Overnight – Stock reach new record as benign Inflation opens the door for rate cuts

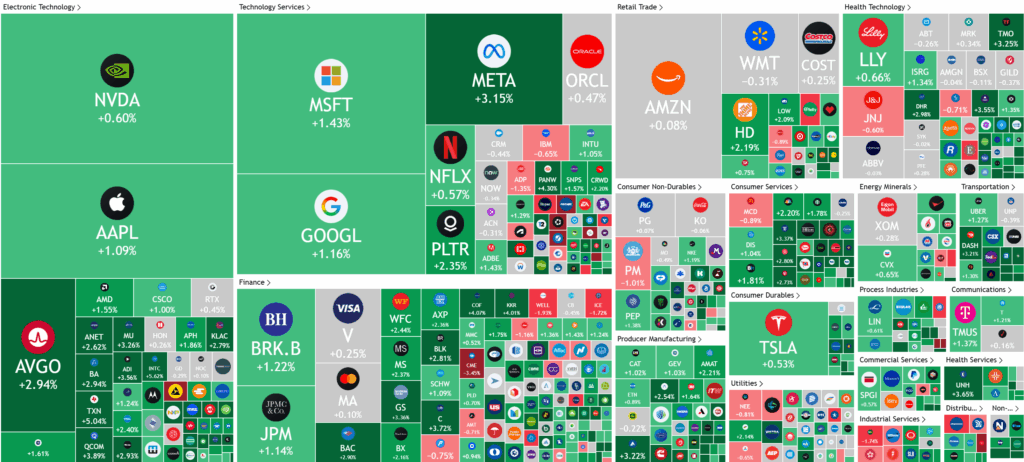

Stocks notched another record high overnight as inflation figures were benign, leaving the door open for the Fed to cut rates.

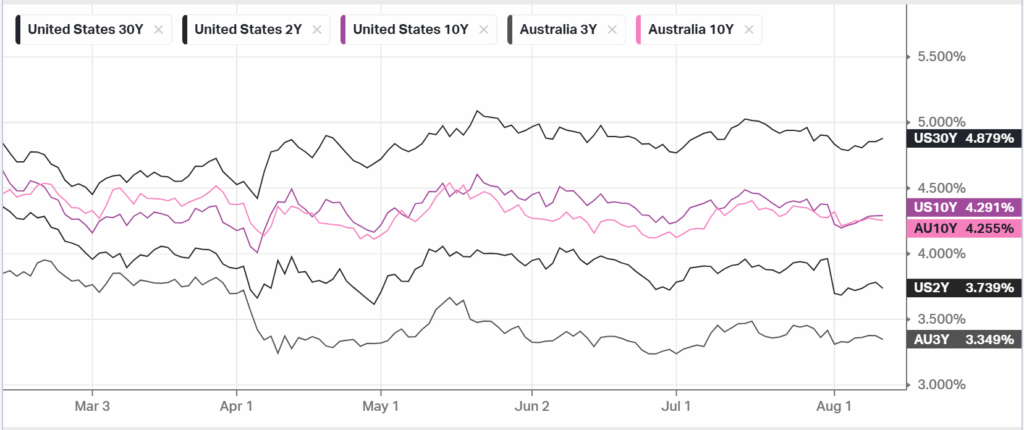

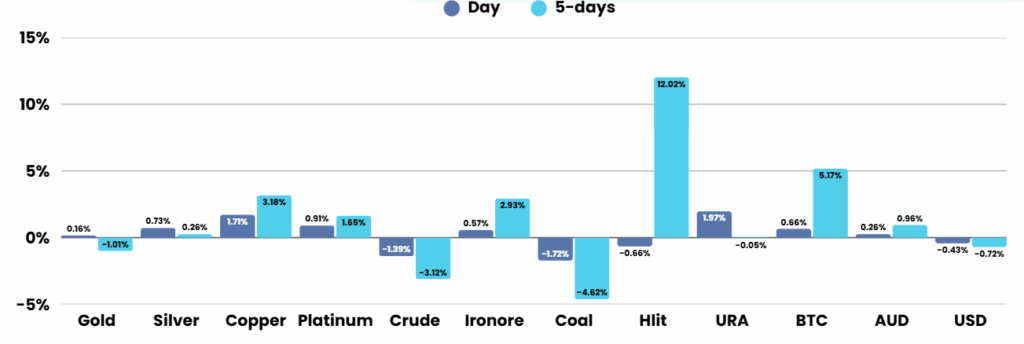

Recent data from the Bureau of Labor Statistics shows that the U.S. consumer price index (CPI) rose by 2.7% year-over-year in July, equaling June’s pace and slightly underperforming economists’ expectations of 2.8%. On a monthly basis, CPI increased by 0.2%, in line with forecasts and cooler than the previous month’s 0.3% rise. However, the “core” CPI, which excludes food and fuel, climbed 3.1% year-over-year—above the 3.0% anticipated—and registered a 0.3% monthly increase. These figures come alongside a weak July jobs report and downward revisions for prior months, increasing market speculation to a roughly 90% chance that the Federal Reserve will reduce rates by 25 basis points in September, with the possibility of a 50-point cut if August employment figures match July’s weakness. Analysts noted that this moderate inflation data could ease concerns among Fed policymakers about President Trump’s aggressive tariff policies driving inflation higher.

In reaction to economic reports, President Trump nominated economist E.J. Antoni to lead the Bureau of Labor Statistics, following the dismissal of former head Erika McEntarfer over disappointing jobs data. Trump accused McEntarfer, without evidence, of manipulating job numbers for political reasons. The nomination is pending Senate confirmation. Meanwhile, Trump also called on Goldman Sachs CEO David Solomon to dismiss his economist after warnings that tariffs could raise consumer prices.

Elsewhere in the market, Alphabet’s stock rose over 1% after reports surfaced that AI startup Perplexity AI—valued at $18b in July—had made a $34.5b offer for Google’s Chrome browser. Sinclair’s shares also saw strong gains amid new merger discussions.

Corporate Earnings

- Tencent Music Entertainment Group +11% – stock rose after the company reported better-than-expected results for the second quarter.

- Circle Internet Group +2% – jumped more than 2% after the stablecoin issue delivered its first quarterly results as a publicly traded company, beating Wall Street estimates on both the top and bottom lines.

ASX SPI 8852 (+0.16%)

Before the Bell: ASX Set to Rise on Wall Street Rally, Rate Cut Bets

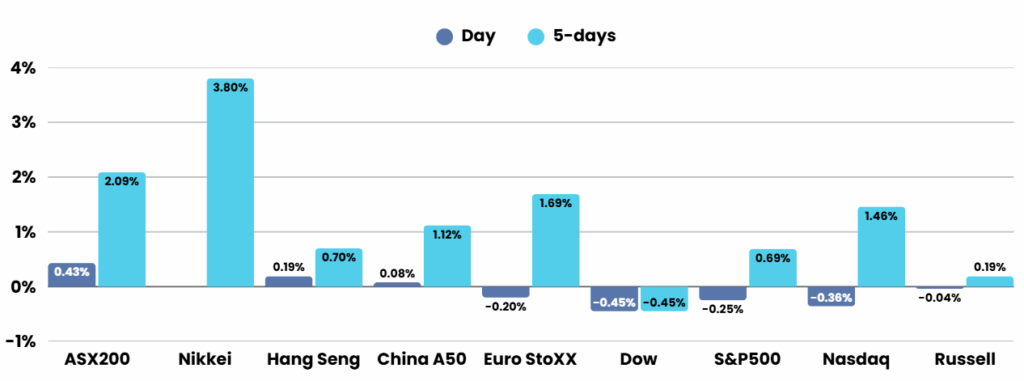

Australian shares are expected to open higher, following a broad rally on Wall Street after US July CPI data strengthened expectations for a September Federal Reserve rate cut. The S&P 500 gained 1.1% to a record 6445.76, with all sectors advancing. Fed rate cut odds rose above 90% per CME’s FedWatch Tool. US CPI rose 0.2% in July, with annual growth steady at 2.7%; core CPI increased 0.3%, lifting the annual rate to 3.1%. Locally, investors await results from AGL Energy, Commonwealth Bank, Treasury Wine Estates, Computershare, Evolution Mining, IAG, and Arena REIT.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.