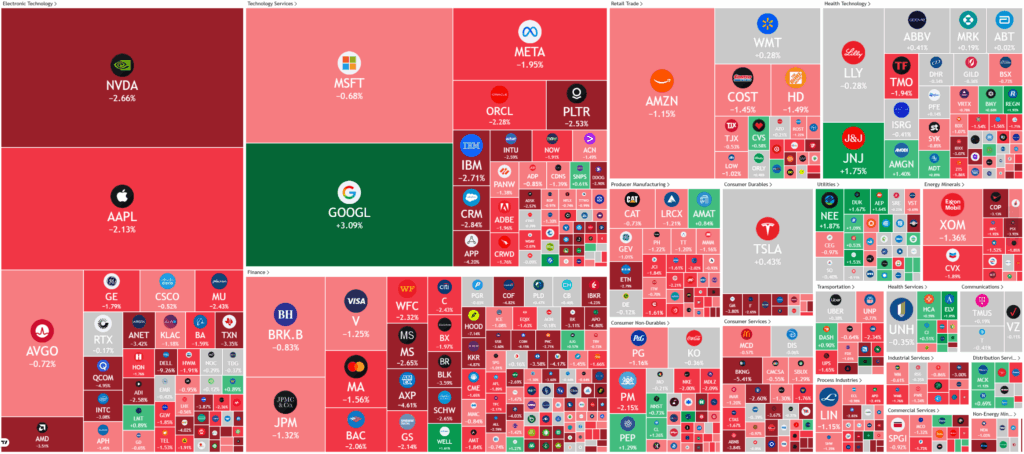

Overnight – AI sentiment continues to sour, driving stocks lower

Stocks closed lower overnight as sentiment on the AI trade continued to sour amid growing concerns about valuations, with Nvidia leading the broader to the downside ahead of its quarterly results due later this week.

Nvidia’s upcoming earnings release on Wednesday is the main event driving market attention this week. The chipmaker’s results will serve as a key test for the ongoing artificial intelligence (AI) boom, given its massive $5 trillion market valuation and dominance in the AI hardware space. Analysts expect another strong quarter, though sentiment remains cautious after recent volatility in tech stocks and billionaire investor Peter Thiel’s sale of his $100 million Nvidia stake. The company’s performance could influence broader market confidence in the sustainability of AI-driven valuations.

Retail earnings from major U.S. chains including Target, Walmart, Home Depot, Lowe’s, and TJX Companies will also draw interest, offering insights into consumer spending patterns ahead of the holiday season. In the tech sector, Alphabet shares rallied after Berkshire Hathaway revealed a new position, signaling Warren Buffett’s continued optimism in the company’s long-term prospects. Meanwhile, automotive stocks such as Carvana and CarMax fell following news of Ford’s partnership with Amazon to sell certified used vehicles online, underscoring shifting dynamics in the auto retail landscape.

On the macroeconomic front, the end of the U.S. government shutdown will allow the release of delayed economic reports, including September’s jobs and inflation data. These figures come at a critical time for the Federal Reserve as it considers its December interest rate decision. After two consecutive rate cuts, markets now expect a pause, with futures implying only a 40% chance of another cut next month. The release of the Fed’s October meeting minutes on Thursday could provide further clarity on policymakers’ thinking, reinforcing Chair Jerome Powell’s recent stance that another rate reduction is far from guaranteed.

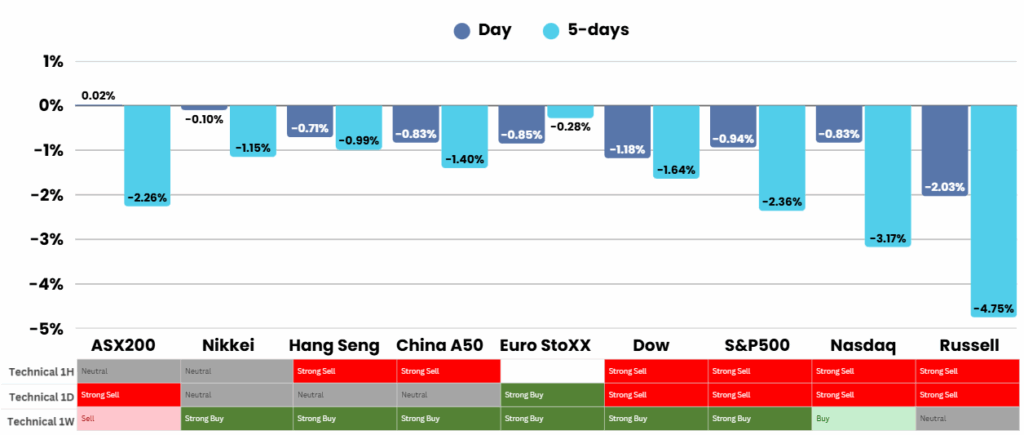

ASX Overnight: SPI 8607 (-0.60%)

The Day Ahead: I would expect the index to be under pressure today from the open as the US Futures were up around at the ASX close yesterday, adding 0.75% to the US market fall of 0.90% in the S&P500

The market is expecting updates from ALS, Plenti, TechnologyOne and Webjet.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.