Overnight – Stocks drift lower as investors wait for Fed decision

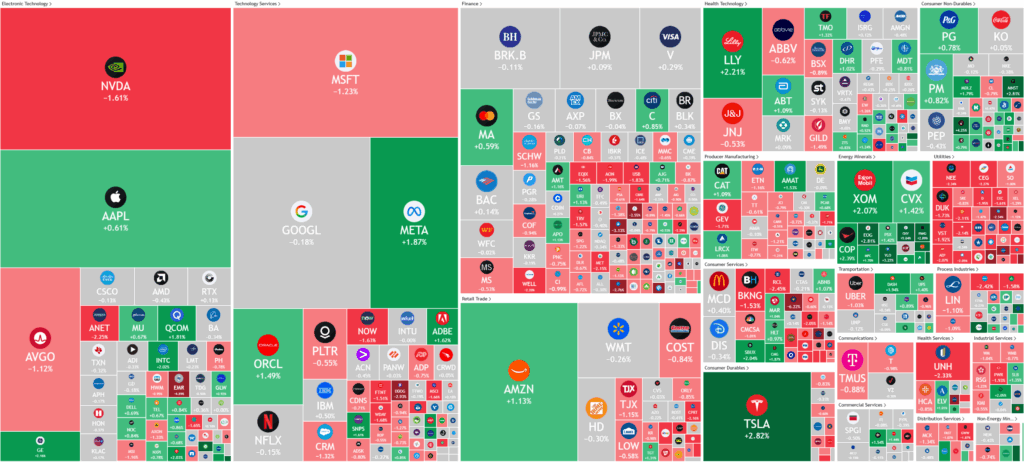

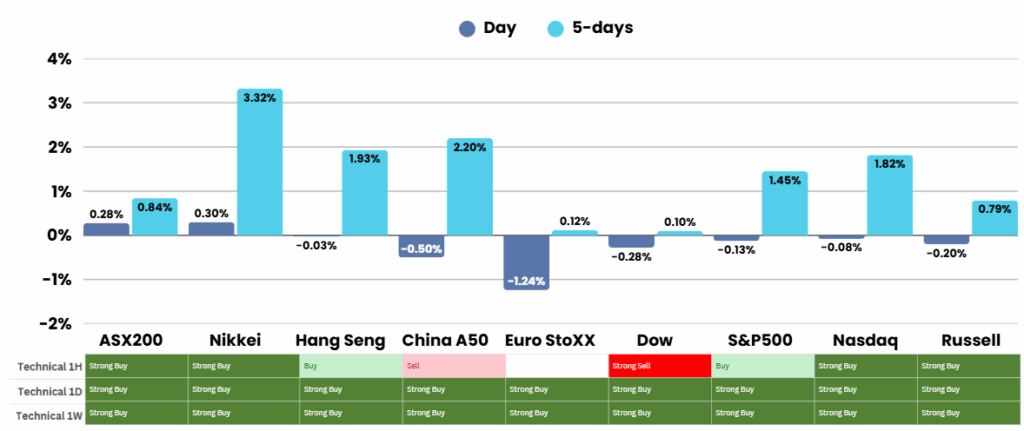

Stocks closed lower after hitting a fresh intraday record overnight as investors looked ahead to a widely expected Federal Reserve rate cut due tomorrow morning.

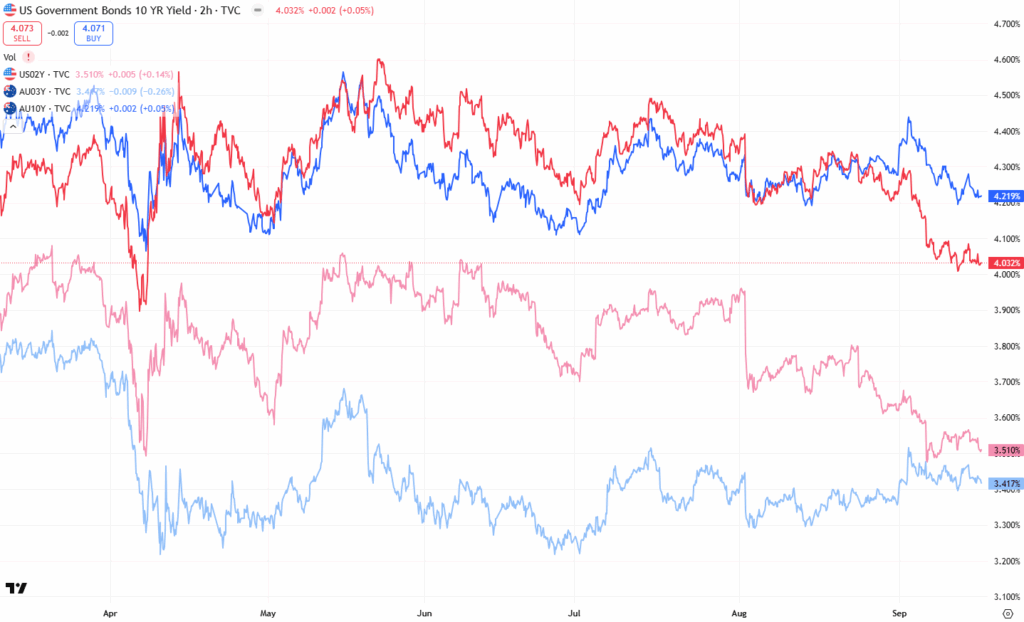

U.S. retail sales posted stronger-than-expected growth in August, rising 0.6% on the month and surpassing projections of a modest 0.2% gain. The uptick, supported by demand in e-commerce, followed a similarly revised increase in July and signaled resilience in consumer spending despite concerns about a softening labor market. While analysts viewed the data as a sign of healthy household demand, they noted the Federal Reserve’s main focus remains on jobs as it begins its two-day policy meeting, where markets broadly expect a 25 basis-point rate cut alongside updated economic projections.

Market sentiment was further buoyed by optimism over U.S.-China trade negotiations in Madrid. President Trump highlighted progress, emphasizing a breakthrough on the future of TikTok’s U.S. operations, which has been a key sticking point in talks. Treasury Secretary Scott Bessent confirmed that a framework agreement over TikTok’s U.S. ownership had been reached, with a call between Trump and President Xi scheduled to finalize terms. Hopes of a successful outcome in trade discussions strengthened risk appetite among investors already watching for the Fed’s policy update.

In corporate news, Ford announced plans to cut around 1,000 jobs at its Cologne EV facility due to weaker-than-expected demand, while Google unveiled a £5 billion investment into Britain ahead of Trump’s upcoming state visit. Company earnings and capital moves drove notable stock shifts: Dave & Buster’s shares tumbled on disappointing results, Rocket Lab declined after disclosing a $750 million stock purchase plan, and Oscar Health dropped following a $350 million note offering. By contrast, Oracle shares gained after reports linked its participation in a consortium that could keep TikTok active in the U.S. under the terms of a potential U.S.-China deal.

ASX Overnight: SPI 8832 (-0.45%)

The Day Ahead:

We are headed for a quiet day leading into the blitzkrieg of Central Bank meetings over the coming days. We expect today to be slightly “risk off”

There is an RBA “fireside chat at 1130am and news that BHP has axed 750 jobs in QLD

Yesterdays Session:

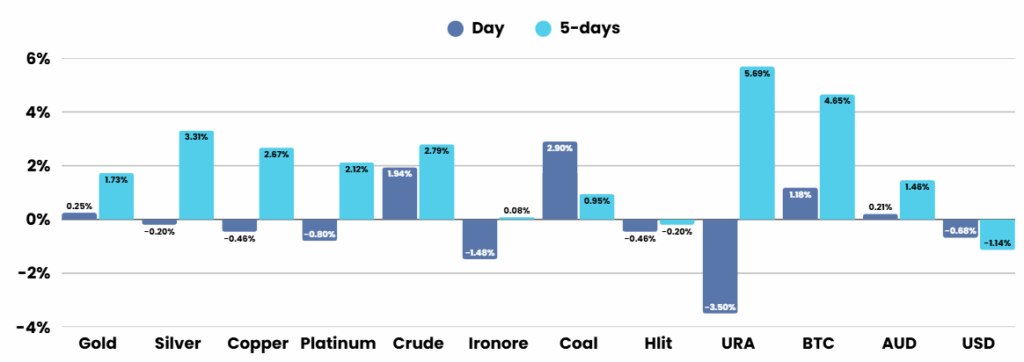

Mining and energy stocks drove market gains, with iron ore near US$107 boosting BHP, Rio Tinto, and Fortescue, while gold miners rallied on record bullion prices. Energy rose on New Hope’s strong profit and dividend, and uranium producers surged on US stockpiling reports. Offsetting the strength, CSL slipped after a $760m biotech investment, and Super Retail tumbled following the CEO’s dismissal over an office romance.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.