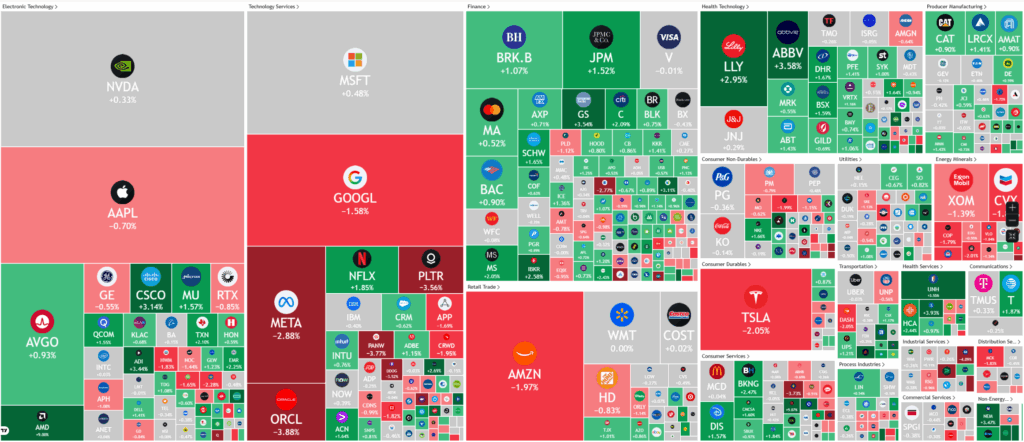

Overnight – Defensive Switch continues as investors rotate out of Tech

The rotation to a more defensive stance continued overnight as investors rotated out of Tech into ahead of the confirmation of a deal to end the longest-ever federal government shutdown.

Lawmakers in the U.S. House of Representatives are preparing to vote on a bipartisan compromise aimed at ending one of the longest government shutdowns in history. The Senate has already passed a bill to fund most federal agencies through January 30, and with the House’s Republican majority signaling support, the measure is expected to reach President Donald Trump’s desk for signature. The reopening of the government is anticipated to restore normal operations across departments that have been shuttered, bringing relief to federal workers and easing concerns about extended disruptions.

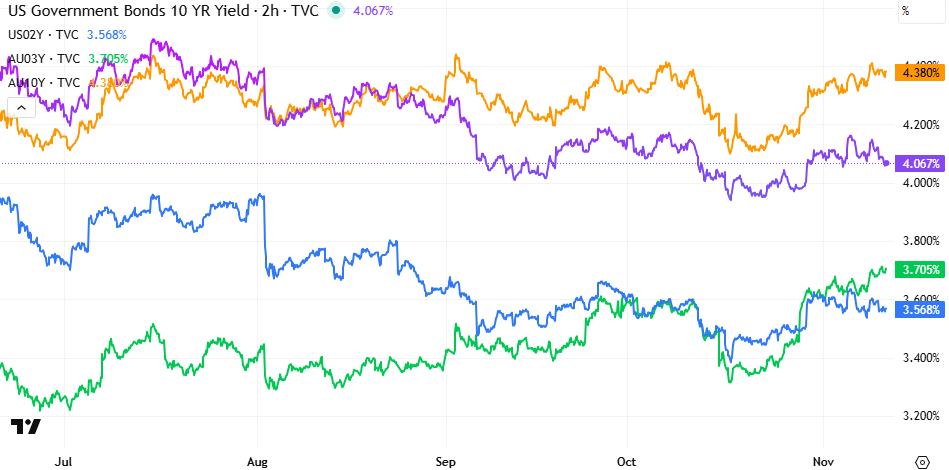

The resumption of government functions will also allow the release of key economic indicators that were delayed during the shutdown, such as the monthly jobs report. These reports are vital for investors and policymakers to evaluate the health of the U.S. economy. The absence of data has created uncertainty for Federal Reserve officials as they approach their final monetary policy meeting in December. Without updated figures, it has been difficult to judge whether additional stimulus is necessary, contributing to volatility in market expectations.

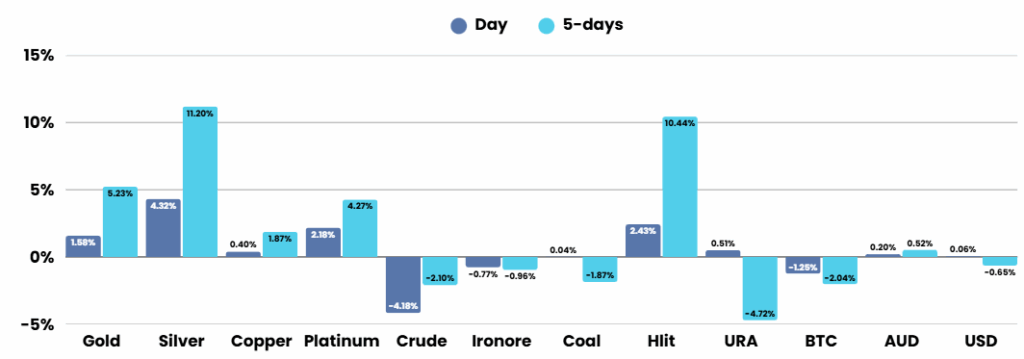

Investor attention has also turned to corporate developments. Alphabet’s stock climbed following news that the company will invest €5.5 billion in Germany to expand its data center and infrastructure network. AMD shares rose after the chipmaker presented ambitious growth targets at its first financial analyst day in three years. Chevron shares also gained ground after announcing plans to grow free cash flow by over 10% annually through 2030 while cutting costs and increasing production. These corporate announcements, combined with optimism over the government’s imminent reopening, have helped lift overall market sentiment.

Corporate Earnings

- Cisco +8.14% – raised its annual revenue forecast after the bell , banking on multi-billion-dollar data center expansions to drive demand for its networking equipment. The company expects fiscal 2026 revenue to be between $60.2 billion and $61 billion, compared with its prior projection of $59 billion to $60 billion.

- Circle -12.58% – fell more than 10% even as the company reported quarterly results that topped Wall Street estimates.

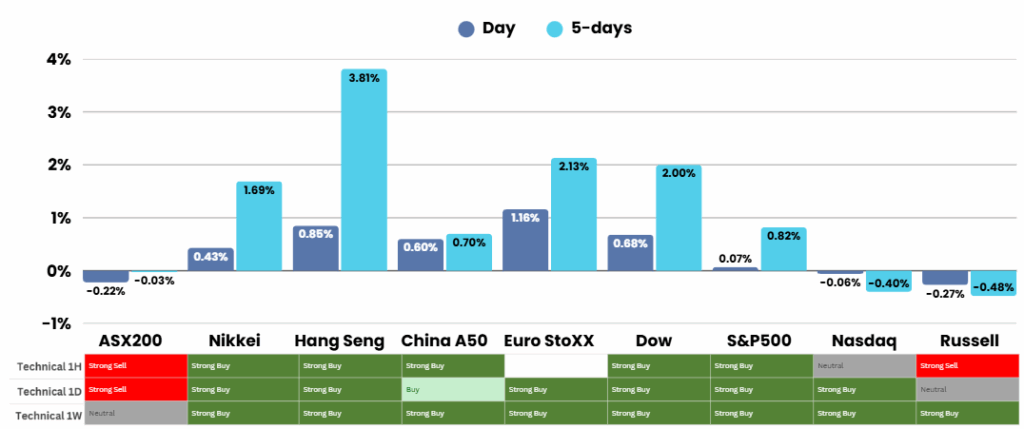

ASX Overnight: SPI 8833 (+0.11%)

The Day Ahead:

- Results expected on Thursday from Graincorp, Orica, Xero, Catapult Sports and Infratil.

- Companies scheduled to host annual meetings include Arena REIT, AUB Group, Computershare, Catalyst Metals, Greatland Resources, Guzman Y Gomez, Ingenia Communities Group, Inghams Group, Nextdc, Pexa Group, SGH, Superloop, Servcorp and Strike Energy.

- On the data front, Australia’s October labour force report is due at 11.30am.

- Overseas, the US House of Representatives is set to vote on a bill that would end the federal government shutdown. The vote is expected to take place at about 7pm (11am AEDT).

Yesterdays Session:

The ASX 200 inched up 0.1% to 8833.8 as gains in mining and energy stocks outweighed losses in tech and financials. Rio Tinto, BHP, and Mineral Resources led the rally on stronger iron ore and a major lithium deal, while gold miners advanced with rising bullion prices. Oil strength boosted Woodside and Santos, but Commonwealth Bank’s drop offset other bank gains. Tech shares tumbled, with Life360 and Aristocrat Leisure slumping, though Flight Centre rose on upbeat profit guidance.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.