Overnight – Stocks hit fresh records as Inflation numbers give the green light to rate cuts

Inflation numbers in line with expectation last night gives the Fed the green light to cut interest rates next week, pushing stocks to yet another record high

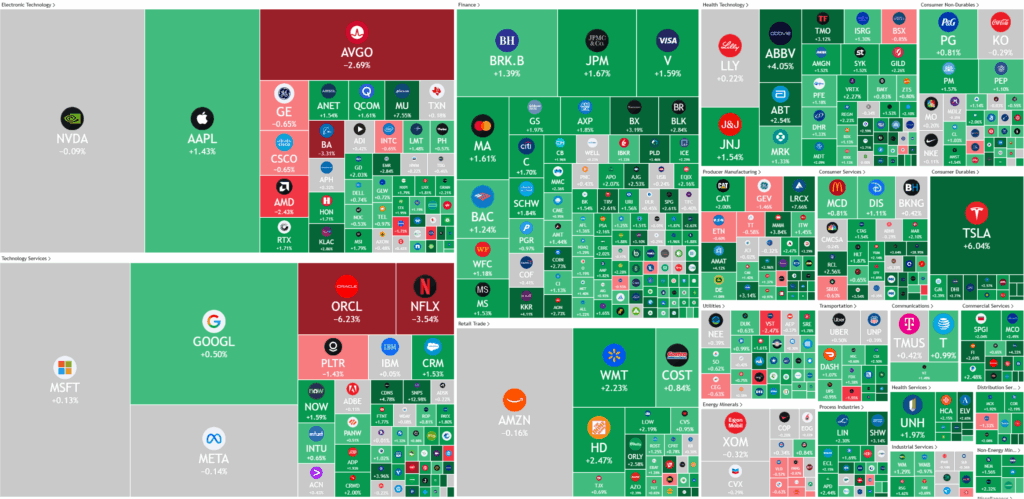

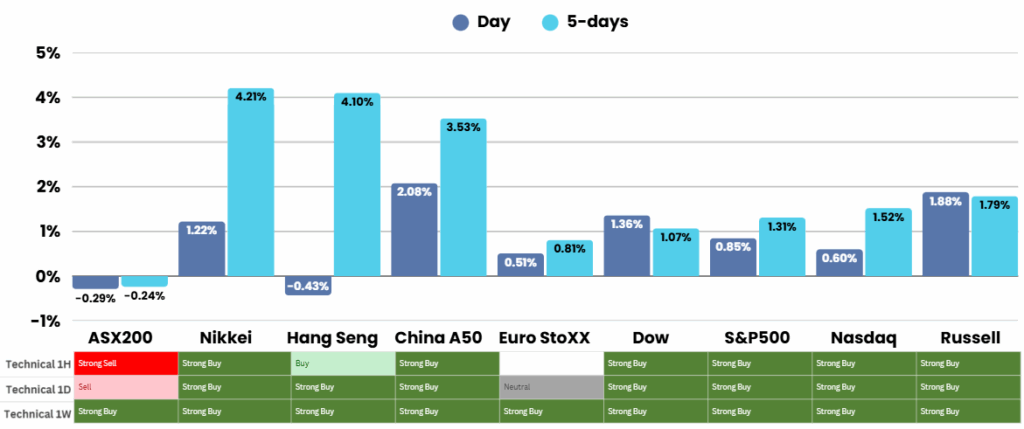

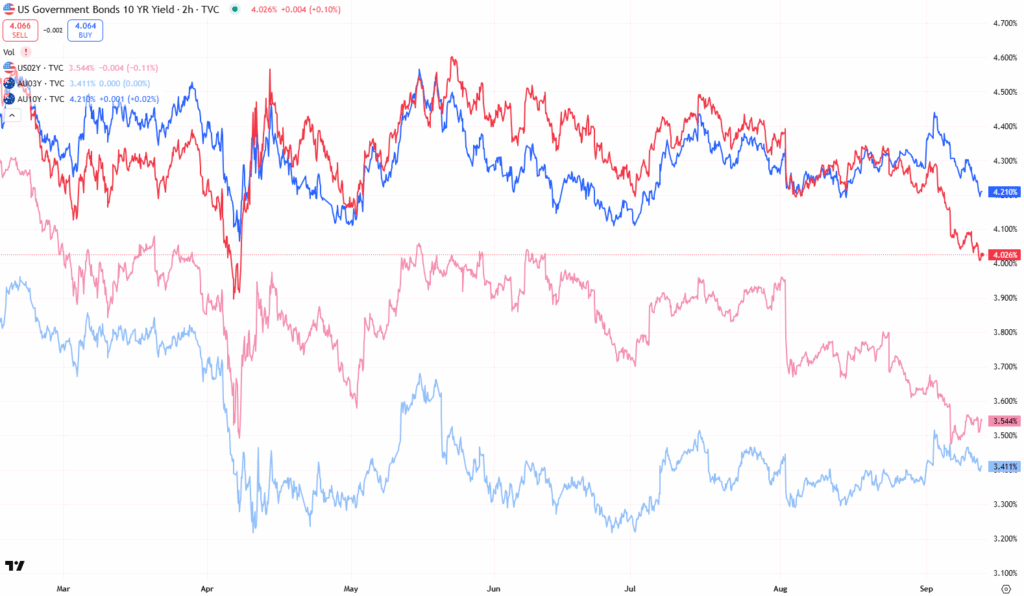

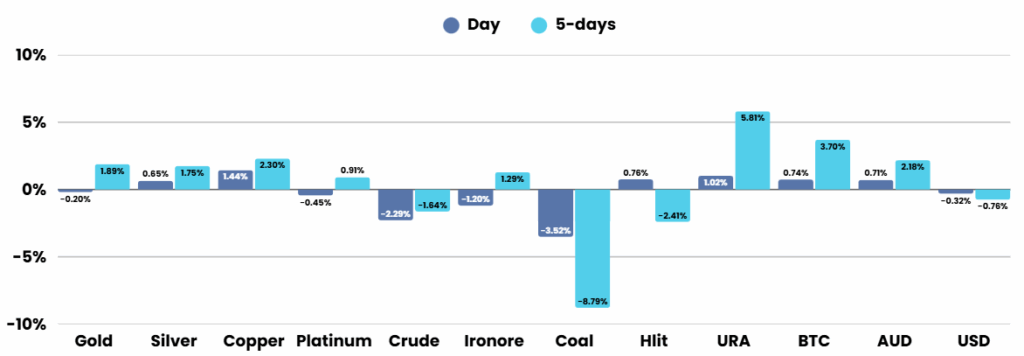

U.S. markets surged to fresh all-time highs this week, with the S&P 500 and NASDAQ Composite closing at record levels as investors bet on a Federal Reserve rate cut next week. The optimism stemmed from the latest consumer price index (CPI) report, which showed inflation rising 2.9% year-on-year in August, in line with forecasts, while monthly CPI climbed by 0.4%, the fastest pace since January. Despite the uptick in inflation, analysts argued that recent labor market weakness outweighs price concerns, keeping the Fed on track for a widely anticipated 25-basis-point cut, with some forecasting multiple reductions by year-end.

The case for easing further strengthened after wholesale inflation data showed August producer prices came in much weaker than expected, signaling cooling pressures. At the same time, jobless claims spiked by 27,000 to 263,000, pointing to a broadening slowdown in employment conditions. Taken together, the data is reinforcing expectations that the Fed will begin a rate-cut cycle at its September 17 meeting, though analysts believe the central bank is unlikely to continue lowering rates into 2026. Lower borrowing costs, paired with supportive government spending and reduced trade policy uncertainty, are expected to stabilize business sentiment and investment in the near term.

Corporate earnings and stock-specific news also moved markets. Delta Air Lines shares slipped as the carrier flagged weak demand for economy-class seats, even while maintaining a stronger Q3 revenue outlook. Semiconductor giant Micron Technology rallied after Citi raised its price target, citing robust demand from data centers, while Kroger gained on raising its annual sales guidance as consumers shift toward affordable grocery items. The standout was Opendoor Technologies, which skyrocketed more than 79% after appointing former Shopify executive Kaz Nejatian as its new CEO, sparking optimism about a turnaround for the real estate platform.

ASX Overnight: SPI 8850 (+0.48%)

The Day Ahead:

With the Fed now given the green light for rate cuts, the discussion will inevitably turn to “25 or 50?” which should support the market, however with Japan, UK, Canada and the US all having “Live” Central bank meetings next week, we don’t expect any significant movement

Yesterdays Session:

The Australian sharemarket slipped on Thursday, with the S&P/ASX 200 down 0.4 per cent by 2pm AEST as weakness in banks and healthcare outweighed strong gains in miners. Banks and healthcare stocks dragged the index lower, led by falls in ANZ, NAB, Westpac, Commonwealth Bank, CSL, ResMed and Sonic Healthcare. In contrast, gold miners surged on hopes of a US rate cut, lithium stocks rebounded, and corporate activity was strong, highlighted by Service Stream’s 15 per cent jump on a $1.6 billion Defence contract. sentiment, with major lenders advancing and Judo Bank jumping on a Citi “buy” upgrade.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.