Overnight – Upbeat bank earnings push stocks higher

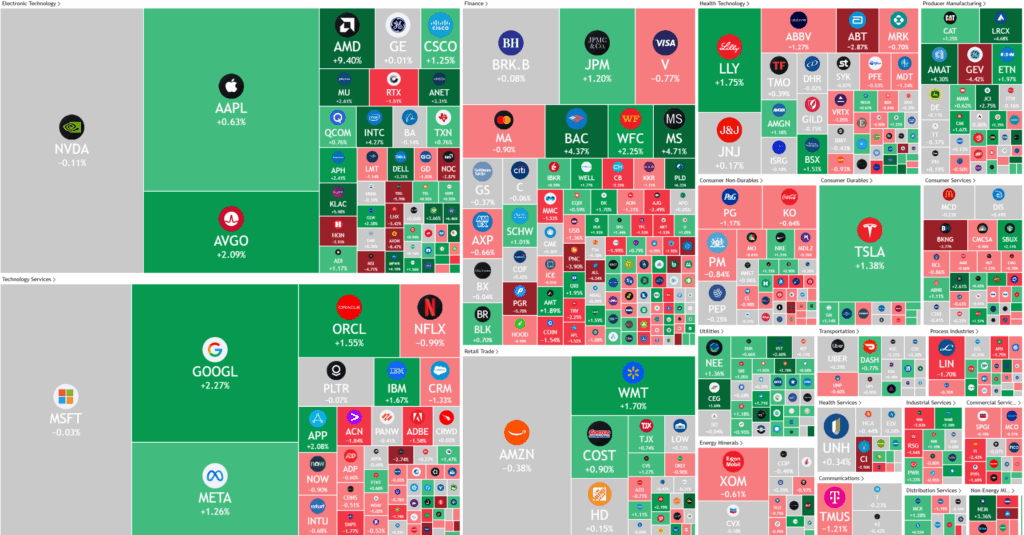

Stocks resumed the rally overnight on upbeat bank earnings and rate cut hopes as US/China relations grew increasingly tense

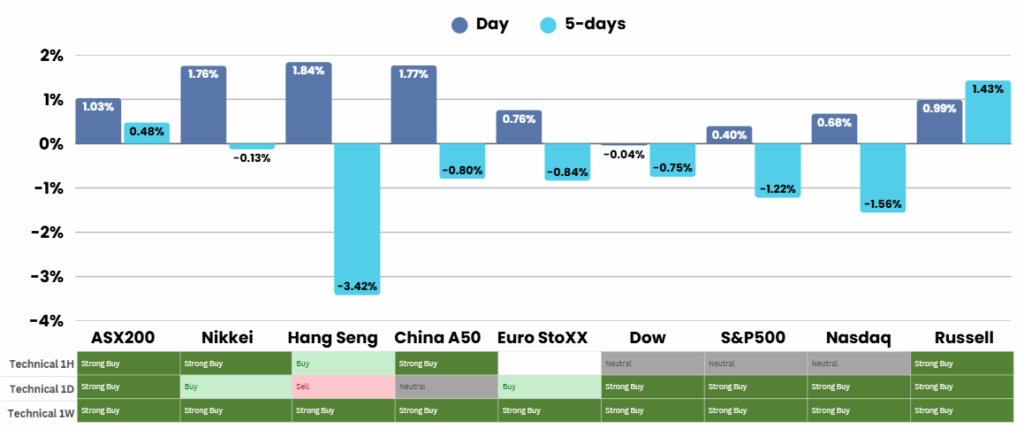

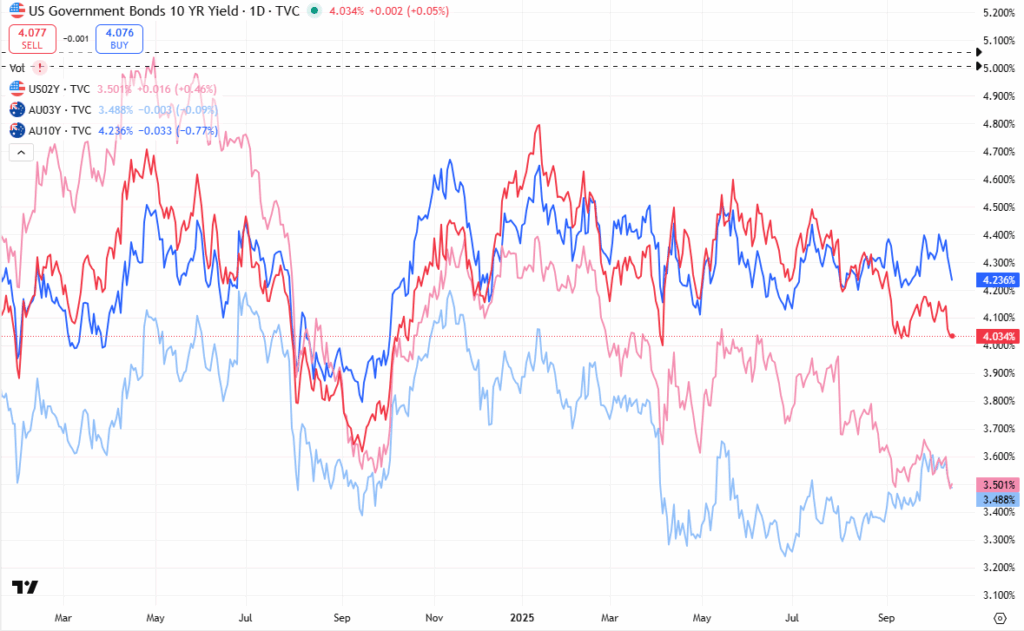

Federal Reserve Governor Stephen Miran on Wednesday urged quick interest-rate cuts, warning of mounting economic risks from escalating U.S.-China trade tensions. He emphasized that the potential for a new “tail risk” justified a faster move toward a neutral policy stance to shield the economy from external shocks. His remarks followed those of Fed Chair Jerome Powell, who signaled that the central bank is likely to continue easing monetary policy in upcoming meetings after a 25-basis-point reduction in September.

Powell, speaking at the National Association for Business Economics, said that the broader outlook for inflation and employment remains largely unchanged since September, although he noted emerging signs of a softer labor market. Markets interpreted his tone as dovish, reinforcing expectations that the Fed will proceed with additional rate cuts before the end of 2025. The combination of Powell’s remarks and Miran’s call for urgency strengthened investor confidence in a more accommodative monetary path amid uncertain global trade conditions.

The U.S.-China trade relationship continued to deteriorate this week, with Treasury Secretary Bessent affirming that the Trump administration would maintain its tough stance regardless of market reactions. President Trump intensified tensions by floating the possibility of cutting off trade with China in the cooking-oil sector, accusing Beijing of deliberately halting U.S. soybean purchases. In response, China sanctioned five subsidiaries of South Korea’s Hanwha Ocean linked to U.S. operations and imposed reciprocal port fees on American vessels, further escalating the trade confrontation.

Corporate Earnings

- Bank of America (BAC) +4.45% –raised the lower end of its full-year net interest income guidance after a better-than-expected quarter. It topped profit estimates, helped by a surge in investment banking revenue and steady consumer lending growth. The bank reported healthy loan demand and disciplined expense management.

- Morgan Stanley (MS) +4.44% – posted a notable profit increase in the third quarter as dealmaking momentum returned. Its investment banking division grew sharply amid improving equity underwriting and advisory activity. Wealth management results were steady, supported by higher client assets and fee income.

- Goldman Sachs (GS) -0.72% –beat analysts’ forecasts, driven by strong investment banking fees and renewed activity in mergers and acquisitions. Trading activity remained robust across both fixed income and equities, adding to the earnings beat.

- JPMorgan Chase (JPM) +1.48% –revised its full-year net interest income forecast higher after a robust quarter marked by strong loan growth and continued margin expansion. The bank also benefited from healthy consumer spending and lower credit provisions.

- Wells Fargo (WFC) +2.12% –reported profit ahead of Wall Street estimates, citing higher institutional deal volumes and an improved credit picture. The lender saw particular strength in its corporate banking and mortgage divisions.

ASX Overnight: SPI 9024 (+0.05%)

The Day Ahead:

Quarterly updates are expected from AMP, Challenger and Santos. Among the companies set to hold annual meetings are Aurizon, Stockland and Treasury Wine.

RBA assistant governor (financial markets) Christopher Kent is scheduled to speak at the CFA Society Australia Investment Conference 2025 in Sydney at 8.50am.

Yesterdays Session:

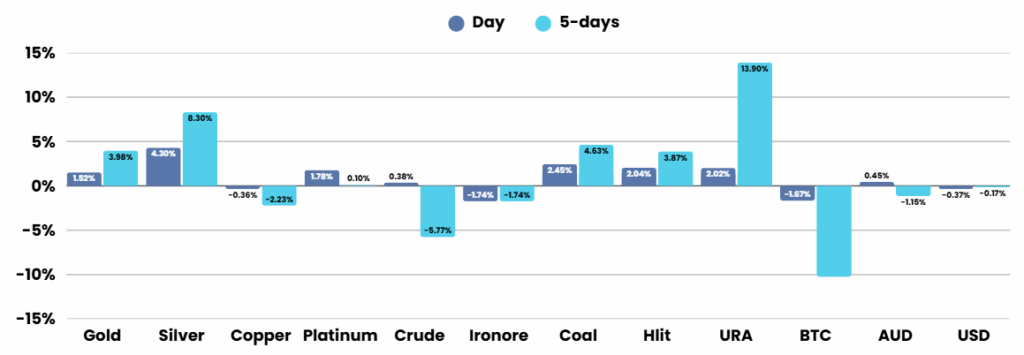

The Australian sharemarket rose 0.9% on Wednesday to 8975.6, driven by strong gains in major banks and miners as gold reached record highs. Financial stocks led the rally after regulatory relief and robust earnings, with Westpac up 1.7% and Bank of Queensland jumping 2% on a higher dividend. Gold miners climbed as bullion hit US$4185 an ounce, lifting Newmont and Perseus by 1.3%, while BHP, Fortescue, and Rio Tinto also gained. Telix Pharmaceuticals soared 15% on upgraded guidance, but DroneShield dropped 7.3% after unveiling new software.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.