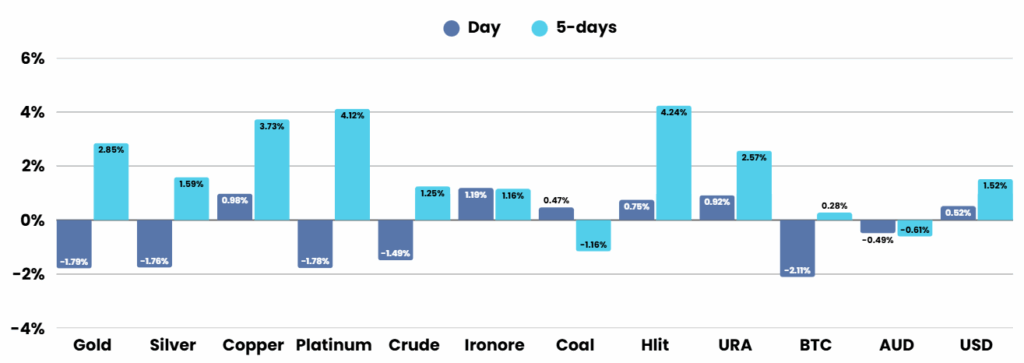

Overnight – Gold and Silver hit Fresh Record highs (then retreats) as Trump announces “Peace in the Middle East”

Silver finally set a new record high above $50 overnight after a long 45 year wait, joining gold in the stratosphere, until profit takes and Trump announcing “Peace in the Middle East” and nominating himself for the Nobel Peace prize

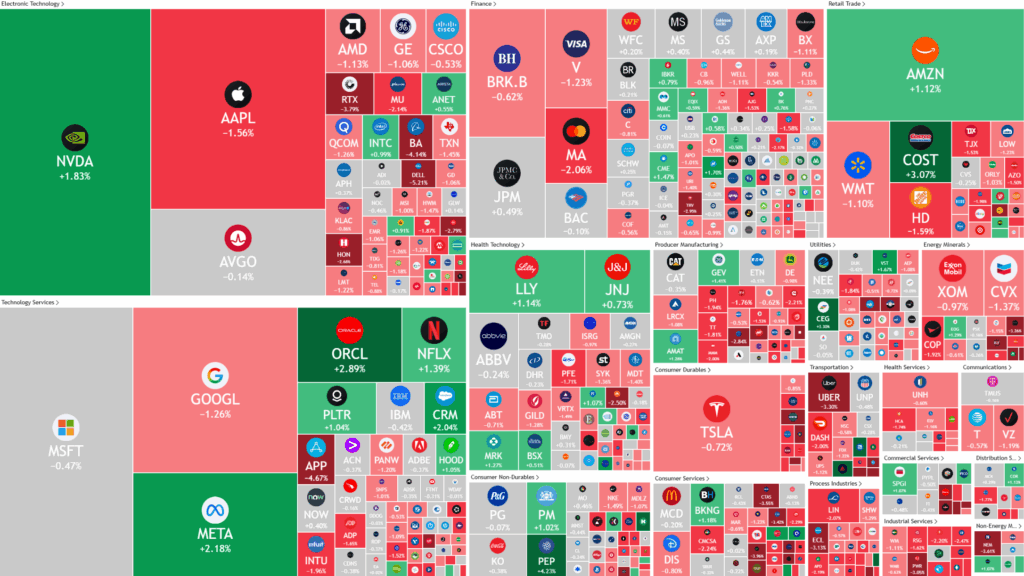

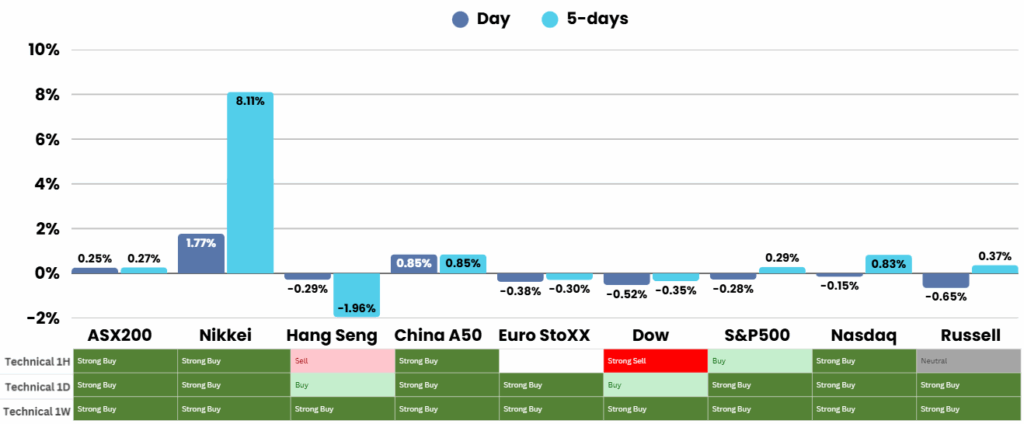

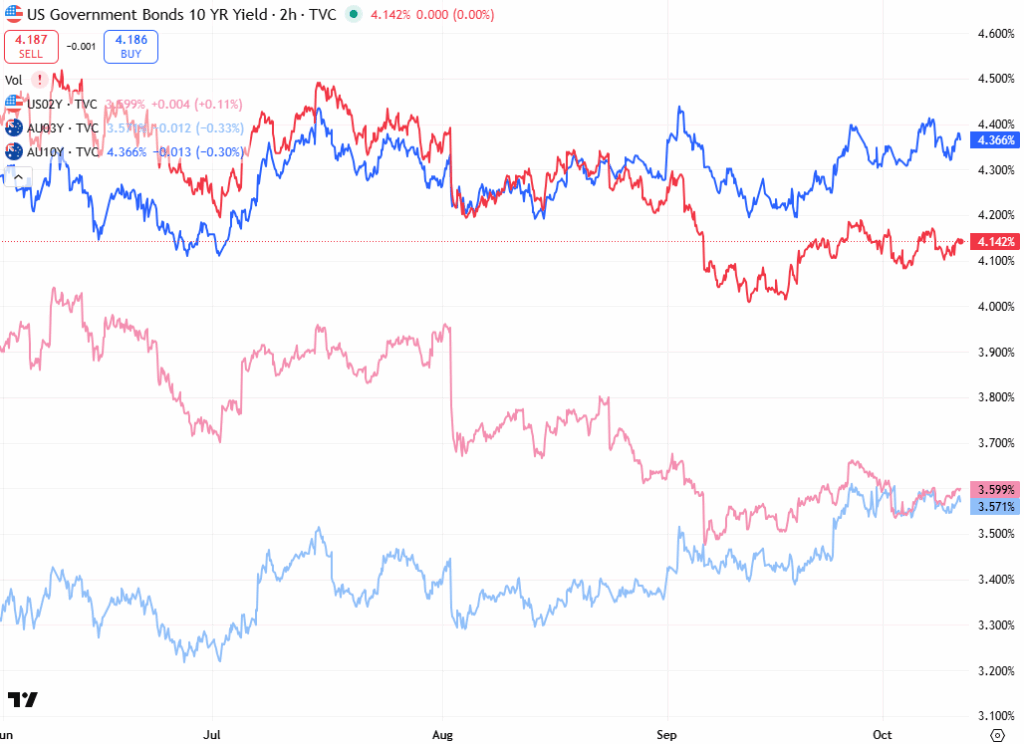

Markets are navigating several important themes in October 2025, including analysis of the Federal Reserve’s latest meeting minutes and excitement around artificial intelligence that has pushed stock prices higher throughout the year. Investors are also grappling with an ongoing federal government shutdown in Washington, which has lasted over a week and threatens to delay further economic data releases. Amid market uncertainty, New York Fed President John Williams spoke of the likelihood of further interest rate cuts in 2025 due to risks from a cooling labor market but cautioned that slower employment growth does not necessarily signal an imminent recession for the U.S. economy. The minutes from the Fed’s September meeting revealed a divided committee, debating the impact of a sluggish labor market and persistent inflation, with most officials supporting additional rate cuts though the timing remained unclear.

On the corporate front, PepsiCo posted third-quarter results that exceeded expectations, citing strong demand for healthier sodas and energy drinks, and outlined plans to adjust product and packaging strategy to better fit consumer trends. This update follows activist investor Elliott Management’s push for cost-cutting measures at Pepsi, including considering the sale of brands and spinning off its bottling operations. Delta Air Lines largely avoided disruption from the government shutdown despite industry-wide travel concerns, reporting record operating revenue and lifting its full-year guidance. In contrast, Ferrari NV’s shares fell sharply after the automaker revised its electrification goal downward, and Oracle Corporation saw gains after positive analyst coverage predicting strong future growth.

Gold markets saw a modest retreat from record highs above $4,000 per ounce following a ceasefire between Hamas and Israel, tempering some safe-haven demand. However, gold continues to hover near peak levels due to sustained concerns about Japanese fiscal stability, the U.S. shutdown, and French political unrest. The Fed’s minutes, which maintained expectations for further rate cuts, also provided support to bullion prices in a landscape marked by heightened financial and geopolitical risks.

President Donald Trump has brokered a peace agreement between Israel and Hamas, marking the first phase of a plan to end the two-year Gaza war. The deal establishes a ceasefire, calls for the release of all remaining Israeli hostages by Hamas in exchange for the freeing of Palestinian prisoners, and includes a partial Israeli withdrawal from Gaza. This development, resulting from months of negotiations and international mediation, is widely recognized as a significant diplomatic achievement, though there are still challenges and uncertainties ahead regarding the full implementation of peace.

ASX Overnight: SPI 8957 (-0.45%)

The Day Ahead:

US Govt Shutdown, Trump for the Nobel prize, VIX and S&P both rally for 5 days straight, Asset prices at record highs and the Fed cutting…. Honestly, I cant rationalise any of it, throw out your economics books and just follow the charts

Yesterdays Session:

The Australian sharemarket edged up 0.2 per cent to 8971.3 on Thursday, lifted by strength in major miners amid higher copper prices. Materials led gains with Sandfire, BHP, and Rio Tinto advancing, while lithium stocks also rose. Rare earths companies Lynas and Brazilian Rare Earths jumped on new international deals. Meanwhile, gold and silver miners fell after recent highs, and Elders declined on a weak trading update, while bank stocks ended mixed.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.