Moody’s downgrade of the U.S. credit rating from “Aaa” to “Aa1” has immediate and longer-term implications for U.S. stocks. In the short term, the announcement triggered a decline in major stock indexes and a rise in Treasury yields, with the S&P 500 and related ETFs dropping about 1% in after-hours trading following the news

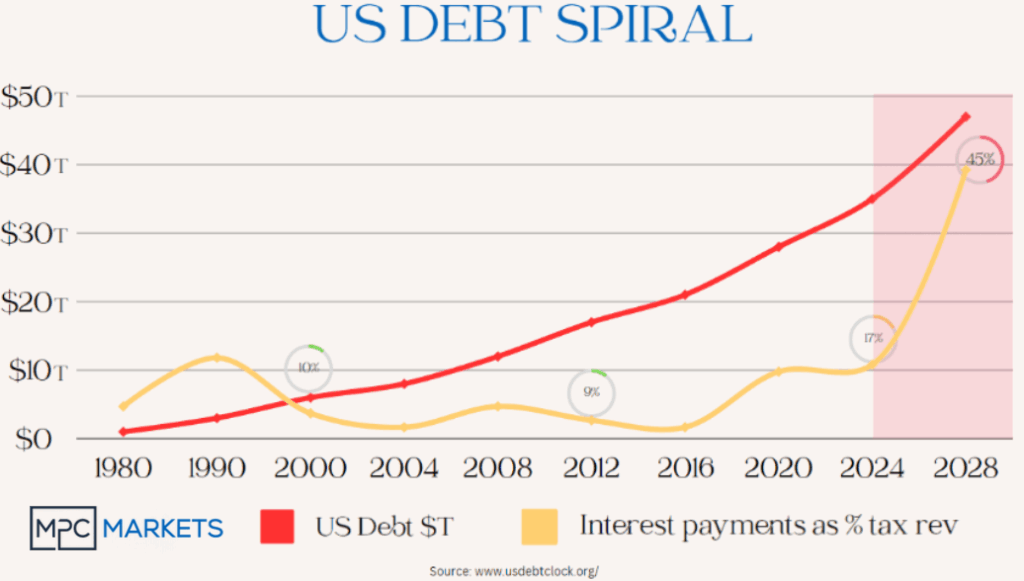

Moody’s downgraded the U.S. credit rating from “Aaa” to “Aa1,” citing persistently high federal debt and interest costs that now exceed those of similarly rated countries. This move follows the failure of President Trump’s tax bill in Congress, largely due to opposition from hardline Republicans demanding deeper spending cuts, with the bill projected to add trillions to the national debt over the next decade. Moody’s noted that successive U.S. administrations and Congress have failed to implement measures to reverse the trend of large annual deficits and rising interest expenses. The downgrade, which caused U.S. Treasury securities to fall and yields to rise, marks the first time all three major agencies-Moody’s, S&P, and Fitch-have rated the U.S. below the top tier.

Moody’s shifted the U.S. outlook from “negative” to “stable,” suggesting no further downgrades are anticipated soon unless conditions worsen. Experts like Darrell Duffie and Christopher Hodge emphasized that the U.S. still enjoys unmatched borrowing capacity and global demand for its debt, but warned that fiscal discipline will eventually be necessary. Some, like Stephen Moore, dismissed the downgrade as politically motivated, while others, including Brian Bethune, called it a wake-up call for Republicans to agree on credible deficit reduction measures. Overall, the downgrade is seen as a warning about unsustainable fiscal policy, with potential long-term consequences for borrowing costs and economic flexibility, but with limited immediate impact on markets due to the enduring status of U.S. Treasuries as the world’s most liquid and sought-after assets. Analysts note that the downgrade may prompt some investors to take profits after a recent rally, especially as concerns about fiscal policy and rising interest costs intensify.

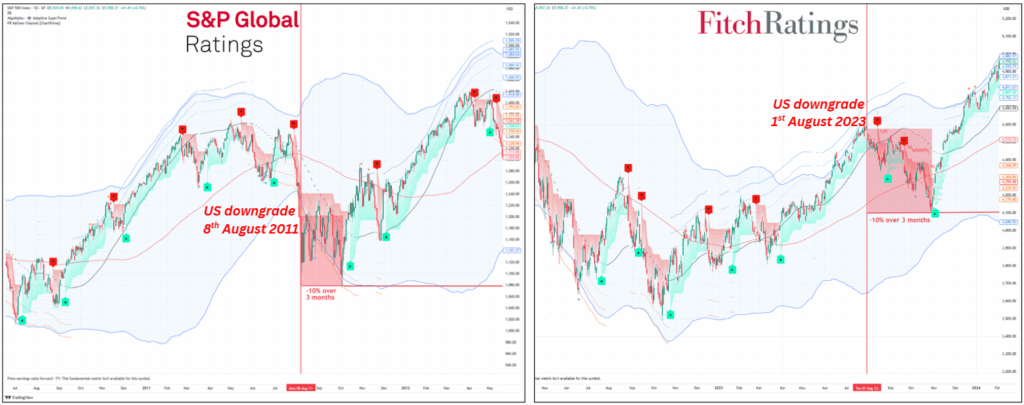

However, many experts believe the downgrade’s impact on equities will likely be limited and short-lived, especially since Moody’s is the last of the three major agencies to act, and markets had already priced in much of the fiscal risk.

Historical precedent supports this view: after previous downgrades by S&P in 2011 and Fitch in 2023, the S&P 500 initially fell by about 10% over several weeks but rebounded strongly within a year, posting gains of over 35% in both cases. This suggests that while sentiment-driven selloffs may occur, U.S. equities have historically recovered as long as economic fundamentals and corporate earnings remain solid.

Longer-term, the downgrade underscores concerns about America’s fiscal trajectory, which could eventually raise borrowing costs for both the government and the private sector, potentially weighing on economic growth and corporate profits if not addressed. Still, U.S. stocks benefit from the country’s deep, resilient economy, the dollar’s reserve status, and strong corporate sector-all factors that have historically helped markets rebound from credit-related shocks.

While Moody’s downgrade may lead to short-term volatility and caution among investors, it is unlikely to trigger a sustained bear market in U.S. stocks unless accompanied by broader economic or financial shocks, which is very possible with trade and tariff uncertainty denting consumer and business confidence.

The real risk lies in the underlying fiscal issues, not the downgrade itself, and markets will be watching closely for credible steps toward fiscal discipline in the months ahead

Got a question about this article? Ask the Team at MPC

ASK A QUESTION

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.