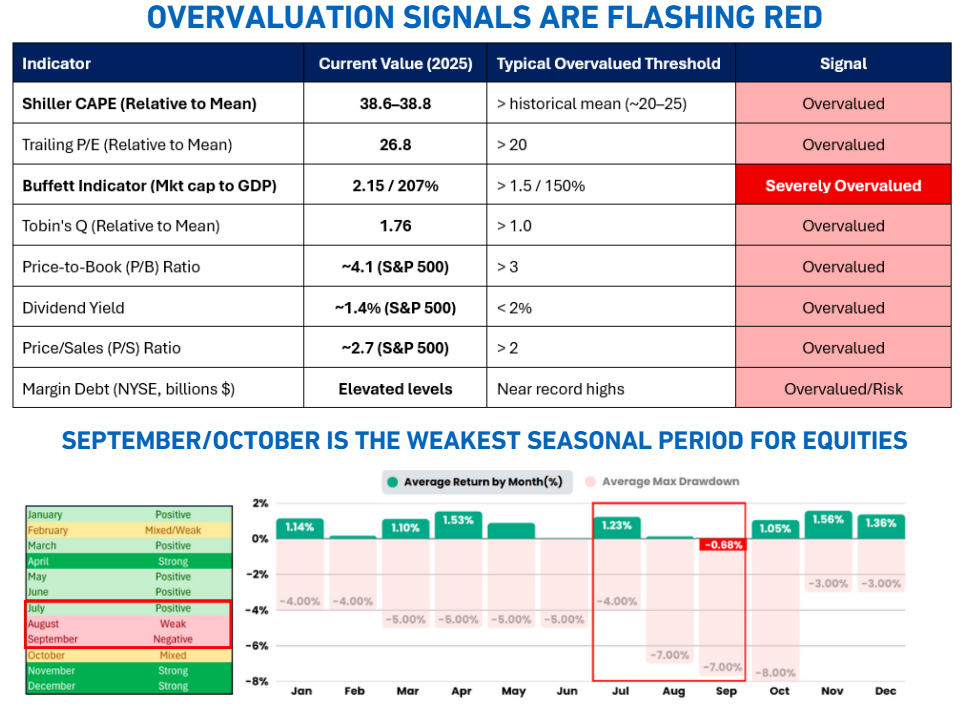

The Megacaps and tech stocks stalled this week as investors questioned AI valuations. With the S&P 500 hovering near record highs, the disproportionate influence of the “Magnificent Seven” – those mega-cap tech giants – has come under scrutiny. These stocks have driven much of the market’s gains, but as valuations stretch beyond historical norms, cracks are appearing. Based on current data (as of August 2025), key indicators are flashing red: the Shiller CAPE ratio stands at around 38.6, well above the historical mean of 20-25; the Buffett Indicator at approximately 207%, severely overvalued compared to 150%; trailing P/E at 26.8 versus 20; Tobin’s Q at 1.76 above 1.0; price-to-book at 4.1 over 3; dividend yield at ~1.4% below 2%; price/sales at ~2.7 exceeding 2; and elevated margin debt near record highs. The US market’s outsized share of global capitalization (far exceeding its GDP contribution) further amplifies vulnerability, with passive investment flows artificially inflating prices. Historically, such extremes have preceded major corrections, as seen in the dot-com bubble (2000) and the 2022 downturn.

As we enter late August 2025, these concerns are amplified by seasonal headwinds. The S&P 500 has a well-documented tendency toward underperformance in August and September, coinciding with increased volatility, lower trading volumes, and market pullbacks. This period often sees larger-than-average drawdowns due to summer investor uncertainty, the approach of fall earnings season, and repositioning ahead of year-end. Historical data underscores this risk:

President Donald Trump’s abrupt firing of Bureau of Labor Statistics (BLS) Commissioner Erika McEntarfer on August 1, 2025, and his nomination of E.J. Antoni, a Heritage Foundation economist, have ignited fierce debate about the politicization of economic data. The move followed a July jobs report showing a mere 73,000 jobs added, far below expectations, with downward revisions of 258,000 jobs for May and June. Trump, without evidence, labeled the data “phony” and “rigged” to undermine his administration, accusing McEntarfer, a Biden appointee with over 20 years of federal experience, of manipulating figures.

Best months include November, December, and April with above-average returns, while September is typically the weakest, often negative. August and February also underperform. For instance, average returns in September have been negative, with notable declines like -7.0% in 2008 and -6.9% in 2001.

Compounding the seasonal risks are softening economic indicators that point to a potential slowdown. Recent data reveals declining consumer confidence, slowing business investment, and rising unemployment rates – signals that have preceded the last five bear markets, including those in 2000, 2008, 2020, and 2022. The Federal Reserve’s “higher for longer” stance on interest rates has tightened credit conditions, contracting P/E multiples and amplifying selling pressure through quantitative tightening. The inverted yield curve, where short-term rates exceed long-term ones, has been a reliable recession predictor over the past 35 years, reflecting expectations of slower growth. Add to this external factors like geopolitical tensions and energy price spikes, and the stage is set for a correction. Investor sentiment is shifting too, with surveys from sources like Bank of America and Bloomberg showing a record number of professionals viewing US stocks as overvalued, leaning toward panic selling and risk aversion.

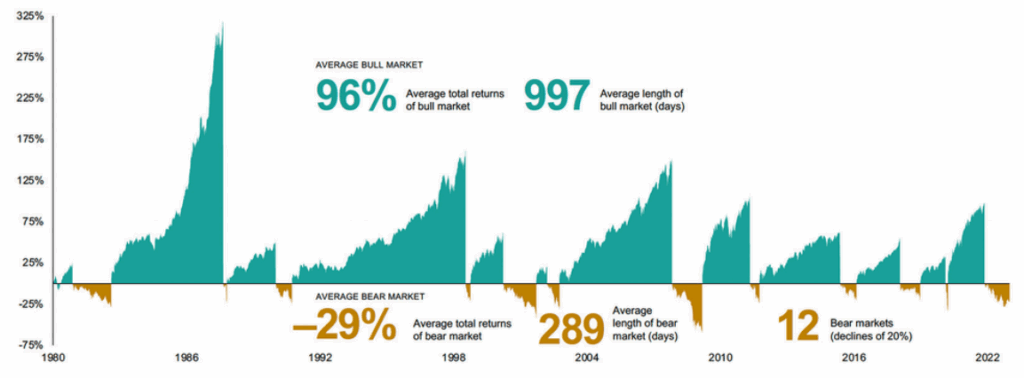

In today’s fast-moving markets, where declines and recoveries happen more abruptly than in previous decades, vigilance is key. Over the last 10 years (2015-2025), bear markets have been steeper and shorter, averaging 289 days but with quicker bounces, compared to more prolonged movements in the 1995-2015 period. This volatility underscores the importance of monitoring trends closely.

But never fear, the bears dont dominate long

Ultimately, while bull markets dominate history – with average returns of 96% over 997 days versus bear markets’ -29% over 289 days – staying vigilant through turbulence pays off. As tech stalls and seasonal weakness beckons, investors should consider reducing exposure to US equities, shifting to cash, bonds, or undervalued international markets for capital preservation. Patience and perspective can turn potential pitfalls into opportunities for long-term growth.

Antoni, nominated to replace McEntarfer, was present outside the Capitol on January 6, 2021, amid the rioting crowd, though the White House describes him as a “bystander.” A Project 2025 contributor, he has criticized BLS methodologies and suggested suspending monthly job reports. His appointment, awaiting Senate confirmation, raises concerns about the BLS’s independence, as economists warn that such actions threaten the credibility of data relied upon by global markets, businesses, and policymakers.

Former BLS Commissioner William Beach, a Trump appointee, called the firing “groundless,” arguing it sets a dangerous precedent. Critics, including economists and Democratic lawmakers, fear this reflects a broader strategy to align federal statistics with Trump’s narrative, eroding trust in a nonpartisan institution. The dismissal of a seasoned labor economist for a loyalist with ties to controversial events signals a troubling shift toward prioritizing political agendas over objective data, potentially destabilizing economic decision-making worldwide.

Got a question about this article? Ask the Team at MPC

ASK A QUESTION

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.