Overnight – Stocks drift lower as Trump and Putin meet in Alaska

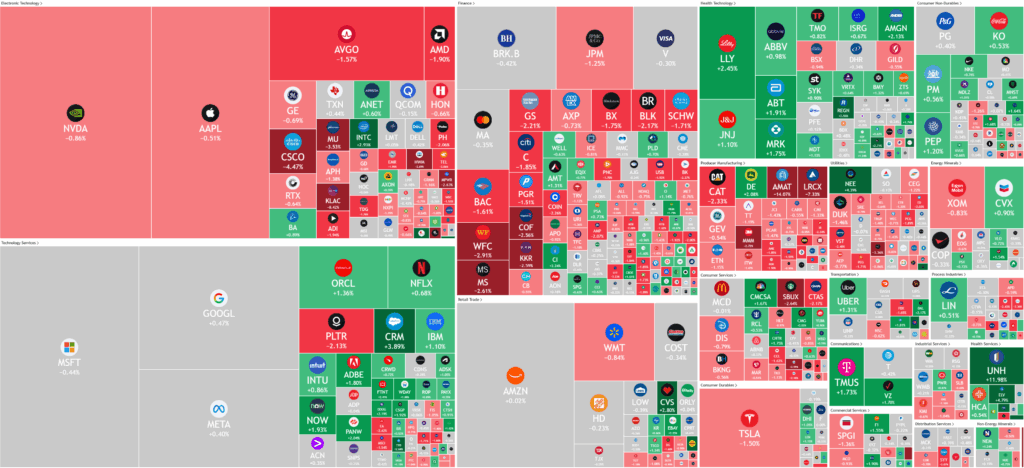

Stocks fell Friday amid pressure from weaker consumer sentiment data, a jump in inflation expectations and the key meeting between President Trump and Putin.

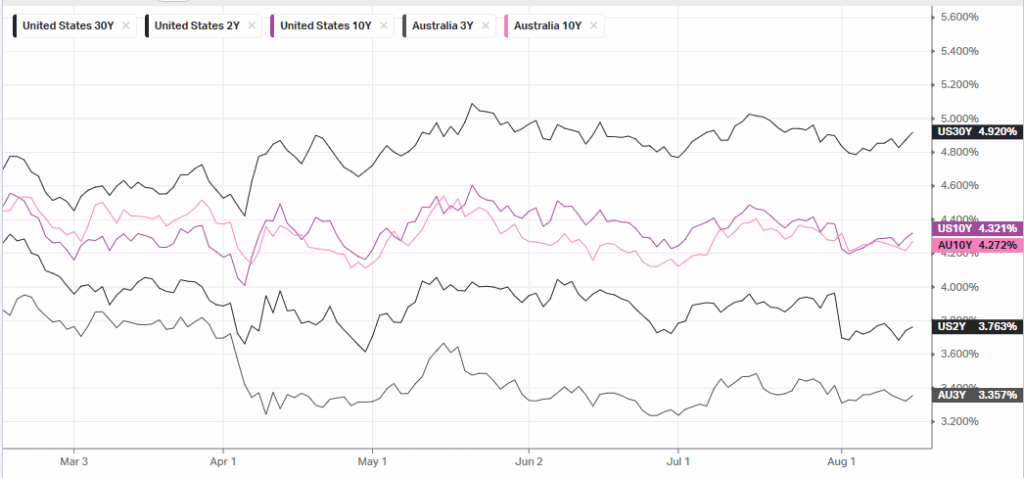

U.S. economic data came under renewed focus as consumer sentiment weakened in August, with the University of Michigan’s survey dropping below expectations amid tariff-related inflation concerns. Inflation expectations rose sharply, prompting markets to temper expectations for aggressive Federal Reserve rate cuts. Supporting the inflation narrative, import prices rebounded due to higher consumer goods costs, while retail sales remained resilient, reflecting steady household spending despite price pressures. Analysts warned, however, that a combination of higher costs and a cooling labor market could weigh on consumer demand in the coming months.

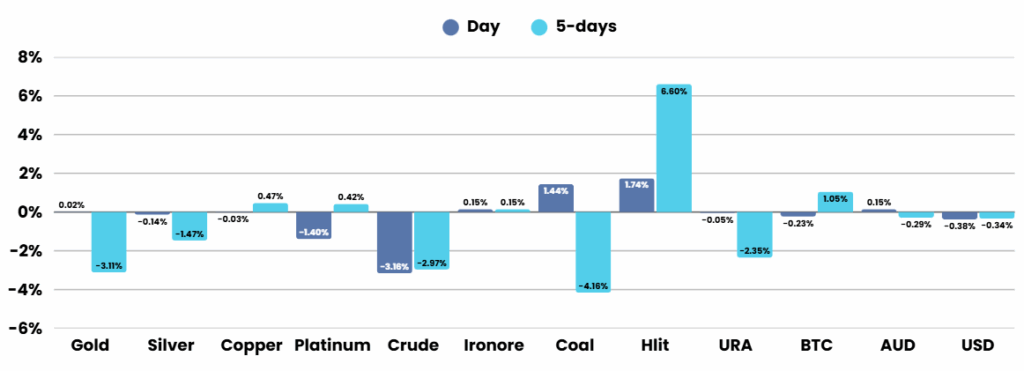

On the geopolitical front, President Donald Trump and Russian President Vladimir Putin were scheduled to meet in Alaska, marking their first direct talks since Trump’s return to office. Central to the discussions is the ongoing Ukraine conflict, now in its fourth year, which has disrupted global supply chains and driven up commodity prices. Pre-meeting, Trump emphasized that the U.S. would not negotiate terms on Ukraine’s behalf, instead aiming to facilitate dialogue between Kyiv and Moscow. His remarks sought to reassure Ukraine that Washington would not press it into unfavorable territorial concessions during these high-stakes talks.

In corporate news, second-quarter earnings have been robust, with more than 80% of S&P 500 companies beating estimates. A major highlight came from Warren Buffett’s Berkshire Hathaway, which revealed a new stake in UnitedHealth Group, sending the insurer’s stock sharply higher after months of underperformance tied to public frustration over healthcare. Berkshire simultaneously trimmed positions in Apple and Bank of America but expanded its holdings in homebuilders DR Horton and Lennar, signaling confidence in the U.S. housing sector despite broader economic uncertainties.

Key points from Alaska Meeting

The weekend Trump-Putin meeting in Alaska ended without a formal deal, with both leaders calling the talks “productive” but leaving major issues unresolved. Trump shifted away from demanding an immediate ceasefire, instead backing Putin’s preference for negotiating a peace agreement, while Putin pressed Ukraine to give up all of Donetsk in exchange for freezing front lines elsewhere—a proposal rejected by President Zelenskiy. Trump suggested offering Ukraine security guarantees similar to NATO’s Article 5, although details remain vague. The summit gave Putin a diplomatic boost, but concerns grew in Europe and Kyiv about being pressured to concede territory. Further talks are possible, but no breakthrough was achieved, and Ukraine’s future remains uncertain.

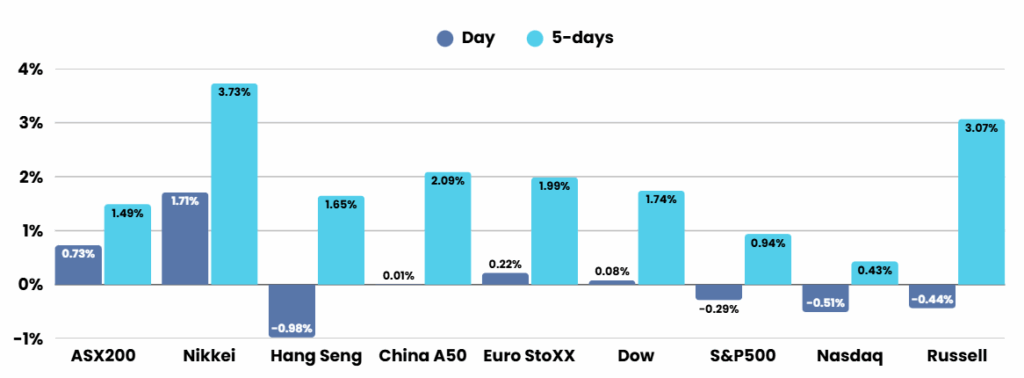

ASX SPI 8852 (-0.59%)

The ASX will start the week on the back foot, with key earnings results from index heavyweights BHP, CSL & WDS due tomorrow. Today we will see a string of REITs, Bluescope, Ampol, Audinate and coal junior, Stanmore

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.