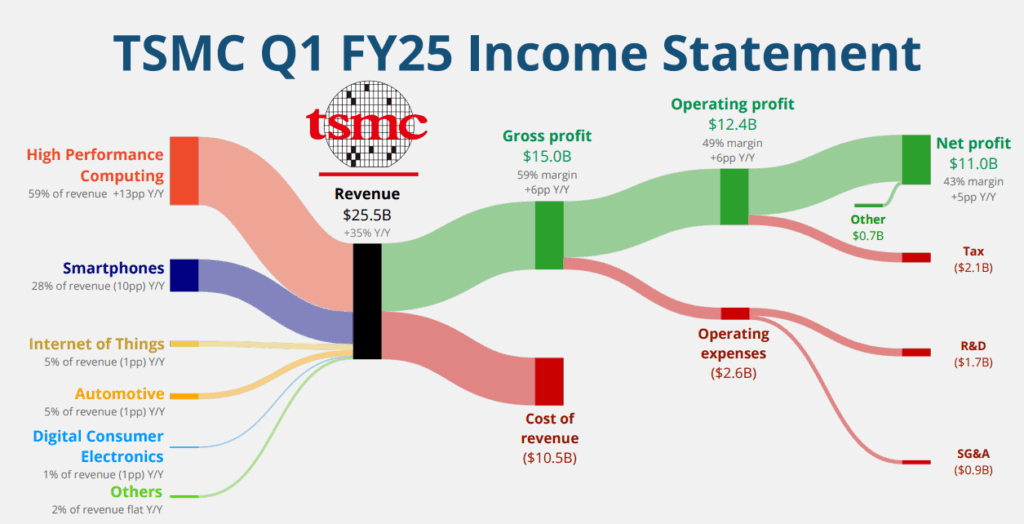

Taiwan Semiconductor Manufacturing Company (TSMC) is a Semiconductor titan, driven by its robust financial performance, industry leadership, and strong growth prospects. The company’s advanced technology portfolio-especially in AI and high-performance computing chips-continues to fuel demand and reinforce its dominant market position. Despite macroeconomic uncertainties and ongoing geopolitical risks, TSMC maintains industry-leading margins and a resilient growth outlook, reaffirming its revenue growth target near the mid-20% range for the year.

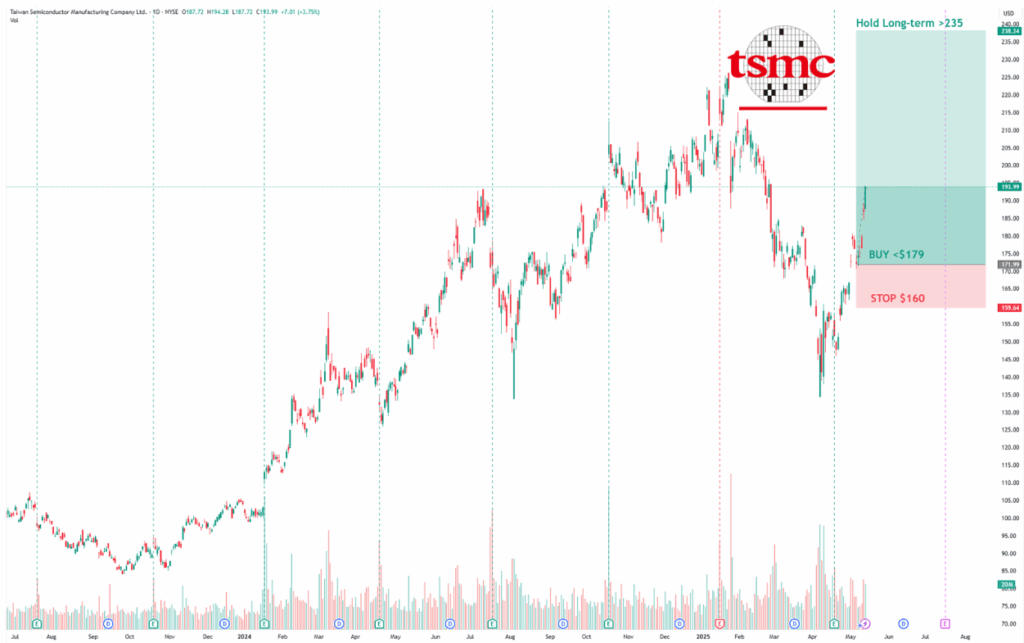

Trade Plan:

- Expected Timeframe: undefined

- Entry: $179.00

- Stop-loss: $160.00

- Trim Zone: (optional)If it settles above $230 Hold potential bull rush

- Target: $220

Semiconductor Titans: TSMC vs. NVIDIA Analysis

Taiwan Semiconductor Manufacturing Company (Price: NT$950.00, Market Cap: NT$24.64T) and NVIDIA (Price: $114.50, Market Cap: $2.79T) represent two powerhouses in the semiconductor industry with fundamentally different business models but increasingly intertwined futures. Let’s examine how these companies compare across key metrics. 📊

Financial Performance & Growth 🚀

Metric | TSMC | NVIDIA | Comment |

Revenue Growth (Latest FY) | 33.9% | 114.2% | NVIDIA’s growth rate is extraordinary, even for tech |

Operating Margin | 45.7% | 62.4% | Both impressive, but NVIDIA’s software leverage shows |

Net Income Margin | 40.5% | 55.8% | NVIDIA’s profitability is exceptional |

Return on Equity | 30.3% | 119.2% | NVIDIA’s capital efficiency is off the charts |

TSMC is demonstrating robust growth with Q1 2025 revenue up 41.6% year-over-year, showing strong recovery from the -4.5% decline in FY2023. However, NVIDIA’s 114.2% revenue growth in FY2025 reflects the unprecedented AI boom that has transformed the company’s trajectory.

Valuation & Market Sentiment 💰

Metric | TSMC | NVIDIA | Comment |

P/E Ratio (TTM) | 26.9x | 38.3x | TSMC offers better value on current earnings |

P/E Ratio (Forward) | 15.9x | 25.6x | Both expect significant earnings growth |

Analyst Consensus | Strong Buy (1.29) | Strong Buy (1.48) | Wall Street loves both, slightly favoring TSMC |

Fair Value Upside | 8.4% | -0.1% | TSMC has more room to run |

While both companies command premium valuations, TSMC trades at more reasonable multiples despite its foundational role in the semiconductor ecosystem. NVIDIA’s higher multiples reflect market expectations for continued AI-driven growth.

Business Models & Strategic Positioning ⚖️

TSMC: The Foundation Builder 🏭

- World’s leading semiconductor foundry manufacturing chips for others

- Recently broke ground on third Arizona facility, expanding U.S. presence

- Total U.S. investment reaching $165 billion over coming years

- Critical supplier to virtually all major semiconductor companies

NVIDIA: The AI Accelerator 💡

- Transformed from gaming GPU maker to AI infrastructure leader

- Creates both hardware and software ecosystems for AI development

- Currently facing new competition from Huawei’s CloudMatrix in China

- Planning massive $500 billion AI server buildout in the U.S.

Interdependence & Risks 🔍

The companies share a critical supplier-customer relationship. TSMC manufactures NVIDIA’s cutting-edge AI chips, including the upcoming Blackwell architecture. This interdependence creates both opportunities and risks:

- NVIDIA’s Blackwell line is reportedly sold out for the year due to packaging capacity constraints at TSMC

- ASE Technology (TSMC supplier) is evaluating how to support NVIDIA’s $500 billion U.S. server buildout

- Huawei has begun delivering CloudMatrix 384 AI chip clusters to Chinese customers as alternatives to NVIDIA

- Both companies face geopolitical risks from U.S.-China tensions and tariff policies

Investment Outlook 🔮

TSMC:

- Strong fundamentals with 4 consecutive years of dividend increases

- Trading at reasonable valuations relative to growth prospects

- Analyst price targets range from NT$939 to NT$1700 (mean: NT$1244.47)

- Benefits from being the essential manufacturing partner for nearly all AI chip designers

NVIDIA:

- Perfect Piotroski Score of 9 indicating exceptional financial health

- Facing new competitive pressures and questions about AI utility and deployment complexity

- Analyst price targets range widely from $100 to $220 (mean: $163.12)

- Recent “Sell” rating from Seaport Global Securities citing concerns about AI budget slowdowns in 2026

The Verdict 🏆

Both companies represent exceptional businesses with strong competitive positions. TSMC offers more reasonable valuations and broader exposure to the entire semiconductor ecosystem, while NVIDIA provides concentrated exposure to the AI revolution but at premium multiples.

For investors seeking semiconductor exposure with less volatility and more reasonable valuations, TSMC presents the stronger value proposition. For those betting specifically on the continued AI boom and willing to accept higher volatility, NVIDIA remains the purest play despite recent concerns about long-term sustainability.

The most prudent approach may be owning both: TSMC for its foundational role in all computing and NVIDIA for its leadership in the AI revolution

Disclaimer: The recommendation given is general advice only. It does not take into account your personal objectives, financial situation, or specific needs. This information should not be your sole resource when making such decisions. We strongly recommend you to seek the advice of financial, taxation, and legal professionals before finalising any investment decisions.