Overnight – Trump boost rate cut hopes with new Fed appointment

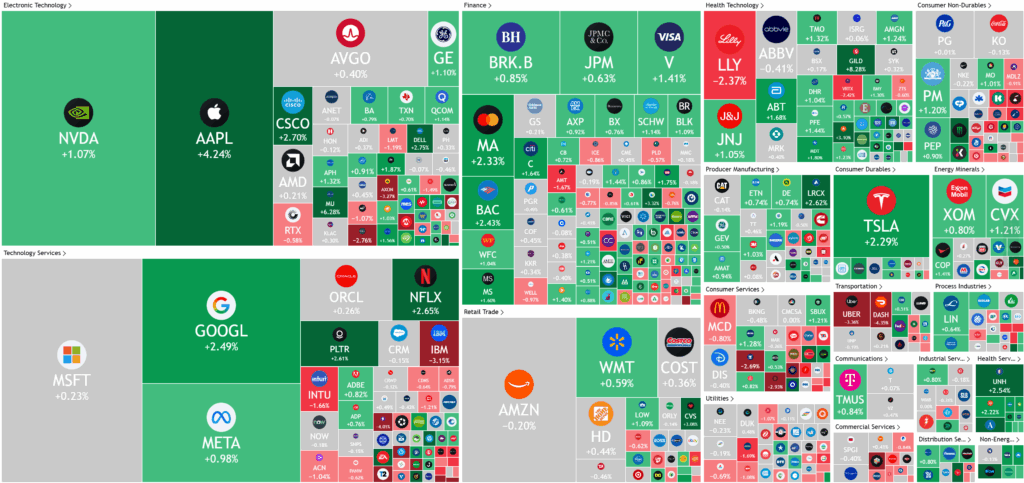

Stocks were led higher by tech on Friday, as bets on a September rate cut were boosted after Trump nominated his top economic adviser, Stephen Miran, to fill a vacant seat on the Fed board at a time when focus on Fed chairman Jerome Powell’s potential successor is heating up.

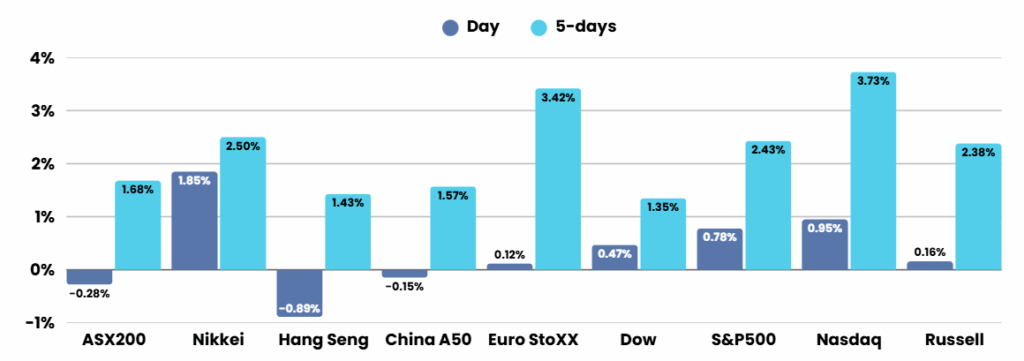

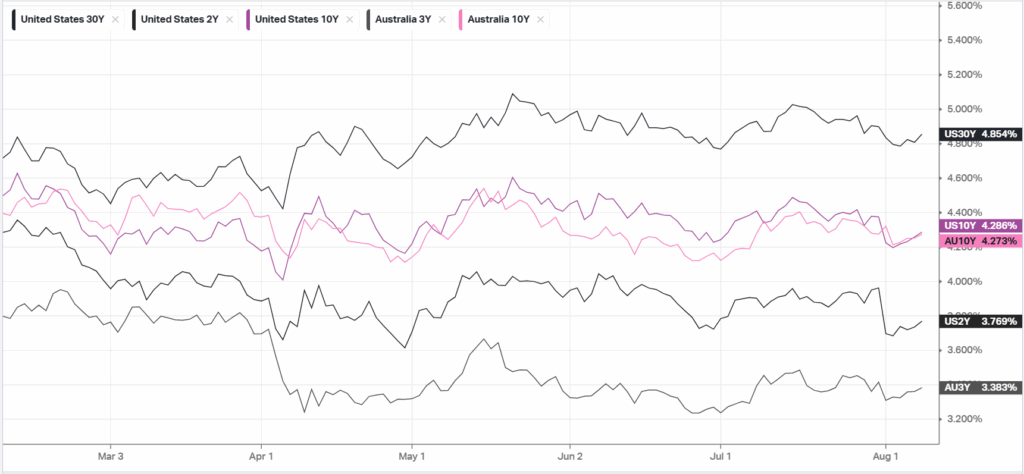

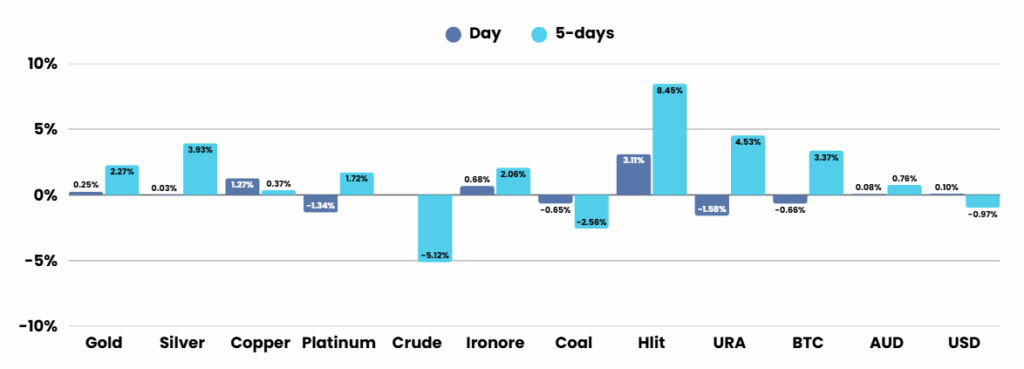

Investor bets on a Federal Reserve rate cut have grown amid signs of a softening U.S. labor market and the economic impact of newly imposed tariffs. The Trump administration initiated tariffs ranging from 10% to 41% on imports from over 90 countries, pushing the average U.S. tariff rate above 15%, the highest since 1938. While the European Union and other nations have negotiated lower tariffs, markets remain uneasy about the potential drag on global growth. An uptick in weekly jobless claims and weak nonfarm payrolls reinforced expectations that the Fed will cut rates in September, a move President Trump has repeatedly urged.

In a notable move, Trump nominated Stephen Miran, his economic adviser and tariff supporter, to fill a vacant Fed governor seat following Adriana Kugler’s abrupt departure. If confirmed, Miran would participate in key interest rate decisions. Trump indicated this appointment could be temporary, also hinting that the search for a permanent replacement might dovetail with the selection of a successor for Fed chair Jerome Powell, whose term concludes next year. Reports suggest Trump has expanded his shortlist for this crucial role, with names such as Fed governor Christopher Waller, St. Louis Fed President James Bullard, Marc Sumerlin, National Economic Council director Kevin Hassett, and former Fed governor Kevin Warsh all under consideration.

Despite macroeconomic headwinds, U.S. corporate earnings have remained robust. More than two-thirds of S&P 500 companies have reported quarterly results, with nearly 80% beating analysts’ profit estimates—a rate near historic highs, according to HSBC analysts. This earnings strength, buoyed by optimism around artificial intelligence, has driven the S&P 500 toward an anticipated 10% per-share income growth in the second quarter, nearly double initial Wall Street forecasts, even as broader economic uncertainty persists.

Corporate Earnings

- Pinterest -10% – stock plummeted as analysts flagged that the social media group’s second-quarter sales in the U.S. and Canada trailed its closest rivals.

- Wendy’s 1.3% – stock fell after the fast food company cut its outlook for full-year global sales outlook, as the burger chain grapples with input cost pressures and a drop in traffic in the United States.

- Expedia +4% – stock soared after the online travel agent raised its full-year gross bookings forecast and struck an optimistic tone on the recovery in U.S. travel demand.

ASX SPI 8768 (+0.01%)

Earning kicks off this week with Car Group CAR:ASX and JB-Hifi JBH:ASX delivering results today. With approx 28% of the ASX200 delivering earnings this week amongst CBA, SUN, PME, CAR, JBH, TLS, COH, we expect the local market to be very single stock focused

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.