Overnight – Equities mixed as investors look ahead to Fed Symposium

Stocks drifted lower for a second day as investors digested a meeting between Ukraine President Volodymyr Zelensky and U.S. President Donald Trump in Washington and looked ahead to the upcoming Jackson Hole Symposium

The meeting between U.S. President Donald Trump and Ukrainian President Volodymyr Zelensky concluded in Washington, with Trump stating that the United States would support Ukraine through security assistance, although he did not elaborate on specific measures. Zelensky described the discussions as “very good,” emphasizing the importance of security guarantees for Ukraine. Trump revealed plans to call Russian President Vladimir Putin after the meeting, raising the possibility of a trilateral discussion involving the U.S., Ukraine, and Russia, though he noted that such a meeting was not guaranteed. European leaders present advocated for a ceasefire to facilitate negotiations, but Trump was noncommittal, suggesting that while a ceasefire “might be good to have,” it was not necessarily essential for achieving peace.

Ahead of the summit, Trump posted on Truth Social, suggesting that Zelensky “can end the war with Russia almost immediately, if he wants to, or he can continue to fight.” Trump also stated that any resolution would not include Ukraine regaining Crimea, which Russia annexed in 2014, asserting “No getting back Obama-given Crimea… and NO GOING INTO NATO BY UKRAINE.” This stance signals significant limitations on Ukraine’s negotiating options and the scope of potential agreements under U.S. mediation.

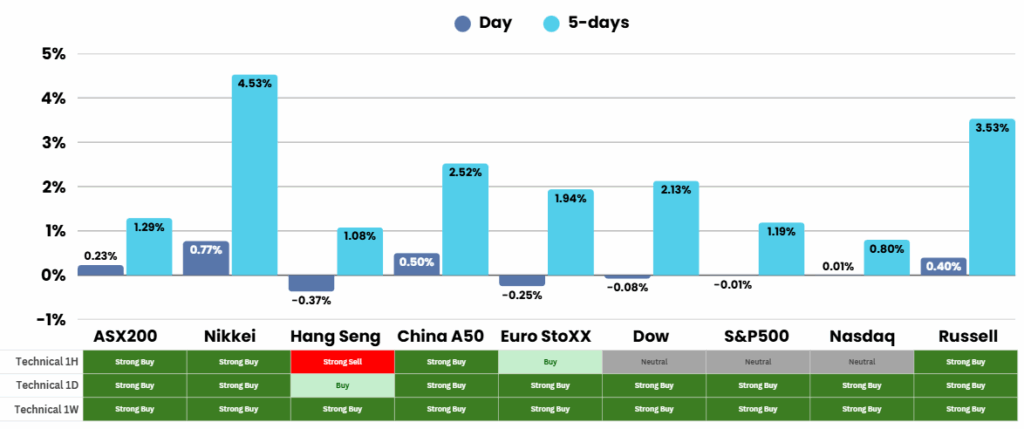

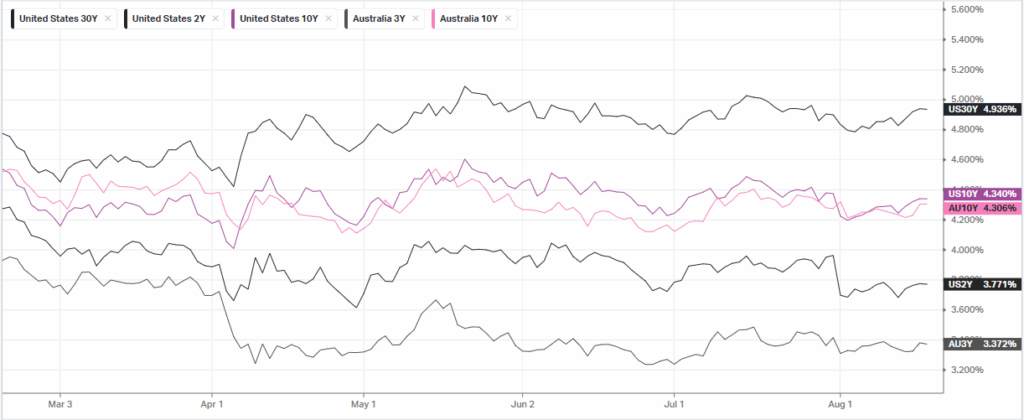

Financial markets are awaiting further direction from Federal Reserve Chair Jerome Powell at the Jackson Hole symposium on Friday, with expectations growing of a 25 basis-point interest rate cut in September. This anticipation is fueled by softer payroll and consumer inflation data for July, with CME Fedwatch indicating investors now see an 83% chance of a cut. However, stronger producer inflation figures released last week appear to have ruled out the prospect of a larger rate reduction.

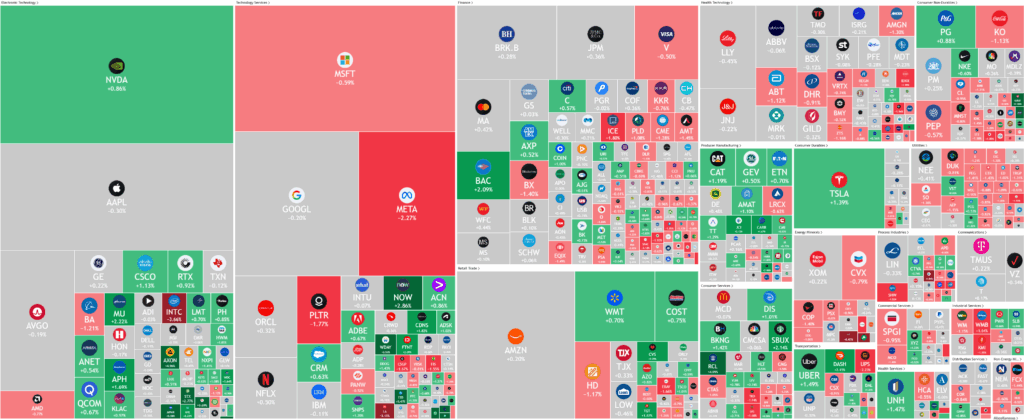

In corporate news, Tesla shares were boosted despite reports of up to 40% discounts on leased vehicles in the U.K., while Novo Nordisk saw gains after its obesity drug Wegovy received accelerated FDA approval for treating liver disease. Major retailers such as Walmart, Target, Home Depot, Lowe’s, and TJX Companies are set to report their second-quarter earnings, offering fresh insights into U.S. consumer trends amid concerns that Trump’s tariffs may dampen spending. FactSet data indicates 81% of S&P 500 companies have posted earnings ahead of expectations for the June quarter. Other prominent firms reporting this week include Workday, Alibaba, Baidu, Palo Alto Networks, and Analog Devices.

ASX SPI 8874 (-0.25%)

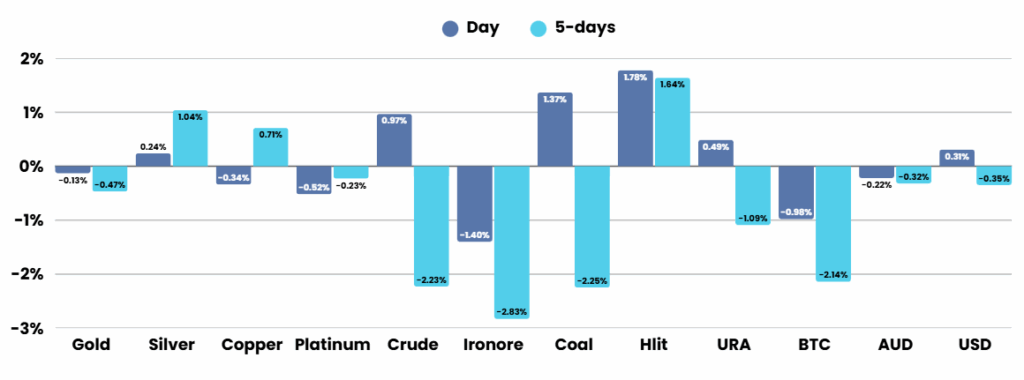

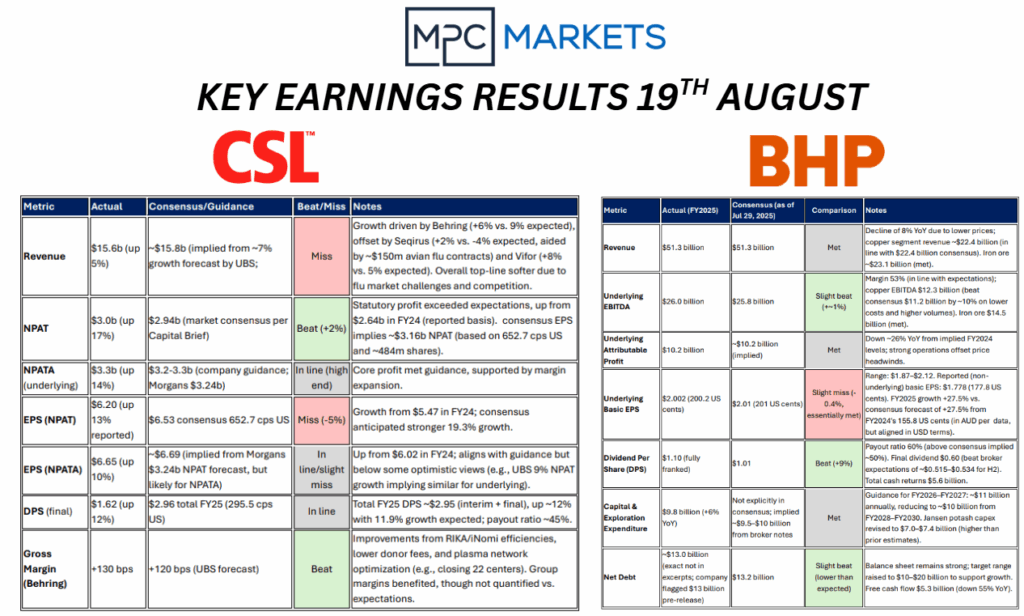

We will be earnings focused today with CSL, BHP and Woodside delivering earnings. At first glance CSL was positive to mixed

The Economic Reform Roundtable begins today with Anthony Albanese, Jim Chalmers and Michele Bullock set to speak.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.