Overnight – Tech stocks hit as Dec rate cuts looking less likely

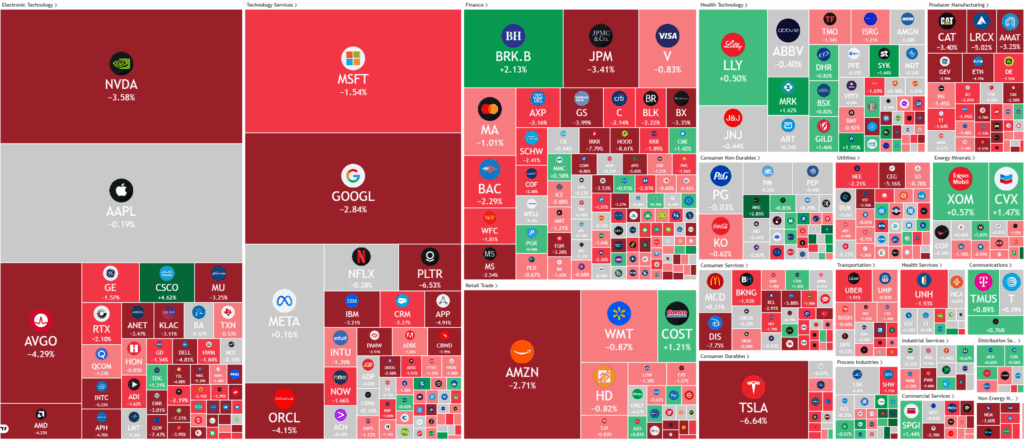

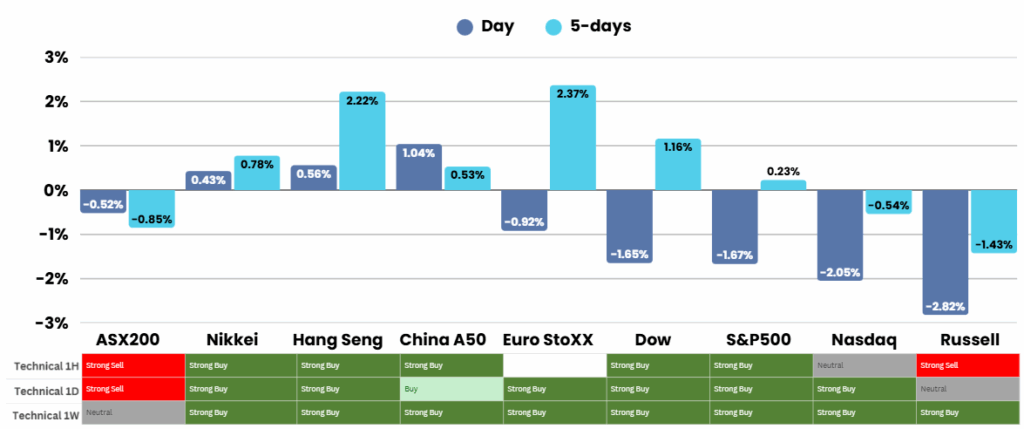

Tech stocks led the market lower as an ongoing rotation out of big tech and waning odds of a December rate cut weighed on sentiment even with the ending of the longest ever US government shutdown.

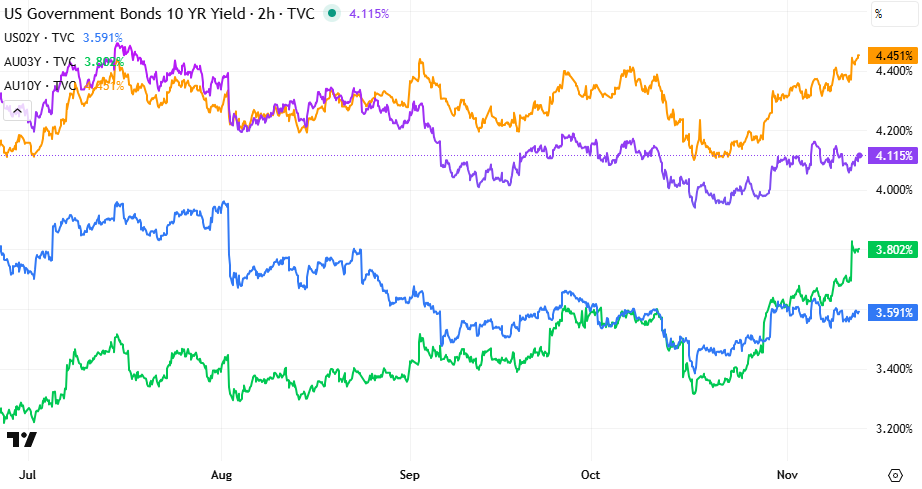

Market expectations for a December Federal Reserve rate cut declined below 50% following cautious comments from policymakers amid limited economic data caused by the government shutdown. Boston Fed President Susan Collins signalled reluctance to support further easing given missing inflation information, while Minneapolis Fed President Neel Kashkari described the outlook as mixed, noting persistent inflation despite strength in some sectors. Analysts at Macquarie suggested that Chair Jerome Powell may be compelled to hold rates steady or indicate that any December cut would likely mark the end of the current easing cycle.

President Donald Trump ended the longest U.S. government shutdown in history by signing a funding bill passed largely along party lines. The 43-day closure had severely disrupted federal services, especially in aviation safety and travel oversight, causing widespread flight cancellations and threatening short-term economic growth. With funding now restored through January 30, data releases critical for assessing the economy are set to resume, though some officials warned that key employment and inflation figures for October might never be published—potentially complicating the Fed’s December decision.

In corporate news, Cisco Systems boosted sentiment in the tech sector by raising its annual revenue and profit guidance. The company now forecasts fiscal 2026 revenue between $60.2 billion and $61 billion, up from earlier projections, and sees adjusted earnings per share ranging from $4.08 to $4.14. Cisco’s better-than-expected first-quarter results and strong demand linked to the AI-driven data center boom—expected to generate $3 billion in AI infrastructure revenue this year—pushed its stock higher despite broader market pressures.

ASX Overnight: SPI 8642 (-1.54%)

The Day Ahead: As expected, the market is struggling to justify current levels. Continue to trim portfolios.

Yesterdays Session:

The Australian sharemarket fell sharply on Thursday after strong jobs data weakened hopes for a 2025 rate cut. The S&P/ASX 200 dropped 1 per cent to a 10-week low as October’s unemployment rate fell to 4.3 per cent with 42,200 new jobs. Markets cut the chance of a June RBA rate cut to 30 per cent from 80 per cent.

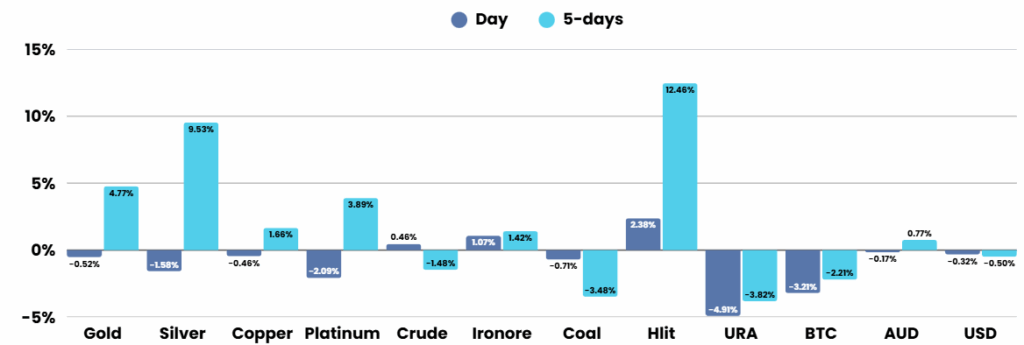

Technology and property stocks led losses, with Xero down 6.8 per cent and NextDC 4.9 per cent lower. Energy stocks slipped after crude oil fell nearly 4 per cent, while gold miners gained as bullion neared $US4200. DroneShield plunged 31 per cent after director share sales, GrainCorp slid 11 per cent on weaker profits, Webjet tumbled 19 per cent on a profit warning, and Havilah surged 31 per cent after Sandfire’s Kalkaroo deal.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.