Overnight – Tech stocks hit as Dec rate cuts looking less likely

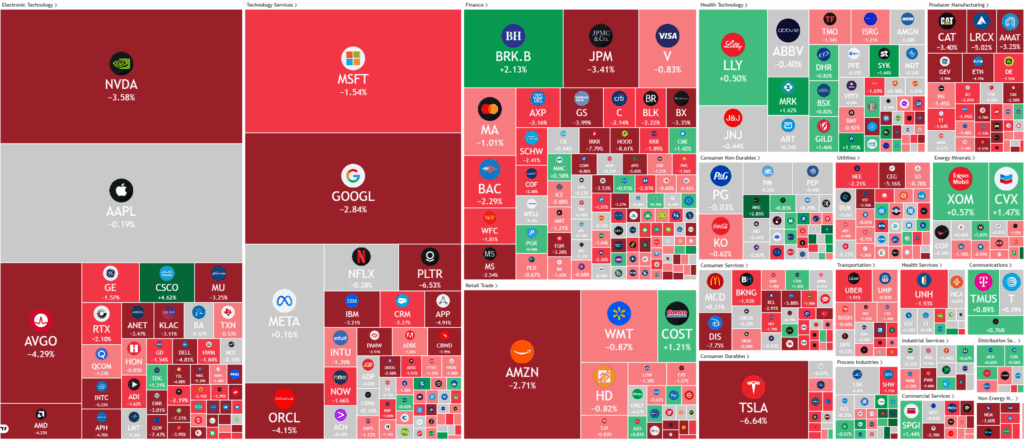

Stocks closed mixed on Friday night, well off the lows of the session as investors bought the dip in AI-related stocks to spark a turnaround in tech and shrugged off concerns about waning odds of a December rate cut.

Tech stocks rebounded to end higher as investors took advantage of the recent selloff in major artificial intelligence names, including Nvidia, Oracle, and Palantir. This uptick in buying came just a week before Nvidia’s quarterly earnings, which are expected to serve as an important gauge of AI demand. Despite the positive close, caution remains in the market as Barclays highlighted a more reserved investor mood ahead of Nvidia’s report on November 19. In the semiconductor space, Applied Materials warned that tougher U.S. export controls on China could lower chip equipment spending in 2026, though the firm expects AI-driven demand to bolster sales later next year.

Broader corporate news reflected a mix of sentiment across other sectors. Walmart shares declined after it announced John Furner will replace longtime CEO Doug McMillon in early 2026. Conversely, Warner Bros Discovery gained after reports surfaced that streaming and media giants including Paramount, Comcast, and Netflix might bid for the company. Meanwhile, StubHub’s stock dropped as its CEO declined to give quarterly guidance — the first update since its September IPO.

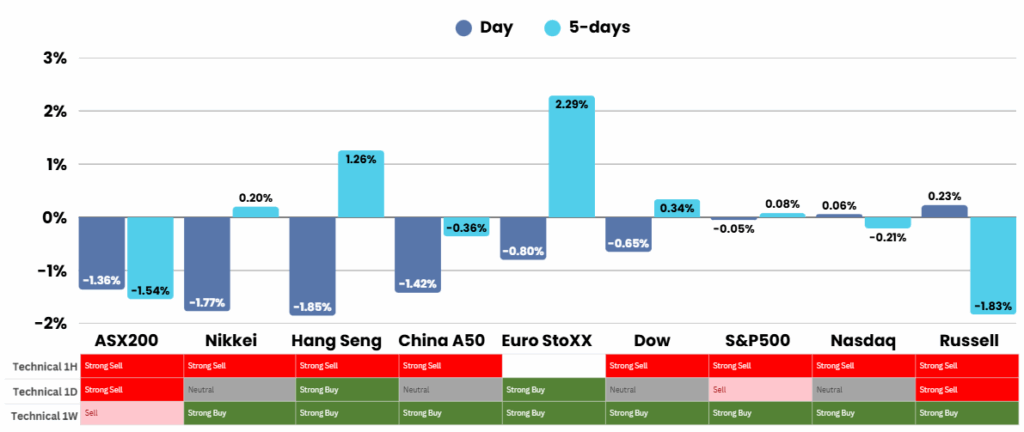

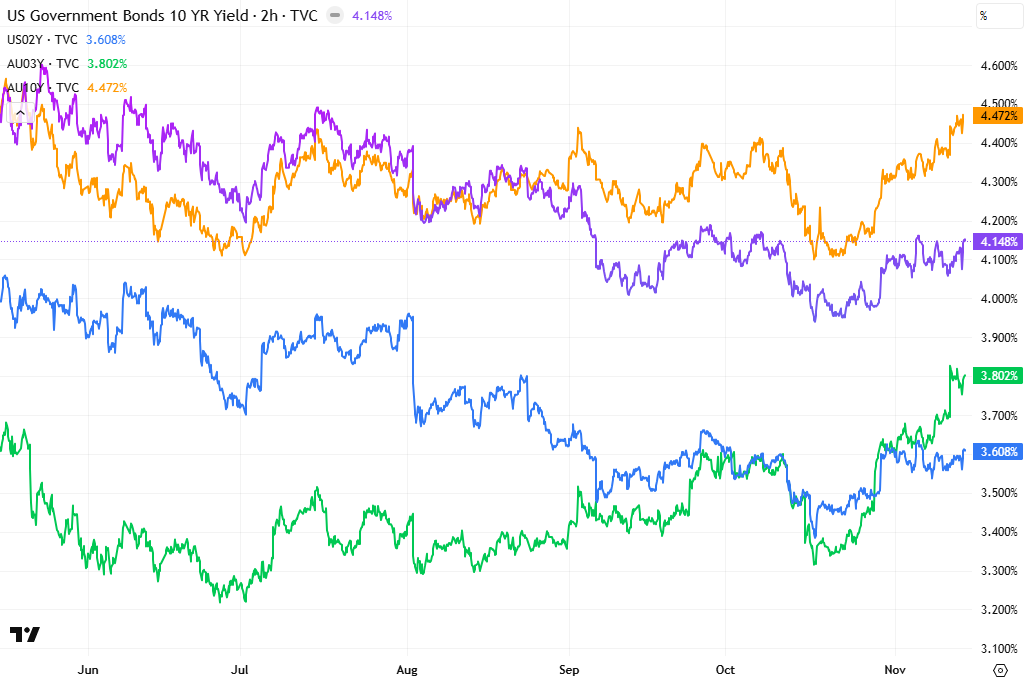

In monetary policy developments, hawkish remarks from several Federal Reserve officials dimmed hopes for a December rate cut. Fed President Neel Kashkari said he remains unconvinced of the need to ease policy, while others, including Alberto Musalem and Beth Hammack, warned against cutting rates too soon amid persistent inflation. Market odds for a 25-basis-point cut in December fell to about 50%, from nearly 68% last week. Economic data added little clarity, as jobless claims slightly eased to around 227,000, according to estimates, but remained insufficient to strengthen the case for immediate rate easing amid ongoing uncertainty tied to the extended government shutdown.

ASX Overnight: SPI 8626 (-0.19%)

The Day Ahead: We don’t see any reason to change our plan of being patient. The Payrolls numbers due this Thursday will be a key risk event.

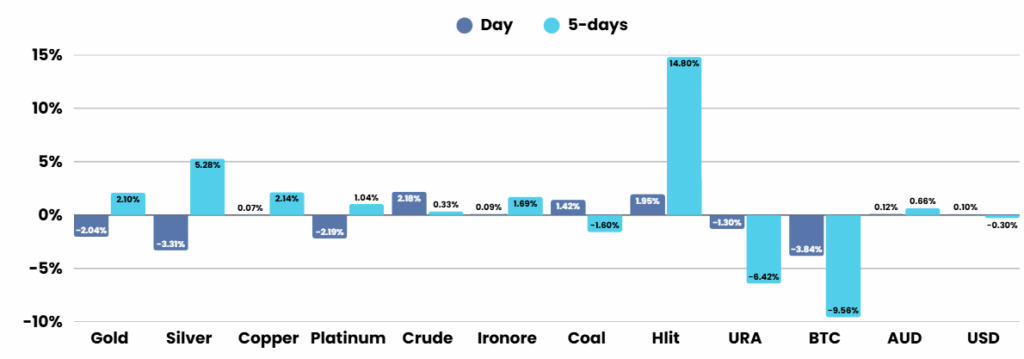

Oil stocks may see a bid tone on geopolitical tensions, as a major drone strike damaged an oil depot and vessel at Russia’s Black Sea port of Novorossiysk, a hub that shipped about 700,000 barrels a day over the past two months.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.