Investment Thesis:

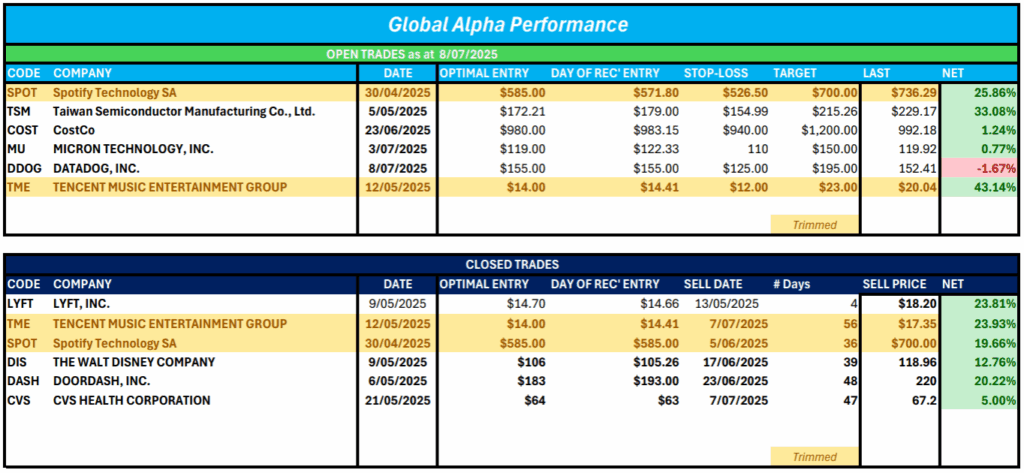

Tencent Music’s rapid earnings growth, expanding user monetization, and continuous margin improvement are irrefutable positives—especially as the company anchors itself as China’s undisputed leader in online music. For long-term investors, TME still offers a compelling combination of growth, profitability, and operating leverage, with fundamentals signaling years of upside if user monetization keeps rising.

That said, with shares at all-time highs and short-term technicals overbought, new entries must weigh the risk of a tactical pullback against the powerful medium-term trajectory. The next earnings print (August 12, 2025) may provide the next catalyst, with any disappointment potentially opening up a better entry point for conviction buyers. Technical signals flash “strong buy” across nearly every timeframe.

Every major technical—MACD, ADX, CCI, and a clean sweep across both simple and exponential moving averages—supports ongoing bullish sentiment.

Trade Plan:

- Expected Timeframe: Short-to-medium term (2–3 Months)

- Entry: $22.10–$22.20 (near current price)

- Stop-loss: $21.10 ( key pivot/support and pre-market low)

- Trim Zone: (optional) $23.00–$24.00 (take partial profits if overbought, RSI >70, or price stalls)

- Target: $26.00 (Jefferies’ raised target, aligns with technical momentum if breakout continues)

Watch the MEMBERS ONLY Weekly Video Podcast on Youtube

Disclaimer: The recommendation given is general advice only. It does not take into account your personal objectives, financial situation, or specific needs. This information should not be your sole resource when making such decisions. We strongly recommend you to seek the advice of financial, taxation, and legal professionals before finalising any investment decisions.