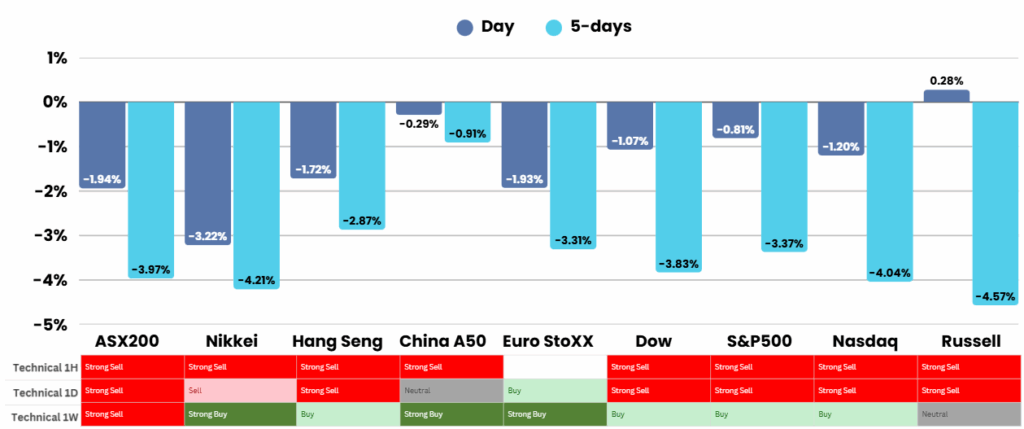

Overnight – Sell off continues as investors worry about economic reality check

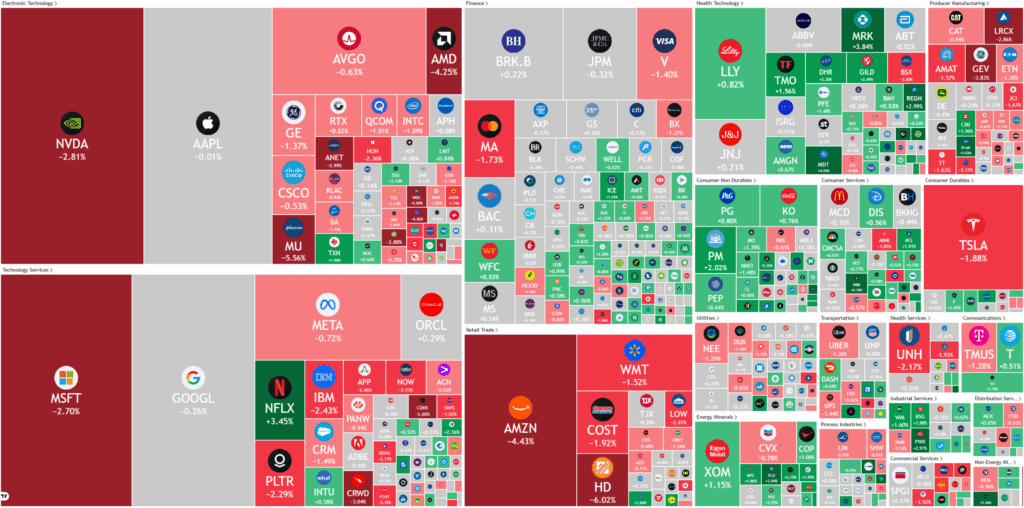

Tech led stocks, adding to recent losses as the selloff in AI related companies continued just a day ahead of key earnings from Nvidia and a long-awaited labour market reading for September due later this week.

Markets continued to see turbulence as investors sold off major technology shares ahead of Nvidia’s highly anticipated quarterly earnings report. The semiconductor giant, which has been a key player in the recent AI-driven market rally, faced mounting scrutiny about the sustainability of its meteoric valuation. Concerns extended to the broader tech sector, with skepticism emerging over the long-term profitability of substantial investments in artificial intelligence. Despite the pullback, Alphabet managed to avoid the worst of the selloff after unveiling its latest AI model, Gemini 3, highlighting ongoing optimism for some AI innovations, while Cloudflare shares slipped on news of service outages.

Retail sector earnings were also in focus, with Home Depot disappointing investors by reporting third-quarter profits below analyst estimates, even as its revenue surpassed forecasts. The company revised its fiscal 2025 outlook in response to ongoing headwinds, now predicting modest total sales growth of around 3% and only slightly positive growth in comparable sales. This cautious update set the stage for upcoming earnings releases from other major retailers like Walmart and Target later in the week, against a backdrop of persistent macroeconomic uncertainty.

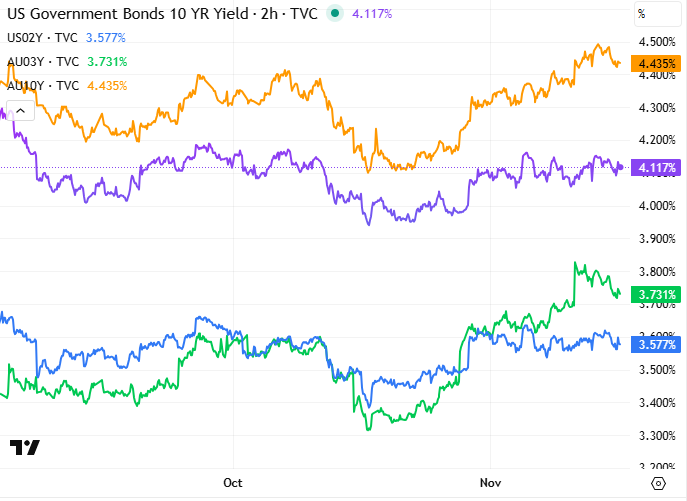

Attention also shifted to broader economic indicators, as the delayed release of U.S. nonfarm payrolls data for September kept investors on edge. This report, postponed due to a government shutdown, is expected to play a significant role in shaping the Federal Reserve’s December policy outlook. Fed Governor Waller’s recent call for interest rate cuts underscored growing concerns over labor sector weakness, but prevailing sentiment suggests the central bank is more likely to hold rates steady until more comprehensive inflation and jobs data become available.

ASX Overnight: SPI 8494 (-0.17%)

The Day Ahead: Nothing changed from our house view. We have returned to 30%-50% cash and see the risk of a market fall of 20%+ as HIGH

The market is expecting updates from Nufarm. Companies holding annual meetings include KMD Brands, Medibank Private and Nuix.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.