Overnight – Trump/China tensions keep a lid on Equities

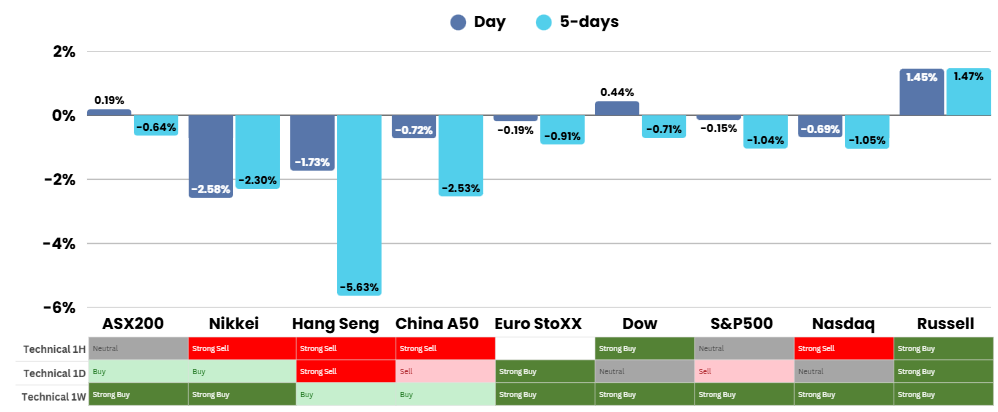

Stocks drifted lower overnight as continued tensions between the US and China and the ongoing US Govt shutdown weighed on investor sentiment, despite positive bank earnings

President Trump warned China that the United States may ban imports of cooking oil if Beijing continues to avoid purchasing U.S. soybeans, calling the action an “Economically Hostile Act” against American farmers. Declaring that the U.S. can produce enough cooking oil domestically, the president’s remarks heightened fears of another trade confrontation between the two world powers. The threat followed his earlier statement about potentially raising tariffs on Chinese imports by 100%, signaling escalating economic tension between Washington and Beijing.

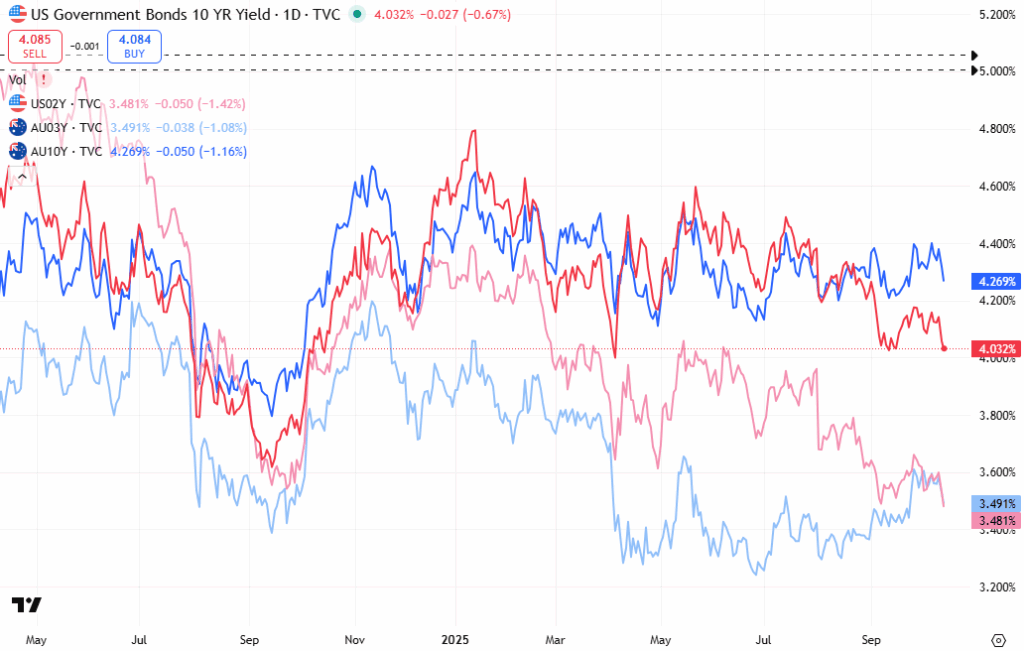

Federal Reserve Chair Jerome Powell indicated that the central bank’s quantitative tightening program could soon reach an endpoint, suggesting that policymakers are preparing to ease monetary conditions amid economic risks. He cautioned that sustained high tariffs could lead to job losses if the Fed is too slow to lower rates. Powell’s dovish comments boosted expectations for forthcoming rate cuts, leading to a steep drop in Treasury yields as investors positioned for a more accommodative policy stance.

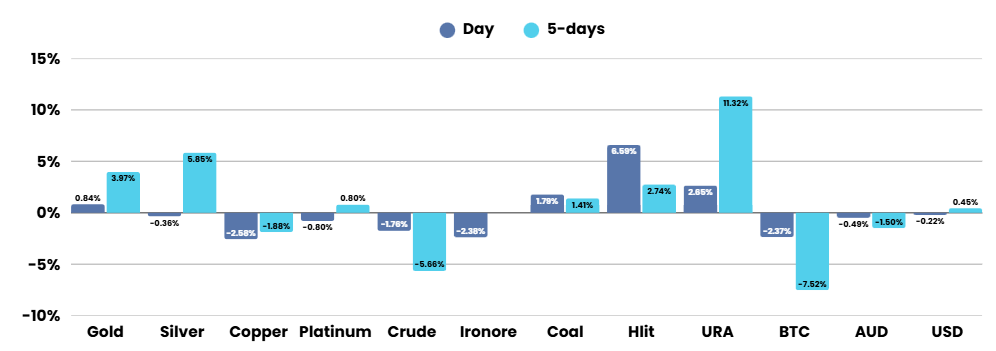

Major U.S. corporations kicked off earnings season with mixed outcomes. JPMorgan Chase posted stronger-than-expected results, driven by a 16% rise in investment banking fees from revived dealmaking, though credit loss provisions weighed on its shares. Wells Fargo also beat profit forecasts, helped by broad-based revenue growth, while other major banks are due to report next. Outside of finance, Johnson & Johnson exceeded revenue expectations but saw shares decline after announcing plans to spin off its orthopaedics unit. In the commodities market, gold surged to a record above $4,100 per ounce on safe-haven demand, while oil prices fell amid trade war concerns and an International Energy Agency forecast of rising global supply through 2026.

ASX Overnight: SPI 8994 (+0.83%)

The Day Ahead:

The ASX should see some upside today as commodities and Uranium remained bid. We remain cautious on the overall market with the VIX grinding higher with a number of geopolitical issues bubbling

Yesterdays Session:

The Australian sharemarket was steady on Tuesday, with the S&P/ASX 200 holding at 8883 points as optimism over improved US-China trade ties and easing Middle East tensions supported sentiment. Gains in gold, iron ore, and uranium stocks—driven by record bullion prices and stronger commodity demand—offset declines in major banks. Rio Tinto, BHP, and Newmont led the advances, while Westpac dragged financials lower after slipping 1.5%. Market confidence rose following President Trump’s comments on renewed trade cooperation with China and news of a Gaza ceasefire that lifted global risk appetite.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.