Overnight – Equities notch another record on immediate rate cut hopes

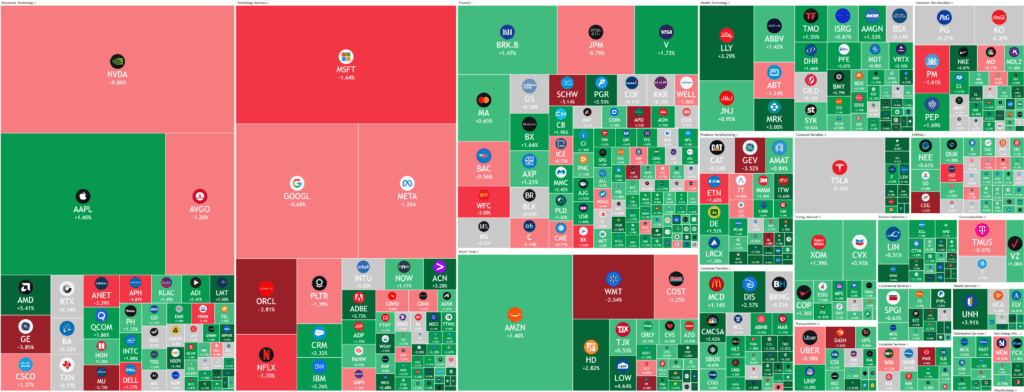

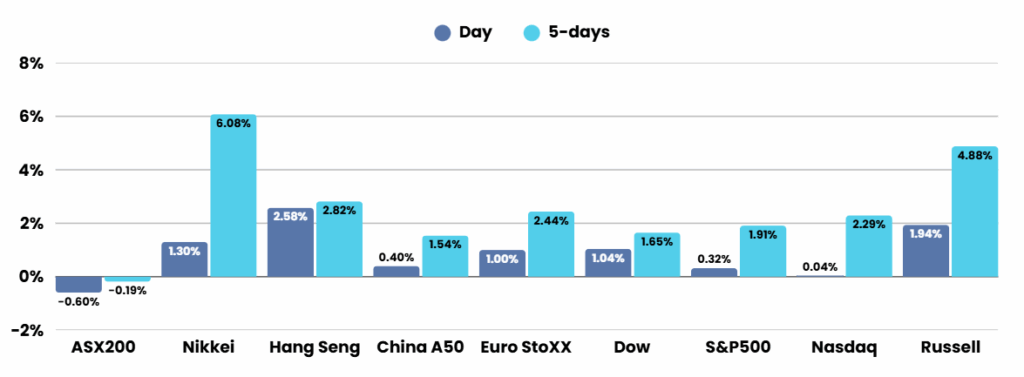

Equites notched a record close for the second day in a row on Wednesday as investors weighed the prospect of a Federal Reserve rate cut as soon as next month and an ongoing slew of mostly upbeat quarterly earnings.

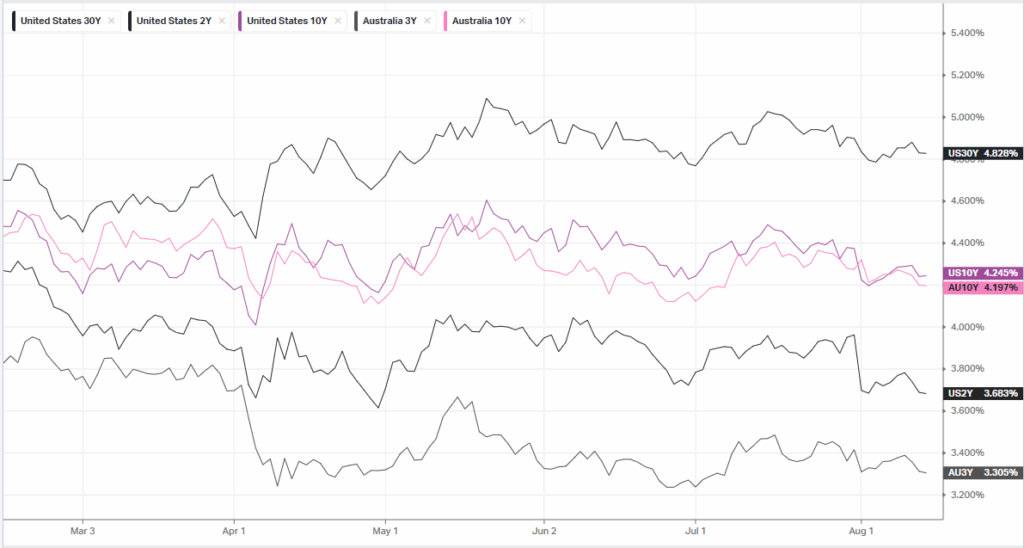

Expectations for a Federal Reserve rate cut in September have surged after recent data indicated tame consumer price growth and a weakening labor market. Market pricing now reflects up to a 99% probability for a 25-basis-point reduction at the September 17 meeting, as persistent tariff impacts have largely been absorbed by corporate profit margins rather than pushing up consumer prices. With inflation hovering above the Fed’s 2% target but still considered manageable, analysts increasingly expect not only a September cut but potentially one or two more before year-end, as policymakers balance lingering inflation concerns with the need to support jobs and broader economic activity.

However, debate remains over the size of the upcoming cut. While Treasury Secretary Scott Bessent and some others have advocated for a larger 50-basis-point reduction to jumpstart growth, influential Fed voices like James Bullard have cautioned against such a move, arguing that a jumbo cut could send panic signals to markets. Bullard suggests that a series of gradual quarter-point cuts totaling 100 basis points over the coming year would be preferable if data continues to show cooling employment and controlled inflation. Meanwhile, Atlanta Fed President Raphael Bostic and others signal a willingness to wait, citing the still-resilient labor market as justification for holding off on aggressive easing.

In parallel with monetary policy discussions, attention has turned to the upcoming replacement of Fed Chair Jerome Powell, whose term expires in May. The Trump administration is reviewing an expanded roster of 11 candidates, recently adding private-sector names such as David Zervos (Jefferies), Larry Lindsey (former Fed Governor), and Rick Rieder (BlackRock), alongside existing contenders like Michelle Bowman, Chris Waller, Philip Jefferson, Lorie Logan, Marc Summerlin, Jim Bullard, Kevin Hassett, and Kevin Warsh. The selection process reflects a blend of central bank insiders and outside economists, signaling the administration’s broad approach to finding a leader who will steer future Fed policy in alignment with evolving priorities.

Corporate Earnings

- CoreWeave Inc -20% – slumped after losses widened much more than expected in Q1, owing to a jump in expenses, which Deutsche Bank attributed the cost of serving incremental demand.

- Cisco -1.42% – forecast first-quarter revenue above Wall Street estimates on Wednesday, as the artificial intelligence boom boosted demand for its networking equipment from cloud customers.

ASX SPI 8825 (+0.35%)

The ASX will again be earnings focused with Telstra, Origin, ProMedicus, ASX and Temple and Webster in the spotlight.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.