Overnight – Stocks have worst day in 6-months as Trump pokes the Tariff war hornets nest

U.S. stocks experienced their steepest decline since April, after President Donald Trump threatened a “massive increase” in tariffs on Chinese imports in response to Beijing’s restrictions on rare earth exports

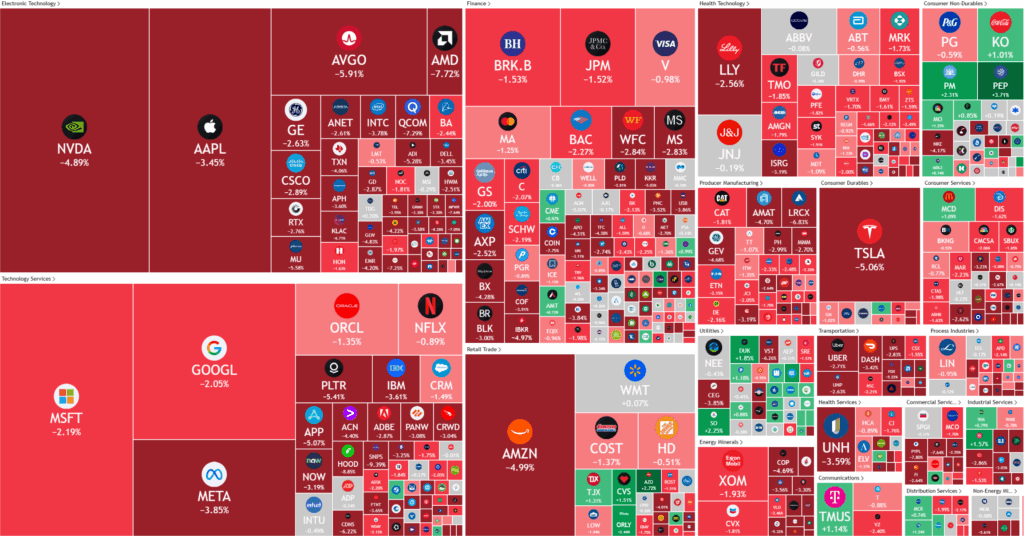

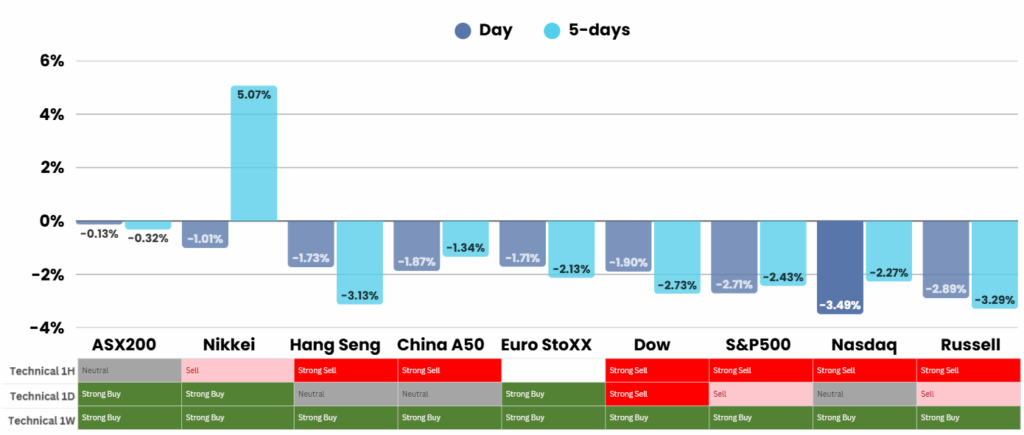

U.S. stocks experienced their steepest decline since April, with the S&P 500 dropping 2.7%, the Nasdaq down 3.6%, and the Dow falling 840 points, after President Donald Trump threatened a “massive increase” in tariffs on Chinese imports in response to Beijing’s restrictions on rare earth exports. Rare earth stocks surged on expectations of continued U.S. strategic interest, while major Chinese companies such as Alibaba and Baidu saw sharp losses. Trump also hinted he may cancel upcoming talks with Chinese President Xi Jinping.

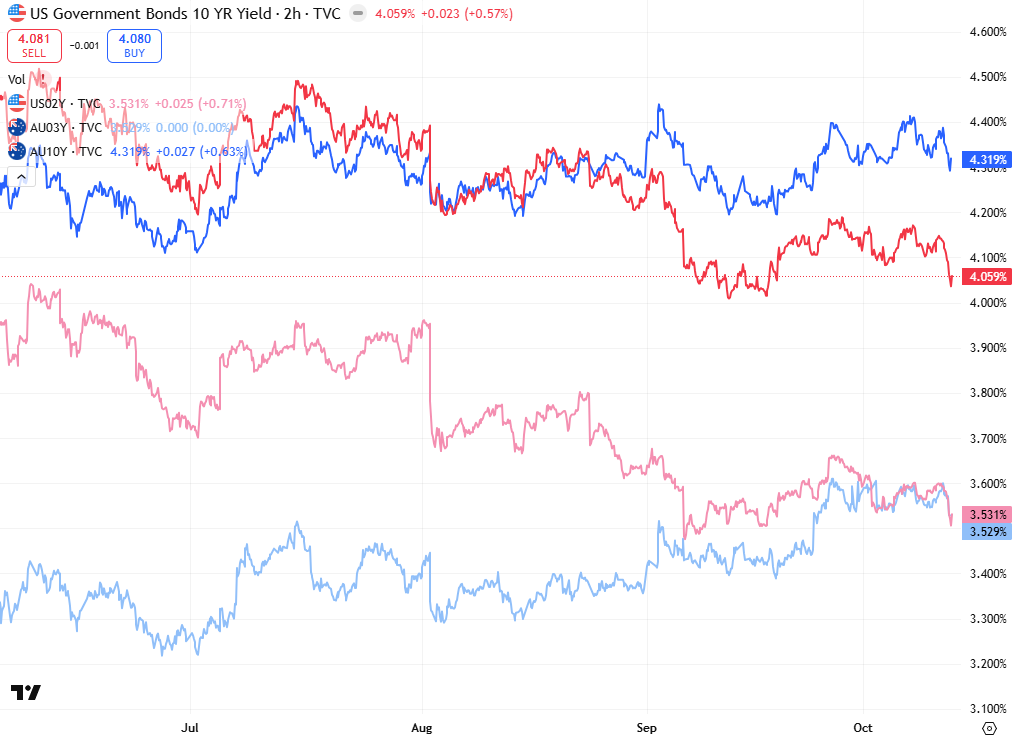

Consumer sentiment in October remained steady at 55.0, slightly above forecasts, with improvements in personal finances and business outlook offset by weaker household and durable goods purchasing expectations. The ongoing U.S. government shutdown has delayed key economic data releases, complicating Federal Reserve interest rate planning. Without fresh inflation and job growth indicators, policymakers are relying on secondary surveys to guide potential future rate cuts.

Applied Digital shares rose over 16% after reporting an 84% revenue jump to $64.2 million, driven by AI-related data center demand. Levi Strauss beat quarterly earnings and raised its full-year outlook, but shares fell more than 10% as analysts noted the results failed to surpass already elevated expectations. Levi now sees fiscal 2025 adjusted earnings between $1.27 and $1.32 per share and raised its revenue growth forecasts.

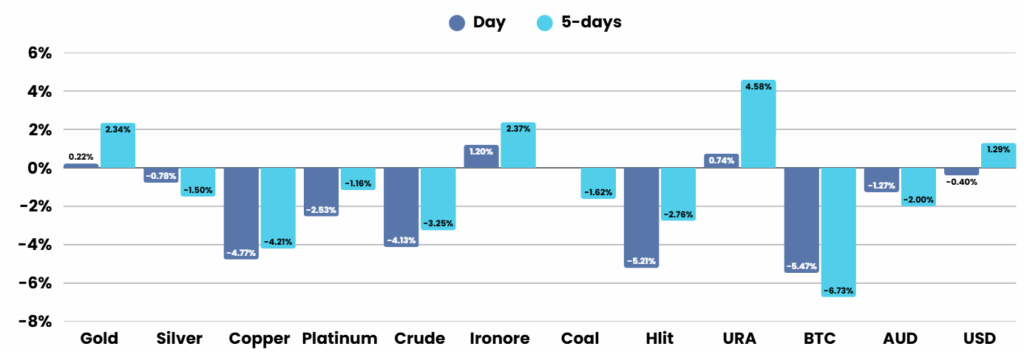

Gold prices rebounded to $3,985.41/oz after briefly falling below $4,000 due to profit-taking following a ceasefire deal between Israel and Hamas. Despite volatility, gold is on track for an eighth consecutive weekly gain amid safe-haven demand and expectations for U.S. rate cuts. Analysts see structural drivers supporting higher prices, including central bank buying, tight supply, and continued geopolitical uncertainty, with markets still betting on another Fed rate cut later in October.

ASX Overnight: SPI 8896 (-0.94%)

The Day Ahead:

The culmination of a number of factors probably contributed the oversized move on Friday night. Be wary an over-exaggerated move in the Asian session

Yesterdays Session:

The Australian sharemarket closed slightly lower on Friday, with the S&P/ASX 200 falling 11.1 points, or 0.1 per cent, to 8958.7, as sharp declines in gold and energy stocks outweighed gains in most other sectors. A ceasefire agreement between Israel and Hamas pushed gold prices down 1.6 per cent to $US3976 an ounce, prompting steep losses for miners such as Alkane, Regis, Ramelius and Genesis. Oil producers also fell as crude prices retreated, while iron ore majors weakened on reports of a dispute between BHP and China’s state buyer. Offsetting some of this pressure, tech stocks rose on Wall Street strength, with Life360 and NextDC posting solid gains.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.